Long story short: A beginner’s guide to Indian Motor Insurance Tariff (IMT) for two-wheelers in India — understand deductibles, add-ons, premiums, IMT 24, IMT 22A, exclusions etc to choose the right policy.

Have you heard about the term IMT in your motorcycle life? 99% of two-wheeler owners have not. Yes, that is a fact, and you might have seen that in the motorcycle insurance document. We usually print the same, keep it safe on our motorcycles, or store it digitally. We are not trying to blame anyone or generalise anything. Let’s discuss what Indian Motor Tariffs (IMT) for Two-Wheelers are about.

Motor insurance in India is governed by various Indian Motor Tariffs (IMTs) that provide specific endorsements and coverage options. This blog explores important IMTs applicable to two-wheelers in India, helping you understand their benefits and implications. Please note that all IMT applicable for two wheelers are not discussed here because they are applicable only for maybe under 1% out of 100 but will surely display the entire list a table.

What is IMT for Two-Wheelers in India?

In India’s motor insurance context, IMT stands for Indian Motor Tariff. It is a set of guidelines from the Insurance Regulatory and Development Authority of India (IRDAI) that regulates the pricing and coverage of motor insurance policies, including two-wheelers. The IMT specifies endorsements, coverage options, and conditions for insurers to follow when offering motor insurance.

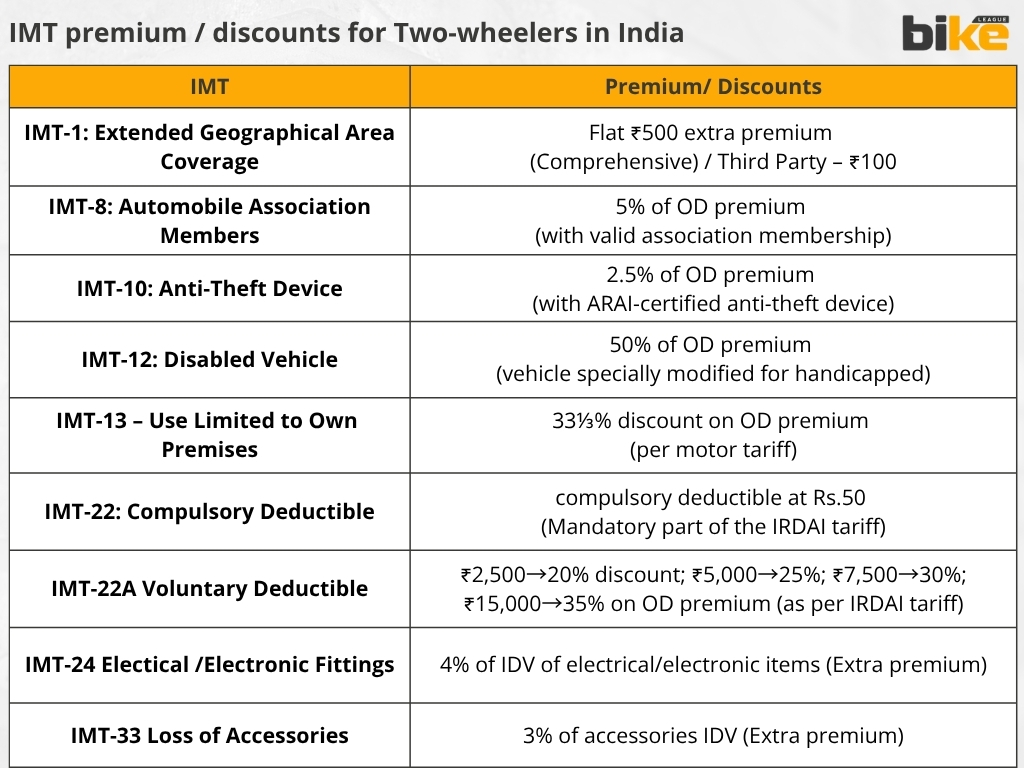

List of all IMTs applicable to two-wheelers in India

| IMT No. | Endorsement Title |

|---|---|

| IMT-1 | Extension of Geographical Area (beyond India) |

| IMT-3 | Automatic Transfer of Liability-Only Policies on Sale of the Vehicle |

| IMT-4 | Substitution of the Insured Vehicle (same-class replacement) |

| IMT-5 | Demonstration / Tuition Use (test-rides, rider training) |

| IMT-6 | Lease Agreement |

| IMT-7 | Vehicles Subject to Hypothecation Agreement |

| IMT-8 | Discount for Membership of Recognised Automobile Associations |

| IMT-11 | Termination of the Undeclared Laid-Up Period |

| IMT-12 | Discount for Specially Designed/Modified Vehicles (for person with a disability) |

