Learn about bike insurance jargons and find must-have bike insurance addons for your ride in India. Stay informed and ride confidently.

Key Takeaways

- Bike insurance provides financial protection against damages and losses and ensures compliance with legal requirements.

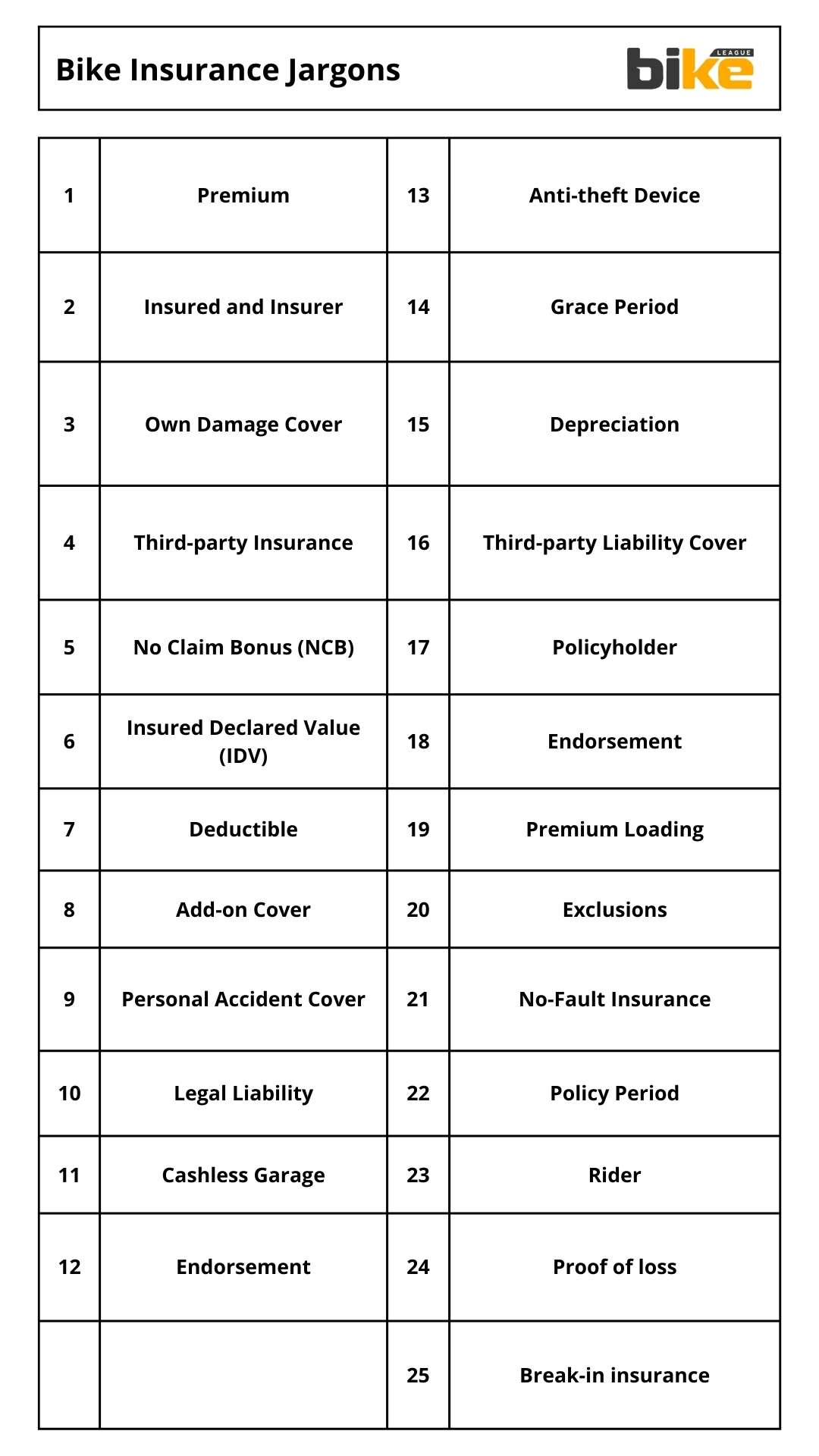

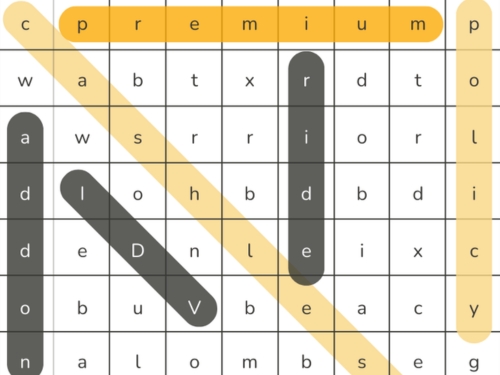

- Premium, Insured and Insurer, Own Damage Cover, Third-party Insurance, No Claim Bonus (NCB), Insured Declared Value (IDV), Deductible, Addon Cover, Personal Accident Cover, Legal Liability, Cashless Garage, Endorsement, Anti-theft Device, Grace Period, Depreciation, Third-party Liability Cover, Policyholder, Endorsement, Premium Loading, Exclusions, No-Fault Insurance, Policy Period, Rider, Proof of loss, Break-in insurance are the bike insurance jargons

- In bike insurance, an addon (also called a rider or endorsement) is an optional coverage you can purchase along with your standard policy to enhance protection based on your specific needs and preferences.

