Long story short – As the law mandates, Every motorcycle or two-wheeler owner in India should have mandatory third-party bike insurance per the Motor Vehicles Act 1988. Also, comprehensive or bumper-to-bumper insurance is the best for motorcycle/ bike insurance, without a doubt.

Key Takeaways

- Motorcycle insurance protects you and your bike against financial losses from accidents, theft, natural disasters, and other risks. It also provides liability coverage if you cause property damage or injure someone in an accident.

- Motorcycle insurance is mandatory in India under the Motor Vehicle Act 2019, requiring new bikes to have a five-year third-party cover. Riding without insurance can lead to legal penalties, fines, imprisonment, and high accident-related expenses.

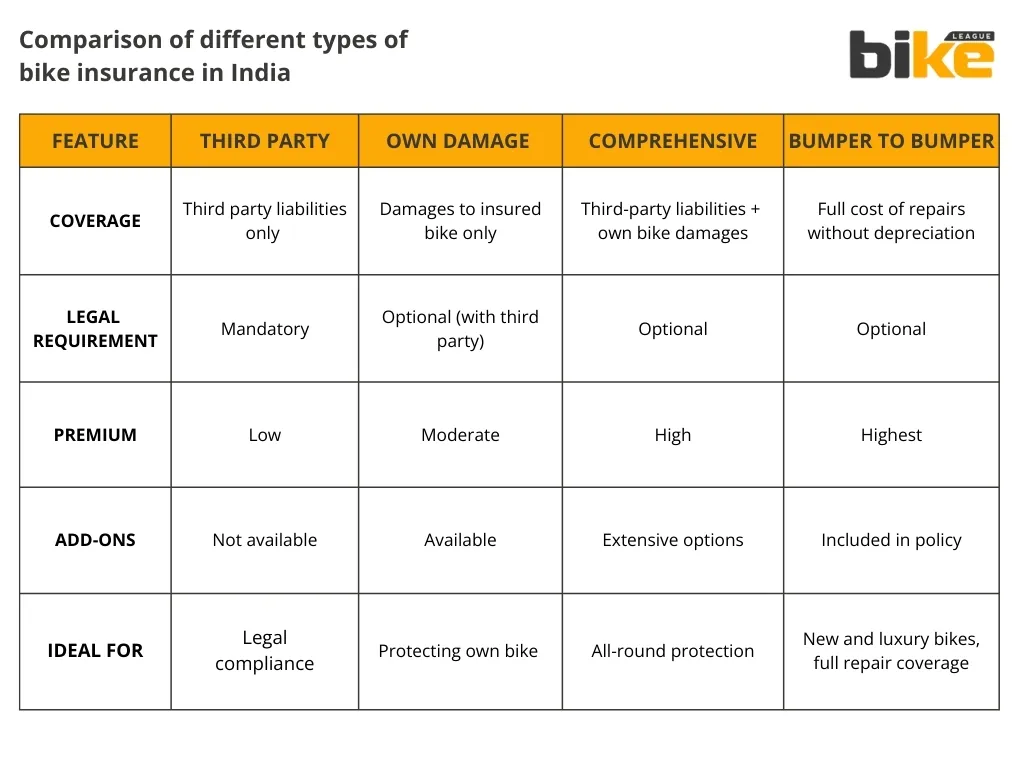

- Third-Party Insurance,Comprehensive Insurance,Own Damage Insurance,Bumper-to-Bumper Insurance are the types of bike insurance in India

- IDV, or Insured Declared Value, represents the maximum amount an insurance company will compensate in case of total loss or theft of your bike.

Two-wheelers are known for their ease of use and are a dream come true for most. Also, in comparison to four-wheelers, the maintenance cost is low but comes with more risk in terms of safety. You will be shocked if you google the percentage of accidents caused by motorcycles in India. So all we can do is drive safely, wear a helmet and do the equally important task of insuring the two-wheeler.

How to buy or select two-wheeler insurance?

Motorcycle insurance is the first tedious thing that comes to the mind of a new two-wheeler owner. Most people need to learn insurance basics and get lured by an insurance agent’s words. If an accident occurs, they do not even know which type of bike insurance policy they hold and have yet to learn all the steps to be taken. So, let’s get to the basics of motorcycle insurance, like how to buy, select, and exclude two-wheeler insurance, and we will simplify this tedious task. First, let’s discuss the types of motorcycle insurance.

What is the legal mandate for Motorcycle Insurance in India?