| IMT-15 | Personal Accident Cover for Owner-Driver |

| IMT16 | Personal Accident Cover for Unnamed Passengers (up to seating capacity) |

| IMT-17 | Personal Accident Cover for Paid Driver/Cleaner |

| IMT-18 | Personal Accident Cover for Hirer/Driver (if used on hire/reward) |

| IMT-20 | Reduction in Limit of Liability for Third-Party Property Damage |

| IMT-22 | Compulsory Deductible (fixed amount per claim) |

| IMT-22A | Voluntary Deductible (higher deductible in exchange for lower premium) |

| IMT-24 | Electrical / Electronic Fittings (to cover battery, controller, lights, etc.) |

| IMT-25 | CNG/LPG Kit in Bi-Fuel System (own-damage cover for the kit; analogous for alternate-fuel EVs) |

| IMT-32 | Accidents to Soldiers/Sailors/Airmen Employed as Drivers |

| IMT-33 | Loss of Accessories (theft or damage to rider’s accessories) |

| IMT-35 | Hired Vehicle – Driven by Hirer (two-wheelers on hiring contracts) |

As previously mentioned all Indian Motor Tariff applicable for two wheelers are not discussed here and lets start digging deep into each of these IMT for Two-wheelers.

1. IMT-1: Extended Geographical Area Coverage

Scope of Cover

IMT-1 allows the insured two-wheeler to be legally used in neighbouring countries with insurance cover extended to:

- Bangladesh

- Bhutan

- Nepal

- Pakistan

- Sri Lanka

- Maldives

The regular comprehensive (own-damage and third-party) or third-party-only cover remains valid in these countries during the policy period.

Premium Calculation

- Comprehensive Policy (Own-Damage + TP): Additional premium of ₹500 per year.

- Third-Party-Only Policy: Additional premium of ₹100 per year.

- This flat fee is not dependent on the IDV or cubic capacity.

Exclusions & Limits

- No coverage during sea or air transit to the extended countries.

- Only valid in the listed countries (other countries not allowed).

- All standard exclusions and limitations of the base policy still apply.

Practical Example

Raj plans a road trip from Siliguri to Bhutan on his Royal Enfield bike. His Indian insurance doesn’t cover Bhutan unless IMT-1 is added.

For an additional premium of ₹500, Raj gets complete insurance protection in Bhutan. However, if he were to ferry the bike by sea or air, any damage in transit would not be covered.

| Insurer | IMT-1: Extended Geographical Area Coverage |

|---|---|

| All insurers | Flat ₹500 extra premium (Comprehensive) / Third Party – ₹100 |

2. IMT-8: Automobile Association Members

Scope of Cover

This endorsement provides a discount on the own-damage portion of the premium for two-wheeler owners who are members of a recognised automobile association such as:

Recognized Associations

Membership in any one association below qualifies for IMT-8; multiple enrollments do not stack:

- Automobile Association of Eastern India (AAEI)

- Uttar Pradesh Automobile Association (UPAA)

- Western India Automobile Association (WIAA)

- Automobile Association of Southern India (AASI)

- Automobile Association of Upper India (AAUI)

Premium Calculation

- Discount: 5% of the Own-Damage premium

- Maximum cap: ₹50 per year

- Discount applies only to the OD portion, not the TP premium.

- The discount is adjusted pro-rata if the policy is taken mid-membership or membership lapses mid-policy.

Exclusions & Limits

- Membership must be active and from a recognised association.

- Only one discount is allowed per policy.

- If membership ends early, the insurer must refund the unutilised discount.

- No effect on third-party-only policies (no discount applicable).

Practical Example

Sita rides a Honda Activa and has a yearly OD premium of ₹1,000. As a member of the Automobile Association of Southern India, she is eligible for a 5% discount.