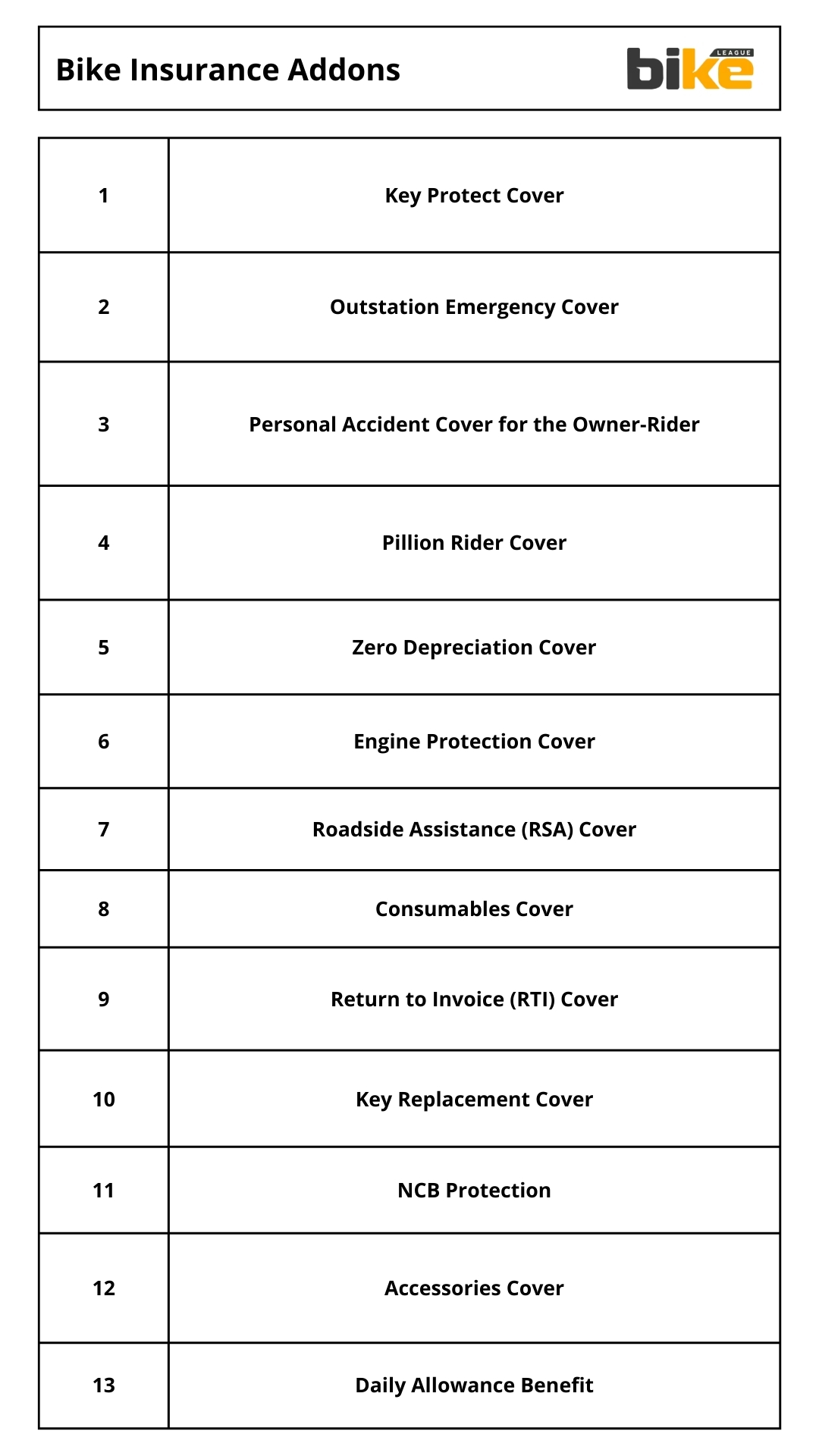

- Key Protect Cover, Outstation Emergency Cover, Personal Accident Cover for the Owner-Rider, Pillion Rider Cover, Zero Depreciation Cover, Engine Protection Cover, Roadside Assistance (RSA) Cover, Consumables Cover, Return to Invoice (RTI) Cover, Key Replacement Cover, NCB Protection, Accessories Cover, Daily Allowance Benefit are the list of all bike insurance addons in india

What is bike insurance jargon and its importance in India?

Bike insurance is crucial for owning a two-wheeler in India. It provides financial protection against damages and losses and ensures compliance with legal requirements. Bike insurance jargon is a specialized term and phrase used in the insurance industry, particularly when handling motorcycle insurance policies. These terms may need clarification for those unfamiliar with insurance terminology.

But the surprising fact is that 99% of people need to learn the basic bike insurance jargon. They will only come to know the terms when they get involved in an accident or other issues. Also, as these people have limited knowledge, they are cheated or duped by insurance agents.

List of all bike insurance jargons

1. Premium

The premium is the amount you pay annually for your bike insurance policy. It is determined based on various factors, including the type of coverage, the bike’s model, and the insured declared value (IDV).

2. Insured and Insurer

The insured refers to the person or entity covered under the policy. The insurer provides coverage.

3. Own Damage Cover

This cover protects against repair and replacement costs when your bike is damaged due to accidents, natural disasters, or riots.

4. Third-party Insurance

Third-party insurance is mandatory and covers damages or losses caused to a third party by the insured bike. It does not cover damages to the insured’s own vehicle.

5. No Claim Bonus (NCB)

NCB is a discount on the premium for not raising any claims during the policy period. It rewards safe driving and can significantly reduce renewal premiums.

6. Insured Declared Value (IDV)

IDV is the maximum amount the insurer will pay if the bike is stolen or damaged beyond repair. It is the bike’s current market value.

7. Deductible

Compulsory Deductible: A fixed amount the policyholder must pay out-of-pocket before the insurer pays the claim.

Voluntary Deductible: The policyholder agrees to pay an additional amount to reduce the premium.

8. Addon Cover

Addons are additional coverages providing specific protections beyond the standard policy, such as engine or roadside assistance.

9. Personal Accident Cover

This mandatory cover protects against physical injuries or death from an accident involving the insured bike.