1. Compulsory Insurance Under the Motor Vehicle Act

Under the Motor Vehicle Act 2019, India requires bike owners to have at least a third-party liability insurance policy. This requirement ensures that bike owners are legally covered for any damages caused to third parties in the event of an accident. Failure to comply with this law can result in fines or imprisonment.

2. Five-Year Insurance Requirement for New Bikes

The Insurance Regulatory and Development Authority of India (IRDAI) mandates that new bike purchases include a five-year third-party insurance plan and a one-year own-damage cover. This long-term bike insurance policy reduces the hassle of annual renewals and ensures continuous coverage.

What are the consequences of not having motorcycle insurance?

1. Legal Penalties

Riding a motorcycle without insurance is a legal offence in India. Non-compliance with the mandatory insurance requirement can lead to significant fines and legal consequences, including imprisonment. This strict enforcement underscores the importance of adhering to the insurance mandate.

2. Financial Risks

Without insurance, motorcycle owners are prone to substantial financial risks. In the event of an accident, they would have to bear the total cost of damages and medical expenses, which can be financially crippling. Insurance mitigates these risks by providing necessary financial support and coverage.

Types of two-wheeler insurance in India

1. Third-Party bike Insurance

In simple terms, third-party insurance must be mandatory for all vehicles in India. The rates are fixed by IRDAI (Insurance Regulatory & Development Authority of India) annually and cover only third-party liabilities and expenses. It provides financial protection against damages or injuries caused to a third party by the insured vehicle.

Pros of third party bike Insurance

- Legal Compliance: Third-party bike insurance is mandatory by law for all two-wheeler owners in India, ensuring legal compliance.

- Cost-Effective: It is generally less expensive as the premium rates are predefined by the Insurance Regulatory and Development Authority of India (IRDAI).

- Quick and Simple Purchase: The process of buying bike third-party insurance is straightforward and can often be completed online.

Cons of third party bike Insurance

- Limited Coverage: This type of insurance only covers damages to third-party persons and property, leaving the owner without coverage for their own vehicle.

- No Own Damage Coverage: It does not provide financial protection for damages to the insured vehicle, which can be a significant drawback.

- Complex Claim Process: The claim process can be complex and time-consuming, involving legal proceedings and documentation.

2. Standalone Own Damage (OD) two-wheeler Insurance

Standalone Own Damage insurance covers damages to the insured two-wheeler due to accidents, theft, fire, or natural disasters. This type of bike insurance policy benefits those who already have third-party bike insurance but want additional coverage for their own vehicle.

Pros of Standalone Own Damage insurance

- Coverage for Own Vehicle: OD insurance covers damages to your own vehicle due to accidents, theft, fire, natural disasters, and other perils.

- Customization Options: You can enhance your OD insurance with addons such as zero depreciation cover, roadside assistance, and engine protection.

- Peace of Mind: It provides financial protection against a wide range of risks, giving you peace of mind.

Cons of Standalone Own Damage insurance

- Higher Premium: OD insurance generally has a higher premium compared to third-party insurance.

- Depreciation Consideration: Insurers may consider depreciation while settling claims, resulting in a lower compensation amount.

3. Comprehensive two-wheeler insurance

In the comprehensive plan, in addition to third-party coverage, expenses for the loss/damage of your vehicle, personal accident cover for driver and rider, third-party bodily injuries, and damages to the owner’s vehicle are covered. We can also add additional riders (addons) to the existing policy. Coverage for plastics is considered, but depreciation rates are applicable.

Pros of Comprehensive two wheeler insurance

- Broad Coverage: Comprehensive insurance covers both own vehicle damages and third-party liabilities, providing extensive protection.

- Additional Coverage Options: It offers various addons such as personal accident cover, consumables cover, and roadside assistance.

- Peace of Mind: With comprehensive coverage, you are protected against a wide range of risks, including accidents, theft, fire, and natural disasters.

Cons of Comprehensive two wheeler insurance

- Higher Premium: Comprehensive insurance generally has a higher premium compared to OD and third-party insurance due to the broader coverage it provides.

- Exclusions and Limitations: There may be certain exclusions and limitations in the bike insurance policy, such as deductibles, waiting periods, and specific conditions for coverage.

4. Bumper to Bumper two wheeler insurance

Bumper-to-bumper insurance, also known as zero depreciation or nil depreciation cover, is an addon to a comprehensive bike insurance policy and is the best and the most expensive motorcycle insurance plan. All the features under the comprehensive plan also come under this plan. Everything is covered under this plan, including plastic parts when met with an accident. Depreciation rates are not applicable under this plan, even for plastic parts and are valid for the first 5 years of ownership.