That’s ₹50 (maximum cap), reducing her OD premium to ₹950. If she leaves the association after 6 months, she must return ₹25 as the unutilised part of the discount.

| Insurer | IMT-8: Automobile Association Members |

|---|---|

| All insurers | 5% of OD premium (with valid automobile-association membership) |

3. IMT-10: Anti-Theft Device

Scope of Cover

Under IMT-10, if you install an ARAI-approved anti-theft device (like a GPS tracker or alarm) on your motorcycle or scooter and get it certified by a recognised automobile association, you become eligible for a tariff discount on the policy. The insurance policy will be endorsed to note that your vehicle has this device.

This endorsement does not change your coverage; it acknowledges the device and gives you a premium break. (It’s not applicable for motor-trade policies where the vehicle is under repair or being sold.)

Premium Calculation

The Indian Motor Tariff specifies a discount of 2.5% of the own damage premium, up to a maximum of ₹500. In practice, insurers cap the discount (often around ₹200–₹500, depending on the company) even if 2.5% of your premium exceeds that.

The discount applies to the own-damage (OD) portion of the premium. For example, if your OD premium is ₹10,000, a 2.5% discount would be ₹250 (within the ₹500 cap). If you install the device mid-policy, the insurer gives a pro-rata discount for the remaining period. These discounts are standardised across insurers by the tariff.

Exclusions & Limits

- Maintenance of Anti-Theft Device: Must be kept in good working order for the duration of the policy to retain benefits.

- Removal or Disabling: If the device is removed or disabled, the insurer may withdraw the discount.

- Certification Requirement: The anti-theft device must be certified by ARAI at the time of policy issuance or added later.

- Premium Implications: IMT-10 affects premium rates but does not automatically provide theft coverage.

- Vehicle Type Limitation: Discount applies only to two-wheelers classified as private vehicles (not for commercial use such as taxis, bikes for hire, or motor-trade).

- Commercial Use Exemption: Different rules apply if the bike is used for hire or commerce; IMT-10 is not applicable for motor trade policies.

Practical Example

Ramesh owns a scooter and adds a certified anti-theft tracker before renewal. His OD premium is ₹4,000. Under IMT-10, he gets 2.5% off, i.e. ₹100 (since 2.5% of 4,000 = 100).

Thus, his payable OD premium becomes ₹3,900 (plus any mandatory third-party premium). If Ramesh installed the device halfway through the year, he’d get roughly half of that ₹100 as a pro-rated discount.

For more in-depth details, you can check our detailed article about the same here Best anti-theft devices for bikes: Secure your ride today

| Insurer | IMT-10: Anti-Theft Device |

|---|---|

| All insurers | 2.5% of OD premium (with ARAI-certified anti-theft device) |

4. IMT-12: Disabled Vehicle

Scope of Cover

IMT-12 applies when the insured two-wheeler is specifically built or modified for a blind, disabled people, or mentally challenged person. In India, the regional transport office officially endorses such vehicles in the vehicle’s registration book.

If your bike or scooter has this special status, the insurer adds IMT-12 to the policy. This endorsement recognises the vehicle’s exceptional design and grants you a significant discount. Again, IMT-12 does not add extra coverage beyond regular policy terms; it merely lowers the premium.

Premium Calculation

The tariff provides a 50% discount on the own-damage premium for vehicles under IMT-12. For instance, if the OD premium of such a bike would usually be ₹6,000, you only pay ₹3,000. This is a straight half-price on the OD part.

No separate cap is mentioned in the tariff for this endorsement (the discount is half, regardless of premium). Note that this discount only applies to the OD portion, so your third-party premium (fixed by government rates) is unaffected.

Exclusions & Limits

- IMT-12 discounts insurance premiums for bikes registered as specially designed for disabled persons.

- Official endorsement must be present on the registration certificate for the discount to apply.

- If modifications are removed or the insured no longer qualifies, the insurer can cancel the discount.

- The discount applies only to private non-commercial vehicles.

- Commercial vehicles, such as ambulances or taxis, are not eligible for the discount.

- IMT-12 does not change liability coverage.

Practical Example

Geeta has a three-wheeler scooter specially fitted with hand controls for her quadriplegic father. It’s legally registered as a “vehicle for the disabled people.” Her insurer applied IMT-12, cutting her OD premium from ₹8,000 to ₹4,000 (50% off).