10. Legal Liability

This term refers to the policyholder’s responsibility for third-party liabilities, including property damage or bodily injuries caused by the insured bike.

11. Cashless Garage

A cashless garage is an authorized repair shop where the insurer directly settles the repair bills, reducing the hassle for the policyholder.

12. Endorsement

An endorsement is a formal change to the insurance policy, such as updating personal information or modifying coverage terms.

13. Anti-theft Device

Installing an anti-theft device can reduce the insurance premium as it lowers the theft risk.

14. Grace Period

A grace period allows the policyholder to renew the policy within a specified time (usually 30 days) after it expires without requiring a vehicle inspection.

15. Depreciation

Depreciation refers to reducing the bike’s value over time due to wear and tear.

16. Third-party Liability Cover

This cover protects against financial liabilities from damages or injuries the insured bike caused to a third party.

17. Policyholder

The person who holds the bike insurance policy is responsible for paying the premium.

18. Endorsement

You can change your insurance policy by adding or removing coverage, updating personal information, or modifying vehicle details.

19. Premium Loading

An additional premium is charged if the insurance company perceives higher risk due to factors like a modified bike or an inexperienced rider.

20. Exclusions

The insurance policy does not cover these specific situations or conditions. It is understanding what needs to be covered to avoid surprises when making a claim.

21. No-Fault Insurance

Specific policies cover accidents where no one is at fault. In these cases, both parties involved in the accident can make claims from their respective insurance policies without assigning blame.

22. Policy Period

The duration of the insurance policy is valid, typically one year.

23. Rider

An optional addon to the base policy that provides extra coverage for specific situations, such as a personal accident or pillion rider cover.

24. Proof of loss

Submit a formal documentation or statement called proof of loss to the insurance company to provide evidence of your claim. This is a crucial part of the claims process as it helps the insurer evaluate the validity and extent of your claim.

25. Break-in insurance

Renew your bike insurance annually to continue enjoying its benefits. If you miss the due date, your policy will be suspended. When you renew a lapsed policy, the time between the due date and the renewal date is called the break-in period in bike insurance.

What are bike insurance addons and their importance in bike insurance in India?

In bike insurance, an addon is an extra coverage option you can buy with your standard policy to customize your coverage according to your specific needs and preferences. It’s also known as a rider or endorsement.

Bike insurance addons offer additional protection and benefits beyond the basic coverage provided by the standard policy. You’ll have to pay extra for these addons, which will be added to your base premium. 99% of customers need to learn what bike insurance addons their respective insurance companies provide and think it is an additional burden.

List of all bike insurance addons in India

1. Key Protect Cover

This addon covers the cost of replacing the bike’s key if lost, damaged, or stolen, providing peace of mind to the policyholder.

2. Outstation Emergency Cover

This addon provides assistance if the bike breaks down or meets with an accident outside a 100 km radius of the policyholder’s residence, ensuring help is available even when far from home.

3. Personal Accident Cover for the Owner-Rider

This provides coverage for accidental injury or death of the policyholder (the bike owner) while riding the insured motorcycle.

4. Pillion Rider Cover

This extends personal accident coverage to the bike’s pillion rider(s).

5. Zero Depreciation Cover

This addon ensures that the policyholder receives the total claim amount without any deductions for depreciation, making it highly beneficial for new bikes.

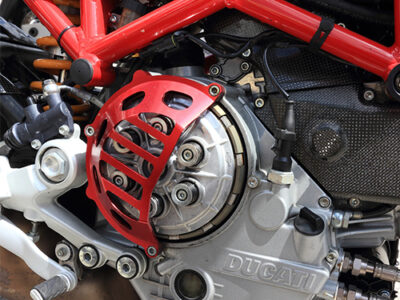

6. Engine Protection Cover

This addon covers the costs of repairing or replacing the bike’s engine and parts, often excluded from standard policies.