Pros of Bumper to Bumper insurance

- No Depreciation Consideration: Bumper-to-bumper insurance ensures that you can claim the full insured amount for your vehicle without any depreciation deductions.

- Enhanced Coverage: It provides slightly broader coverage compared to comprehensive insurance, including coverage for all metal parts, fibre, and rubber.

- Higher Claim Amount: The claim amount is higher because the insurer does not deduct depreciation from the parts of the vehicle that have been repaired or replaced.

Cons of Bumper to Bumper insurance

- Higher Premium: The premium for bumper-to-bumper insurance is higher due to the additional zero depreciation cover.

- Limited Claims: Insurers may limit the number of claims allowed under bumper-to-bumper insurance.

- Exclusions: It may not cover damages to tyres, engine, or gearbox due to water ingression or oil leakage.

What’s not covered in two-wheeler insurance in India?

1. Driving Under the Influence

Insurance policies do not cover damages if the rider is found driving under the influence of alcohol or drugs. This is a standard exclusion across all policies to discourage irresponsible behaviour and ensure road safety.

2. Lack of Valid Documentation

Claims are rejected if the rider does not possess valid documents, such as a driver’s license or insurance certificate, at the time of the accident. This exclusion emphasizes the importance of adhering to legal requirements while riding.

3. Mechanical or Electrical Failures

Damages resulting from mechanical or electrical faults in the vehicle are not covered. These issues are part of regular maintenance and the owner’s responsibility.

4. Regular Wear and Tear

Insurance policies do not cover damages due to regular wear and tear of vehicle components. This exclusion ensures the policy is used for unforeseen events rather than routine maintenance.

5. Geographical Limitations

Accidents that occur outside the geographical boundaries specified in the policy are not covered. This exclusion is crucial for riders who frequently travel across different regions.

6. Purposeful Damage

Any damage caused intentionally to raise a fraudulent claim is not covered. This exclusion helps prevent insurance fraud and ensures that only genuine claims are honoured.

7. Expired Policy

Claims made on a lapsed or inactive bike insurance policy are not entertained. It is essential to renew the policy on time to maintain continuous coverage and avoid claim rejections.

8. Riding Without a Helmet

Some policies exclude coverage if the rider is not wearing a helmet during the accident. This exclusion promotes using safety gear and reduces the risk of severe injuries.

9. Overspeeding

Accidents caused due to overspeeding are often not covered. This exclusion encourages safe riding practices and reduces the likelihood of high-speed accidents.

10. Theft Due to Negligence

The claim may be rejected if the vehicle is stolen due to the owner’s negligence, such as leaving the keys in the ignition. This exclusion underscores the importance of taking basic precautions to prevent theft.

11. Third party Damages

An own damage bike insurance policy does not cover damages incurred by third parties. Separate third-party bike insurance is required to cover such liabilities.

12. Accidents as a Passenger

Accidents that occur while the insured person is a passenger on someone else’s two-wheeler are not covered. This exclusion clarifies the scope of coverage, which is limited to the insured vehicle.

13. Protective Gear Damage

Damage to the helmets or other protective gear is generally not covered under standard two-wheeler insurance policies. Riders may need to purchase additional coverage for such items.

How do motorcycle insurance premiums vary based on location in India?

Motorcycle insurance premiums in India vary significantly based on location. Let’s explore how these factors impact insurance rates.

Urban vs. Rural Areas

Urban Areas

Generally have higher insurance premiums due to several factors:

- Increased traffic congestion

- Higher accident rates

- Elevated theft risks

- Greater population density

- Higher crime rates

Rural Areas

Typically benefit from lower insurance premiums due to:

- Reduced traffic

- Lower accident rates

- Decreased overall risk for insurers

State-Specific Variations

Insurance premiums can vary between states due to:

- Differing local regulations

- Unique risk assessments

- Traffic volumes

- Theft rates

For instance, coastal states like Tamil Nadu, prone to cyclones, may have higher premiums than inland states like Bihar due to the elevated risk of weather-related damages.

How do motorcycle insurance premiums vary based on rider experience in India?