So, she pays ₹4,000 plus whatever the third-party charge is. Suppose she loses the special registration or no longer fits the criteria. In that case, the insurer will remove IMT-12 on renewal and charge the full premium.

| Insurer | IMT-12: Disabled Vehicle |

|---|---|

| All insurers | 50% of OD premium (vehicle specially modified for blind/handicapped) |

5. IMT-13: Use Limited to Own Premises

Scope of Cover

The policy covers loss or damage only if the vehicle is used on the insured’s own premises (private property not open to the public). Use outside the premises is excluded. (An exception is made if the vehicle is used to fight a fire – such use is still covered.) “Own premises” are defined as the public has no general access.

In practice, the insurer pays only for accidents or theft on the owner’s property; any incident on public roads or elsewhere is not covered.

Premium Calculation

Because road-use risks (especially third-party liability on public roads) are eliminated, insurers typically reduce the premium when IMT-13 is applied. There is no IRDAI-mandated rate for this; insurers offer a 33⅓% % discount on OD premium (per motor tariff).

The Own Damage portion of the premium is often significantly discounted (reflecting much lower risk) when the vehicle is confined to private premises. The exact reduction varies by insurer and underwriter, as IRDAI’s tariff does not fix a percentage.

Exclusions and Limits

- Besides the standard policy exclusions (e.g., mechanical breakdown, wear and tear), IMT-13 explicitly excludes use outside the insured’s premises.

- If the bike is ridden on a public road or any area with public access, this endorsement does not cover any resulting damage/injury.

- IMT-13 does not add separate exclusions (beyond the above and normal policy exceptions).

Limits of Liability

The sum insured (IDV) and third-party limits remain per the base policy. Still, they effectively apply only on the premises. For example, suppose a third party is injured on the insured property. In that case, the insurer pays up to the policy limit (subject to usual legal limits).

However, no liability applies off-premises. In short, the insurer’s maximum payment (IDV or third-party limit) is unchanged but is enforceable only for on-premises incidents.

Practical Example

A two-wheeler owner who only drives on his private farm might purchase IMT-13. Suppose the bike slips on the farm and damages itself (or injures someone on the farm). In that case, the insurer pays per the IDV or liability limit.

| Insurer | IMT-13 – Use Limited to Own Premises |

|---|---|

| All insurers | 33⅓% discount on OD premium (per motor tariff) |

But if the same bike were driven onto a public road, any accident would not be covered under this endorsement. IMT-13 is suitable when a vehicle never leaves the private property, and insurers will charge a lower premium for this limited use.

6. IMT-15 Personal Accident Cover for Owner-Driver

Scope of Cover

When you hold IMT 15 on your two-wheeler, the policy pays out a lump sum—based on the CSI—if the owner-driver suffers bodily injury or death directly due to an accident involving the insured bike (including mounting into/dismounting from it)

Premium Calculation

IRDAI has prescribed a flat rate of ₹50 per ₹1 lakh of CSI per year. With the mandatory CSI now ₹15 lakh, your annual premium (before GST) is:

₹50 × 15 (lakhs) = ₹750 per year

Exclusions & Limits

- Driving under influence of alcohol or drugs

- Non-vehicular accidents (e.g., slipping at home)

- Intentional self-injury or suicide attempts

- War, invasion, riot, nuclear risks

Practical Example

Death Benefit

Mr. X is fatally injured in a bike crash on May 8, 2025.

CSI: ₹15 lakh → Payout: 100% of CSI = ₹15 lakh.

Loss of One Limb

Ms. Y loses her left leg in a collision on April 22, 2025.

CSI: ₹15 lakh → Payout: 50% of CSI = ₹7.5 lakh.

Permanent Total Disablement

Mr. Z suffers quadriplegia (complete paralysis) in an accident on March 30, 2025.

CSI: ₹15 lakh → Payout: 100% of CSI = ₹15 lakh.

| Nature of Injury | % of CSI Payable |

|---|---|

| Death | 100% |

| Loss of two limbs, or sight of both eyes, or one limb and one eye | 100% |

| Loss of one limb or sight of one eye | 50% |

| Permanent total disablement (other than above) | 100% |

7. IMT-16 Personal Accident Cover for Unnamed Passengers

Scope of Cover

When IMT 16 is taken, the insurer undertakes to pay compensation for bodily injury or death sustained by any unnamed passenger (other than the owner-driver, paid driver or cleaner) while mounting into, dismounting from, or travelling on the insured two-wheeler, caused by violent, accidental, external and visible means. The scale of compensation is:

| Nature of Injury | % of CSI Payable |

|---|---|

| Death | 100% |

| Loss of two limbs, or sight of both eyes, or one limb and one eye | 100% |

| Loss of one limb or sight of one eye | 50% |

| Permanent total disablement (other than above) | 100% |

Here, “CSI” refers to the Capital Sum Insured per passenger (inserted at policy inception).