7. Roadside Assistance (RSA) Cover

RSA cover provides emergency services like towing, fuel delivery, and on-site repairs, which can be invaluable during unexpected breakdowns

8. Consumables Cover

This addon covers the cost of consumable items like engine oil, nuts, and bolts used during repairs, which are not covered under standard policies.

9. Return to Invoice (RTI) Cover

In the event of a total loss (e.g., theft or severe damage), this addon pays the difference between the insured declared value (IDV) and the bike’s invoice value.

10. Key Replacement Cover

It covers the cost of replacing lost or stolen keys, including crucial programming and rekeying the bike’s locks.

11. NCB Protection

This addon ensures you keep your accumulated No Claim Bonus (NCB) even if you claim it during the policy period.

12. Accessories Cover

It covers additional accessories or modifications not included in the standard policy, such as customized seats, helmets, or exhaust systems.

13. Daily Allowance Benefit

In case of a claim-related repair that takes time, this addon provides a daily allowance to cover the cost of alternative transportation while your bike is undergoing repairs.

What specific addons should be considered essential for bike insurance in India?

1. Zero Depreciation Cover

This addon is one of India’s most essential and popular bike insurance options. Its importance stems from the following benefits:

- Ensures the policyholder receives the full claim amount without any deductions for depreciation.

- Particularly beneficial for new bikes or those with expensive parts.

- Covers the full replacement cost of bike parts, maximizing the claim payout.

- Reduces out-of-pocket expenses during claims, making it a valuable option for all bike owners.

2. Roadside Assistance Cover

This addon is essential due to its practical benefits, especially for those who travel frequently or in remote areas. Key advantages include:

- Provides emergency services such as towing, fuel delivery, and on-site repairs.

- Offers peace of mind by ensuring help is available during unexpected breakdowns.

- Particularly valuable for long-distance travellers or those in areas with a higher risk of breakdowns.

3. Engine Protection Cover

This addon is crucial for safeguarding against costly engine repairs, which are often excluded from standard policies. Its importance is highlighted by:

- Covers the cost of repairing or replacing engine components due to water ingress or oil leakage damage.

- Especially recommended for those living in flood-prone areas or regions with poor road conditions.

- Protects against one of the most expensive potential repairs for a bike.

4. Personal Accident Cover

While often mandatory, this cover is sometimes listed as an addon essential for comprehensive protection. Its significance lies in:

- Provides financial support for medical expenses or compensation in case of injuries, permanent disability, or accidental death while riding the bike.

- Can be extended to cover the pillion rider, offering broader protection.

- Offers significant financial protection for the rider and their family.

5. Return to Invoice (RTI) Cover

This addon is particularly beneficial for new and high-value bike owners. Its importance is due to:

- Covers the gap between the insured declared value (IDV) and the bike’s invoice value in case of total loss or theft.

- Ensures that the policyholder can recover the full purchase price of the bike, including registration and road tax. It provides peace of mind, especially for those with significant bike investments.

6. Consumables Cover

This addon is essential for reducing the overall maintenance costs of the bike. Its benefits include:

- Covers the cost of consumable items like engine oil, nuts, bolts, and other materials used during repairs.

- Helps reduce out-of-pocket expenses during repairs, especially for frequent riders.

- Particularly useful for maintaining the bike without incurring additional costs.

7. No Claim Bonus (NCB) Protection

This addon is crucial for maintaining lower premiums over time. Its importance is highlighted by:

- Allows policyholders to retain their accumulated NCB even if they make a claim during the policy period.

- Helps maintain lower premiums in the future, rewarding safe driving habits.

- Particularly beneficial for experienced riders with a good claim history.

FAQ about bike insurance jargon and addons in India

1. What is the grace period for bike insurance?

A grace period is the extra time policyholders are given to renew their insurance policy after it has expired. During this period, the insurance coverage stays active, giving the policyholder a limited opportunity to make the premium payment and renew the policy without any interruption in coverage.