Rider experience is another significant factor influencing motorcycle insurance premiums in India:

1. Experienced Riders

Generally considered lower risk by insurers

Often benefit from lower insurance premiums

Perceived to have better riding skills and less likely to be involved in accidents

2. Inexperienced Riders

Typically, they face higher premiums due to increased risk perception

3. Riding Record

A clean riding record, free from accidents and traffic violations, can significantly reduce insurance premiums

Riders with a history of claims or violations are often seen as high-risk, leading to higher premiums

4. Duration of Riding

The length of time a rider has been riding influences premiums

Insurers may require 2 to 5 years of good riding habits before offering reduced rates

5. Safety Practices

Adhering to safe riding practices and following traffic rules can enhance a rider’s profile

Safe riders are eligible for lower premiums as they reduce the likelihood of accidents and claims

What is Insured Declared Value (IDV)?

IDV, or Insured Declared Value, represents the maximum amount an insurance company will compensate in case of total loss or theft of your bike. It is the current market value of your motorcycle after accounting for depreciation. The IDV is crucial as it determines the maximum payout you can receive from your insurer in case of a total loss or theft.

1. Calculation of IDV

The IDV is calculated based on the bike’s manufacturer’s selling price minus the depreciation rate applicable to its age and parts. Factors such as the make and model of the bike, registration date, city of registration, type of fuel, and age are considered in determining the IDV.

2. IDV Impact on Premium and Coverage

IDV directly impacts the insurance premium; a higher IDV results in a higher premium but offers better financial protection. Conversely, a lower IDV might reduce the premium and decrease coverage. It is essential to balance adequate coverage and manageable premiums by choosing an IDV that aligns with your bike’s value and budget.

3. IDV Depreciation and Adjustments

Depreciation plays a significant role in calculating the IDV. Older bikes experience higher depreciation, resulting in lower IDVs. The IDV is typically fixed at the policy’s inception but may be adjusted during renewal based on mutual agreement between the insurer and policyholder.

What is No-Claim Bonus?

NCB, or No Claim Bonus, is a discount the insurer awards for not raising any claims during the policy period. It serves as a reward for safe riding and helps reduce the premium for the subsequent policy period. The NCB can significantly lower the premium’s Own Damage (OD) component.

1. Calculation and Accumulation of NCB

The percentage of NCB increases with each consecutive claim-free year, reaching up to 50% for five successive claim-free years. This bonus is applied to the renewal premium, making it a cost-saving benefit for policyholders.

2. NCB Transfer and Protection

When you sell your bike or switch insurers, NCB transfer is possible from one bike insurance policy to another. An NCB Protection Addon Cover can be purchased to safeguard your NCB even if a claim is raised during the policy period. However, the NCB is nullified if the policy is not renewed within 90 days of its expiry.

3. NCB Limitations

NCB is unavailable with third-party Bike Insurance Plans; it only applies to Comprehensive Bike Insurance Policies. The NCB earned on one bike cannot be shared between bike insurance policies or transferred to another person.

What all addons are available for two-wheeler insurance?

1. Zero Depreciation Cover

Zero Depreciation Cover ensures that the insurance company covers the total cost of repairs or replacements without considering the depreciation of parts. This addon is highly beneficial as it maximizes the claim amount you receive.

2. Engine Protect Cover

The Engine Protect Cover is crucial as it covers engine damages, which are not typically included in a standard comprehensive policy. This addon is particularly useful in scenarios involving water ingress or oil leakage.

3. Roadside Assistance Cover

Roadside Assistance Cover provides help if you are stranded due to a breakdown or accident. Services may include towing, minor repairs, fuel delivery, and more. This addon ensures you are not left helpless on the road.

4. Outstation Emergency Cover

This addon offers assistance if your two-wheeler breaks down or meets with an accident outside a 100 km radius of your residence. It is beneficial for those who frequently travel long distances.

5. Key Protect Cover

Key Protect Cover covers the cost of replacing your bike’s key if it is lost, damaged, or stolen. This addon can save you the inconvenience and expense of key replacement.

6. Consumables Cover

Consumables Cover includes the cost of consumable items such as engine oil, nuts, bolts, and other materials used during the repair or service of your two-wheeler. This addon ensures you are not out-of-pocket for these small but essential items.

7. Personal accident Cover for Pillion Rider

This addon extends the personal accident coverage to the pillion rider, covering medical expenses incurred due to an accident. It is a valuable addition for those who often ride with a passenger.

8. Medical Cover

Medical coverage allows the policyholder to claim medical expenses incurred for treatment or hospitalization in case of an accident. This addon provides financial support for medical emergencies.

9. No Claim Bonus (NCB) Protection Cover

NCB Protection Cover ensures that your No Claim Bonus remains intact even if you make a claim during the policy period. This addon helps maintain the discount on your premium for the next policy term.