Premium Calculation

IRDAI’s Motor Tariff specifies that the additional premium for IMT 16 on a private two-wheeler is ₹50 per passenger per annum (for a CSI of ₹1 lakh). You can align this with your policy’s term (1, 2, or 3 years, where multi-year term is allowed under long-term third-party norms).

Exclusions & Limits

While IMT 16 broadens protection, the following standard exclusions apply (mirroring those under IMT 15 and general PA covers):

- Intoxication: No cover if the passenger is under the influence of alcohol or drugs at the time of accident.

- Self-harm: Injuries or death due to intentional self-injury or suicide attempts.

- Non-vehicular incidents: Accidents not involving the insured two-wheeler (e.g., a fall at home).

- War & nuclear risks: Any injury arising from warlike operations, invasion, civil war, or nuclear radiation.

Additionally, total liability under IMT 16 per passenger per period of insurance cannot exceed the chosen CSI for that passenger.

Practical Example

Death of a Pillion Rider

Scenario: On May 5, 2025, Ms. A meets with a fatal accident while riding pillion.

CSI: ₹1,00,000 → Payout: 100% of CSI = ₹1,00,000 to her nominee.

Loss of One Limb

Scenario: On April 18, 2025, Mr. B loses his left leg in a collision while riding pillion.

CSI: ₹1,00,000 → Payout: 50% of CSI = ₹50,000 to Mr. B.

Permanent Total Disablement

Scenario: On March 12, 2025, Mr. C suffers complete paraplegia in an accident as an unnamed passenger.

CSI: ₹1,00,000 → Payout: 100% of CSI = ₹1,00,000 to Mr. C.

8. IMT-20 Reduction in Limit of Liability for Third-Party Property Damage

Scope of Cover

When you attach IMT-20 to your two-wheeler policy:

- Insurer’s liability for third-party property damage (i.e., damage to vehicles or property belonging to others) is capped at ₹6,000 per event.

- All other aspects of your third-party cover (bodily injury, death, legal defence costs) remain unchanged.

Premium Impact

IRDAI’s Motor Tariff specifies a flat ₹50 per annum premium reduction (pre-GST) for two-wheelers that opt for IMT 20. You can choose this for 1-, 2-, or 3-year third-party cover

Exclusion & Limits

Attaching IMT 20 only affects your insurer’s maximum payout for third-party property damage. All other exclusions of a standard two-wheeler third-party policy continue to apply.

Practical Examples

Minor Fender-Bender

- Scenario: You clip a parked scooter, causing ₹4,000 of damage.

- Without IMT 20: Insurer pays full ₹4,000.

- With IMT 20: Insurer still pays ₹4,000 (under the ₹6,000 cap).

Moderate Collision

- Scenario: You collide with a car, rendering property damage of ₹8,500.

- Without IMT 20: Insurer pays full ₹8,500.

- With IMT 20: Insurer pays only ₹6,000; you’re responsible for the remaining ₹2,500 out-of-pocket.

Major Pile-Up

- Scenario: A multi-vehicle accident causes ₹15,000 in third-party property damage.

- Without IMT 20: Insurer pays the full ₹15,000.

- With IMT 20: Insurer’s liability maxes out at ₹6,000; you must cover ₹9,000 yourself.

9. IMT-22: Compulsory Deductible

Scope of Cover

Under IMT-22, the insured must pay a fixed portion of every Own Damage claim. IRDAI fixes this compulsory deductible for two-wheelers at Rs.50. This means that in every claim (even total loss), the insured bears the first ₹50 of damage. The insurer pays the remainder (subject to the policy limit).

IMT-22 is mandatory per IRDAI rules for all two-wheeler comprehensive policies. It does not affect liability (third-party) coverage.

Premium Calculation

IMT-22 usually does not change the premium (it is a mandatory part of the IRDAI tariff). The standard tariff tables for two-wheelers assume this ₹50 deductible, so no additional premium is charged for adding IMT-22.