2. What is a consequential loss in bike insurance in India?

Consequential loss, also called “consequential damage,” in bike insurance refers to indirect or secondary losses or damages caused by an incident or accident involving your insured motorcycle. These losses are not the accident’s immediate or direct outcome but its consequences or effects. Standard bike insurance policies in India do not include consequential loss addons.

3. What is a cashless claim in motorcycle insurance?

In a cashless claim, your bike can be repaired at a garage or service centre affiliated with your insurance company. The garage will directly communicate with the insurance company to settle the claim, so you don’t have to pay for the repairs upfront.

The insurance company will cover the cost of repairs up to the policy’s coverage limit, taking into account deductibles and depreciation. However, according to the policy terms, you may still be responsible for paying any applicable deductibles, depreciation, or non-covered expenses. Using a garage that is part of the insurance company’s network is essential for a cashless claim.

4. What is a reimbursement claim in motorcycle insurance?

In a reimbursement claim, you must pay for the bike repairs or expenses upfront using your funds. Once the repairs are done, you must gather all the necessary invoices, bills, and receipts for the repairs and costs. These documents and a claim form should be submitted to your insurance company.

The insurance company will review your claim and determine if the expenses are covered under your policy. If approved, they will reimburse you for the eligible costs by sending you a check or depositing the amount directly into your bank account. You can choose a repair shop or garage with reimbursement claims, as you are not limited to network garages.

5. What are the benefits of taking a Return To Invoice (RTI) addon?

- Suppose your bike is stolen or damaged beyond repair. In that case, the RTI addon guarantees you will receive the full invoice or original bike purchase price, including taxes and registration fees.

- Unlike standard insurance policies, the RTI addon does not factor in depreciation when settling a claim for a total loss. This means you will receive the bike’s full invoice value without any deduction for wear and tear.

- The RTI coverage bridges the gap between the bike’s market value and the actual purchase price, ensuring you won’t suffer a financial loss in the event of a total loss. This lets you easily replace your stolen or irreparably damaged motorcycle with a new one of the same make and model, quickly getting you back on the road.

- The RTI addon is particularly valuable in motorcycle theft cases, as it prevents you from bearing the cost of the stolen bike.

6. List some examples of consequential loss in bike insurance?

- Consequential losses occur when you cannot use your bike due to an accident, resulting in a loss of income. This includes using alternative transportation methods like taxis or rental vehicles, which can be costly.

- Medical expenses unrelated to the accident may also be considered consequential losses. Towing and storage charges for your bike are also included.

- If your bike is unavailable for an extended period, you may incur additional expenses related to commuting or transportation. Renting a replacement vehicle is also a consequential loss.

- Travel expenses incurred while waiting for your bike to be repaired far from home are also considered consequential losses.

7. Is there a difference between insurer and insured in two-wheeler insurance?

The insurance company or organization provides the insurance policy to the policyholder (the insured). The insured (such as a bike owner) purchases and holds the insurance policy from the insurer. Another term for insured is the policyholder.

Essential links for bike insurance in India

- Insurance Regulatory Authority Of India (IRDAI)

- Institute of Actuaries of India

- Insurance Brokers Association of India (IBAI)

- Indian Institute of Insurance Surveyors & Loss Assessors

- Insurance Information Bureau of India

Other related articles from Bikeleague India

- Two-wheeler insurance in India – How to buy and select

- Must have bike documents for travel in India

- Tips to reduce your bike insurance premium in India

- Things to know while buying second hand motorcycle

- How to choose the perfect motorcycle for your riding style in India

Conclusion

We hope this article covers all bike insurance jargon and must-have bike insurance addons in India. If you have any other doubts or queries, email us at bikeleague2017@gmail.com or share your doubts or opinions in the comments section below. We are always eager to help and assist you. Also, here are several social media platforms of Bikeleague India to raise your suspicions.