10. Return to Invoice Cover

Return to Invoice Cover ensures that in case of total loss or theft, you receive the invoice value of your bike rather than the depreciated value. This addon is beneficial for new bike owners.

Factors to consider when choosing & selecting Two Wheeler Insurance in India

1. Coverage Options

Ensure the policy provides adequate coverage for damages to your two-wheeler, third-party liability, and personal accident cover.

2. Claim Settlement Ratio (CSR)

A higher CSR indicates a higher likelihood of your claims being settled promptly.

3. Cashless Garage Network

A vast network of cashless garages ensures getting your vehicle repaired conveniently without upfront payments.

4. Additional Covers

Look for policies offering addons such as zero depreciation cover, roadside assistance, and engine protection cover.

5. Customer Service

Opt for an insurer with good customer service and responsiveness to customer needs.

6. Premium and Discounts

Compare premiums across insurers for similar coverage and look for discounts like No Claim Bonus (NCB).

7. Reputation and Financial Stability

Choose an insurance company with a good reputation and financial stability to ensure timely claim settlements.

8. Ease of Purchase and Renewal

Consider the ease of purchasing and renewing the policy, especially if you prefer online transactions.

How to claim for your two-wheeler after an accident?

1. Inform Your Insurer Immediately

Contact Your Insurer: Notify your insurance company about the accident within 24 to 48 hours. Provide detailed information about the accident, including the number of people involved, casualties, and the extent of vehicle/property damage.

Digital Notification: Many insurers offer the convenience of filing a claim through their online platforms or mobile apps, making the process faster and more efficient.

2. File an FIR with the Police (If Required)

Legal Liabilities: If the accident involves legal liabilities or third-party damage, file a First Information Report (FIR) with the police. This step is crucial for claims involving significant damage or third-party involvement.

3. Collect Evidence of the Damages

Photographic Evidence: Take clear pictures of the damage to your bike. This evidence will be essential for the claims process and the surveyor’s assessment.

4. Initiate the Claims Procedure

Online Claim Submission: Visit your insurer’s website or use their mobile app to initiate the claim. Fill out the claims form and upload the required documents, such as copies of your bike insurance policy, FIR, driver’s license, and bike registration certificate (RC).

5. Request a Surveyor

Damage Assessment: After submitting your claim, the insurer will assign a surveyor to assess the damage to your bike. This inspection typically occurs within 2-3 days of submitting your claim.

6. Get Your Bike Repaired

Cashless or Reimbursement: Depending on your policy, you can either opt for a cashless claim at a network garage or get your bike repaired at a garage of your choice and seek reimbursement. In a cashless claim, the insurer directly settles the repair bill with the garage. You must pay the repair costs upfront and then submit the bills to the insurer for reimbursement.

7. Submit Required Documents

Documentation: Ensure you have all the necessary documents ready for a smooth claims process. These typically include:

- Filled and signed claims form

- Driving license

- Bike insurance policy certificate

- Pollution Under Control (PUC) Certificate

- Identity proofs

- Bike Registration Certificate (RC)

- FIR (if required)

- Fire Brigade Report (for comprehensive policies)

- Cancelled cheque

- Original receipts/bills for repairs

How to Download Two Wheeler Insurance Document Online in India

Steps to Download Two Wheeler insurance document from DigiLocker

- Log into DigiLocker: Access your DigiLocker account using your mobile number, Aadhaar number, or username.

- Select the Issuer: Navigate to the ‘Banking and Insurance’ section and select your insurance provider, such as United India Insurance Co. Ltd.

- Choose Policy Type: Select the type of policy you want to download (e.g., two-wheeler insurance).

- Enter Search Parameters: Provide the necessary details like policy number and other required information.

- Fetch Document: Click on ‘Get Document’ after consenting to the terms. Your policy document will be added to the ‘Issued Documents’ section in your DigiLocker account.

Steps to Download from Two Wheeler insurance provider’s App/website

- Visit the Official Website/App: Log in to your insurance provider’s official website or app.

- Navigate to Policy Section: Go to the section where your policies are listed.

- Download Policy Document: Select your bike insurance policy and download the document. Most insurance companies provide a soft copy of the policy.

Which is the best method to take two-wheeler insurance offline or online in India?

Advantages of taking bike insurance online

- Convenience and Time-Saving: Buying and renewing bike insurance online is highly convenient and can be done from the comfort of your home or office at any time of the day, eliminating the need to visit a physical office or wait in long queues.