In other words, you don’t pay extra for IMT-22, but you also don’t get a discount for accepting it – it simply reduces the insurer’s payout per claim. (IRDAI’s General Rule GR.40 sets this deductible amount).

Exclusions and Limits

No notable exclusions are added by IMT-22 beyond normal ones.

The only effect is that the insurer will not cover the first ₹50 of any own damage loss. All other policy terms apply as usual. For example, if the policy excludes wear-and-tear, that still applies.

But accident damage is covered above the deductible. Section II (third-party liability) is unaffected by IMT-22; it does not impose any deductible on liability claims (only on section I own damage claims).

Limits of Liability

The policy’s declared value and third-party liability limits are unchanged. IMT-22 merely shifts the first Rs.50 of each claim to the insured. For instance, if the vehicle’s IDV is ₹50,000 and it suffers ₹10,000 damage, the maximum insurer payout is ₹9,950 (₹10,000 – ₹50).

The insurer’s overall liability remains subject to the IDV and legal limits; IMT-22 only carves out that fixed ₹50 per claim.

Practical Example

Suppose a bike is damaged in an accident, and the repair estimate is ₹4,500. Under IMT-22, the owner pays ₹50 out of pocket; the insurer covers the remaining ₹4,450. If the damage had been ₹40,000, the insured still pays ₹50, and the insurer pays ₹39,95. The IMT-22 slightly lowers payouts on each claim but has a negligible effect on premiums.

10. IMT-22A: Voluntary Deductible

Scope

Under IRDAI’s motor tariff, IMT 22A allows the policyholder to voluntarily accept an extra deductible (excess) on top of the compulsory deductible (₹100 for two wheelers.

The rider pays a fixed amount per claim out of pocket for a lower damage premium. The IRDAI endorsement wording specifies: “the insured, having opted a voluntary deductible of Rs. X, a reduction in premium of Rs. is allowed. Y under Section I of the policy… the insured shall bear … the first Rs. X (or any lesser expenditure) of any expenditure for which provision has been made under this policy”.

In other words, the rider pays the chosen amount per claim (including if the bike is a total loss), and the insurer pays the remainder up to the insured’s IDV.

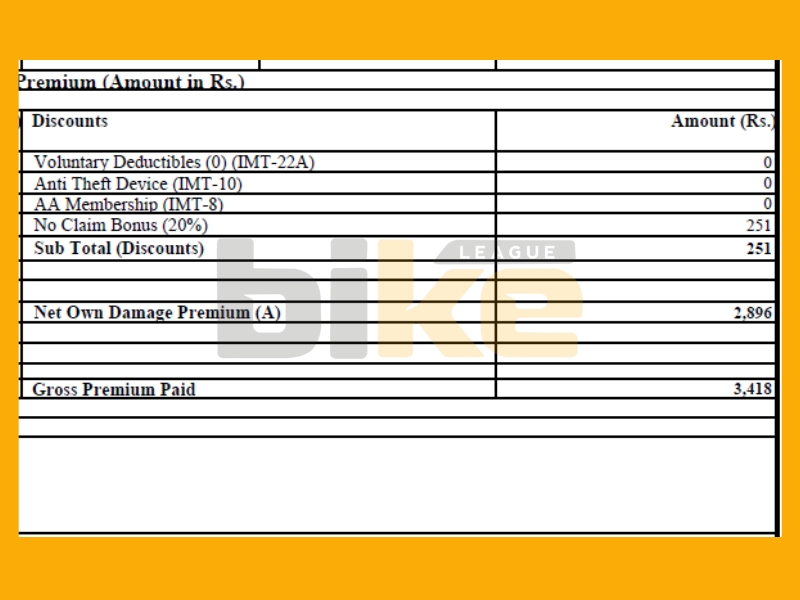

Premium Rates

All IRDAI-approved insurers apply the standard tariff discount schedule. Typically, the discounts on Own Damage (OD) premium are:

- ₹2,500 deductible ⇒ 20% discount (max ₹750)

- ₹5,000 ⇒ 25% (max ₹1,500)

- ₹7,500 ⇒ 30% (max ₹2,000)

- ₹15,000 ⇒ 35% (max ₹2,500)

Exclusions

IMT 22A is not a coverage add-on but a premium modifier, so it has no notable exclusions beyond the standard policy terms. It applies only to Own Damage claims – third party liability and personal accident sections are unaffected. Importantly, the voluntary deductible is in addition to the compulsory ₹100 deductible on two wheelers.

In a claim, both deductibles are applied. (E.g., with ₹5,000 voluntary plus ₹100 compulsory, the rider pays ₹5,100 per claim.) There is no IRDAI exclusion specific to voluntary deductibles; the rider bears that cost for any damage covered under Section I.

Limit of Liability

There is no separate sum insured for IMT 22A; the “limit” is the deductible. The insured must pay the chosen amount each time. IRDAI’s tariff typically allows voluntary deductibles of up to ₹15,000 on two wheelers.

In practice, insurers cap the maximum deductible and discount, as shown in the table below. The insurer’s liability is the loss minus the deductible (subject to the vehicle IDV and other limits).

Practical Example

A rider insures a motorcycle with an OD premium of ₹4,500. By selecting a ₹5,000 voluntary deductible, they earn a 25% discount (up to ₹1,500).

Suppose the discounted OD premium becomes ₹3,000. Later, the bike suffers ₹12,000 damage in an accident. The rider must pay ₹5,100 of that (₹5,000 voluntary + ₹100 compulsory), and the insurer covers the remaining ₹6,900 (subject to depreciation limits).

If the bike were a total loss (IDV ₹50,000), the rider would pay ₹5,100, and the insurer would pay ₹44,900.

| Insurer | IMT-22A Voluntary Deductible |

|---|---|

| All insurers | ₹2,500→20% discount; ₹5,000→25%; ₹7,500→30%; ₹15,000→35% on OD premium (as per IRDAI tariff) |

11. IMT-24: Electrical/Electronic Fittings Cover

Scope

IMT 24 is an optional add on that covers loss or damage to electrical/electronic accessories fitted to the bike (but not included in the manufacturer’s listed price). Examples include aftermarket items like GPS units, sound systems, fog lamps, charging ports, etc.

The endorsement states that the insurer will indemnify the insured for any loss/damage to the specified electronic/electrical fittings (named in the policy schedule) caused by any insured perils (accident, fire, theft, etc.).

Note: Damage from mechanical failure or breakdown of the fittings is expressly excluded.

Premium calculation

IRDAI’s tariff (G.R. 41) mandates an extra premium of 4% of the declared value of the electrical/electronic items. In practice, the insurer requires the rider to declare the total value of such accessories when purchasing IMT 24; the premium is simply 4% of that amount.

For example, if a motorcycle has a Bluetooth stereo system worth ₹10,000 fitted, the IMT 24 premium would be ₹400. (United India and other insurers confirm the 4% rule on their websites.)

Exclusions

- Per the endorsement, mechanical or electrical breakdown of the fittings is not covered.

- Only items listed in the schedule (whose value is declared) are insured.

- Damage to any non declared accessory would not be payable.

- Otherwise, coverage follows the standard Section I perils. (Liability to third parties is unaffected by IMT 24, as this endorsement only extends the own damage cover to accessories.)

Limits of liability

The insurer’s maximum payout for any covered accessory loss is its Declared Value (IDV), as entered in the policy. In other words, if the rider declares an accessory’s value as ₹5,000, that is the cap on recovery for that item under IMT 24. Depreciation rules for parts generally apply to repair estimates as usual (except for a total loss where IDV is paid).

Practical Example

A rider adds an LED lamp and a mobile charger to their bike, worth ₹5,000. They buy IMT 24 cover and pay 4% of ₹5,000 = ₹200 extra premium. Later, these accessories are damaged in a covered collision.

The insurer will reimburse up to ₹5,000 (minus any salvage), subject to standard depreciation rules for repair parts. If the accessories had cost only ₹2,000, the extra premium would have been just ₹80, and the payout would have been capped at ₹2,000.

| Insurer | IMT-24 Electrical/Electronic Fittings |

|---|---|

| All insurers | 4% of IDV of electrical/electronic items (Extra premium) |

12. IMT-33: Loss of Accessories Cover

Scope

This endorsement (IMT‐33) covers loss or damage to declared accessories (electrical or non-electrical) caused only by theft, burglary or housebreaking – provided the vehicle is not stolen in the same event.

It must be specifically purchased (payment of additional premium). The insured must declare all accessories covered; then, the loss/theft of those items is indemnified.