- Lower Premiums: Online policies often come with lower premiums as they are bought directly from the insurance company, bypassing agent commissions.

- Easy Comparison: The online method allows you to compare policies from different insurance companies easily, helping you make an informed decision and select the best plan that suits your needs.

- Quick and Hassle-Free Process: The process of buying or renewing bike insurance online is straightforward, quick, and paperless, often taking less than five minutes.

- 24×7 Assistance and Addon Covers: Online platforms offer 24×7 assistance and the option to purchase addon covers for enhanced protection.

- Retention of No Claim Bonus (NCB): Renewing your bike insurance online allows you to retain your No Claim Bonus (NCB), which provides a discount on your premium for every claim-free year.

- Secure Transactions: Online transactions are secure, with most insurance providers using secure server protocols to ensure a safe environment for purchasing policies.

Disadvantages of taking motorcycle insurance online

- Digital Literacy: Some individuals may find it challenging to navigate online platforms due to a lack of digital literacy or access to the internet.

- Perceived Lack of Personal Touch: The absence of face-to-face interaction with an agent might be a drawback for those who prefer personalized service and guidance.

Advantages of taking bike insurance offline

- Personalized Service: Buying motorcycle insurance offline through an agent provides personalized service, where the agent can offer tailored advice and assistance based on your specific needs.

- Trust and Reliability: Some individuals may feel more secure dealing with an agent or visiting a physical office, as it provides a sense of trust and reliability.

Disadvantages of taking bike insurance offline

- Time-Consuming: The offline method can be time-consuming, requiring visits to the insurance company’s branch and potentially waiting in long queues.

- Higher Premiums: Offline policies may come with higher premiums due to agent commissions and additional administrative costs.

- Limited Comparison: Comparing multiple policies offline can be cumbersome and less efficient, making it harder to find the best deal.

- Inconvenience: The need to physically visit the insurance office or meet with an agent can be inconvenient, especially for those with busy schedules.

Common Myths and Misconceptions about motorcycle insurance in India

1. Comprehensive Insurance is Expensive

Many believe that comprehensive insurance is prohibitively expensive. While it may have a higher premium than third-party insurance, it offers extensive coverage that can save significant costs in an accident or theft.

2. third party Insurance is Sufficient

Some think that third-party insurance is enough since it is mandatory. However, it does not cover damages to the insured vehicle, which can lead to substantial out-of-pocket expenses.

3. No Claim Bonus (NCB) Applies to third-party Insurance

There is a misconception that NCB benefits apply to third-party insurance. In reality, NCB applies only to own-damage and comprehensive policies.

4. IDV is Irrelevant

The Insured Declared Value (IDV) is often misunderstood. It is crucial in determining the sum assured for one’s own damage coverage, affecting the premium and claim amount.

Frequently Asked Questions (FAQs) about motorcycle insurance in India

1. Is Two-Wheeler Insurance Mandatory?

Yes, under the Motor Vehicles Act of 1988, every bike owner in India must have at least third-party insurance.

2. Can I Change my third-party bike insurance to Comprehensive Insurance?

Yes, you can contact your insurance provider to upgrade your third-party insurance to a comprehensive policy during the policy term or upon renewal.

3. What Should I Do in Case of an Accident or Theft?

In case of an accident or theft, immediately contact your insurance provider, lodge a First Information Report (FIR) at the police station, and raise a claim.

4. Can I Cancel My Bike Insurance Policy?

Yes, you can cancel your policy by contacting your insurance provider with a valid reason for cancellation.

5. Is Aadhaar Linking Mandatory for Insurance?

Linking Aadhaar with insurance plans is now mandatory per the IRDAI regulations.

6. Is renewal before expiry important for bike Insurance?

Yes, Renewing your bike insurance policy on or before the due date is essential to avoid any lapse in coverage. Missing the renewal date can lead to legal penalties and loss of benefits like the NCB.

Other related articles from Bikeleague India

- Understanding motorcycle insurance jargons & Essential Addons

- Tips to reduce your bike insurance premium in India

- The ultimate guide to bike number plates in India – Everything you need to know

- How to choose the perfect motorcycle for your riding style in India

- The dos and don’ts of bike modification & traffic rules in India

Conclusion

If you have any other doubts or queries about selecting and buying two-wheeler insurance in India, email us at bikeleague2017@gmail.com or share your doubts or opinions in the comments section below. We are always eager to help and assist you. Also, here are several social media platforms of Bikeleague India to raise your suspicions.