Premium Calculation

Insurers typically charge an extra premium of 3% of the total declared IDV of accessories. For example, United India Insurance explicitly notes that accessories cover (for bikes) are “covered on payment of an additional premium of 3% of the IDV of such accessories.”.

Exclusions

- IMT-33 covers theft/burglary only. Any accidental damage to accessories (even in a crash) is not covered under this endorsement.

- Only loss by unauthorised taking is insured.

- All usual policy exclusions (e.g. wear-and-tear, mechanical breakdown) still apply otherwise.

Limit of Liability

The claim payout is limited to the declared IDV of each accessory. If multiple items are covered, the insurer pays up to each item’s sum insured (aggregate not exceeding total declared accessories IDV).

Practical Example

A rider declares accessories (seat cover, bike cover, etc.) worth ₹10,000 and pays an extra premium of 3% × ₹10,000 = ₹300.

Suppose the helmet lock and cover (total IDV ₹2,000) are stolen. In that case, the insurer reimburses up to ₹2,000 (subject to depreciation) under this cover.

| Insurer | IMT-33 Loss of Accessories |

|---|---|

| All insurers | 3% of accessories IDV (Extra premium) |

FAQs on Indian Motor Tariff (IMT) for Two-Wheelers in India

1. How do I avail myself of the IMT-8 Automobile Association Membership discount?

Submit your valid IRDAI-recognised automobile association card at policy inception or renewal to get a 5% discount on your damage premium (capped at ₹50).

2. Which anti-theft devices qualify for the IMT-10 discount, and how much can I save?

Install an ARAI-approved GPS tracker or immobiliser and submit the installation certificate to receive a 2.5% OD premium discount (up to ₹500).

3. Who is eligible for the IMT-12 Specially Designed/Modified Vehicles discount?

Two-wheelers modified for use by blind, disabled people, or mentally challenged persons (with RTA endorsement) qualify for a 50% OD premium discount.

4. When should I choose IMT-13 to use within the insured’s own premises?

If your bike is used exclusively within private premises (e.g., farm, factory yard) to exclude public-road risk, opt for IMT—13. Insurers offer a 33⅓% tariff reduction on OD premiums.

5. What is the difference between IMT-22 and IMT-22A deductibles?

IMT-22 is a compulsory ₹50 deductible on every own damage claim; IMT-22A is an optional, voluntary deductible (₹2,500–₹15,000) that earns you up to 35% OD premium discount.

6. How do voluntary deductibles under IMT-22A affect my claim payout?

Your total deductible becomes ₹50 + the chosen IMT-22A amount. For example, a ₹5,000 voluntary deductible means you bear ₹5,050 per own damage claim but save 25% on OD premium.

7. Can I combine multiple Indian Motor Tariff endorsements on the same two-wheeler policy?

Yes—endorsements like IMT-1, IMT-8, IMT-10, IMT-12, IMT-13, IMT-22 and IMT-22A can opt together if you meet each declaration or proof requirement.

8. Will my premium be reduced if I install an anti-theft device mid-term?

Yes—providing the ARAI-approved device certificate mid-term triggers a pro-rata IMT-10 discount for the remaining policy period.

9. How do I ensure my Indian Motor Tariff endorsements are correctly reflected in my policy?

Always tick the chosen IMT boxes on the proposal/renewal form and attach the required proofs. Verify your policy schedule’s “Endorsements” section for correct premiums and discounts.

Other related articles from Bikeleague India

- Understanding bike insurance jargons & Essential Addons

- Two wheeler insurance in India – How to buy and select

- Must have bike documents for travel in India

- Third party Bike Insurance Calculator – Calculate your insurance

- Bike IDV Calculator – Calculate Your Bike’s Value Online

Conclusion

In conclusion, understanding Indian Motor Tariff (IMT) is essential for two-wheeler owners to make informed decisions about their motor insurance coverage. By familiarising themselves with various endorsements, such as extended geographical coverage, benefits for automobile association members, and options for voluntary deductibles, riders can tailor their policies to better suit their needs.

We hope this article has cleared up all your basic doubts about Indian Motor Tariffs for Two Wheelers in India. If you have any other doubts or queries, email us at bikeleague2017@gmail.com. You can also share your doubts or opinions in the comments section below. We are always eager to help and assist you. Also, here are several social media platforms of Bikeleague India to raise your suspicions.