Long story short: Discover the key factors affecting bike loan interest rates in India. Get the insights you need to make informed decisions.

Times have changed, and even a person with a limited salary can fulfil their dream of owning a motorcycle. Yes, only through the bike loans provided by the banks. So, loans are now integral to a person’s financial situation. But to avail of a loan for your motorcycle nowadays is daunting as it requires a lot of paperwork and other guidelines. However, the bike loan interest rate is one significant and crucial factor in bike loans. Various factors can affect the loan interest rate both positively and negatively. So, Let’s break down the positive and negative factors that can affect bike loan interest rates in India.

key factors affecting bike loan interest rate

1. High Credit Score

Maintaining a credit score above 750 is advantageous as it can reduce interest rates. Lenders perceive individuals with elevated credit scores as less hazardous borrowers.

2. Stable Income

Having a consistent and verifiable source of income, such as steady employment or business revenue, can be advantageous when negotiating lower interest rates.

3. Large Down Payment

Providing a significant initial payment decreases the sum required to be borrowed, leading to potentially favourable loan terms and a reduced interest rate.

4. Loan Tenure

Choosing a shorter loan tenure may result in reduced interest rates. Nevertheless, the monthly EMI (equated monthly instalment) will be higher.

5. Relationship with the lender

Customers with a positive track record of financial transactions with a bank or financial institution may be eligible for preferential interest rates.

6. Government Policies

From time to time, the Indian government or the Reserve Bank of India (RBI) may implement policies to encourage the uptake of loans for specific categories of vehicles, such as motorcycles, by providing subsidies or reduced interest rates.

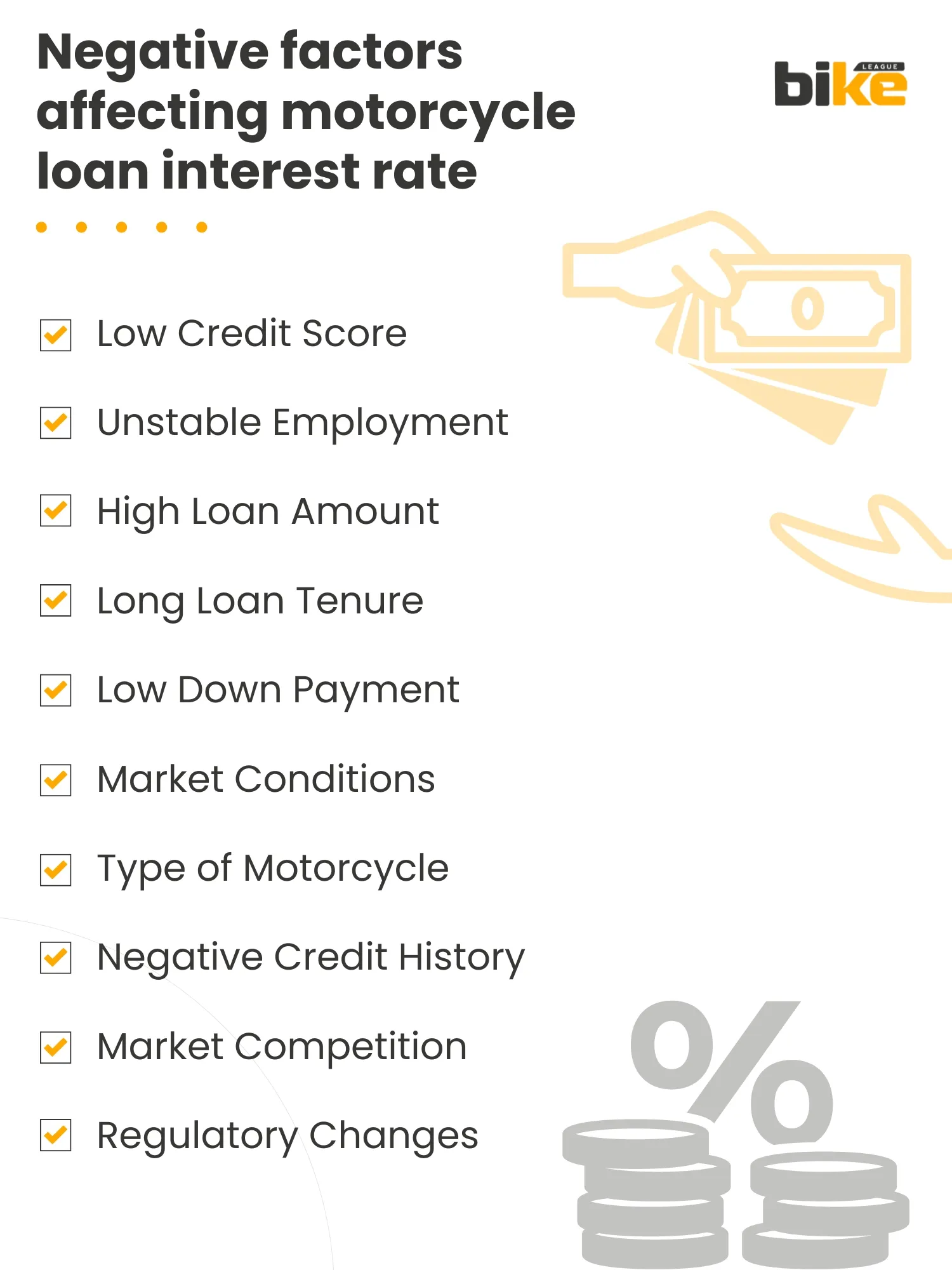

Negative factors affecting bike loan interest rate

1. Low Credit Score

A credit score below 650 is considered low and can adversely affect an individual’s financial standing. Such a score may lead to higher interest rates or loan rejection, indicating a higher credit risk.

2. Unstable Employment

Frequent changes in employment or inconsistent income may cause lenders to perceive you as a high-risk borrower, which could result in elevated interest rates.

3. High Loan Amount

Obtaining a substantial loan in proportion to one’s income may result in elevated interest rates, thereby augmenting the lender’s exposure to risk.

4. Long Loan Tenure

Choosing a lengthier loan term may decrease your monthly equated monthly instalment (EMI). However, it may also increase the overall interest expense incurred during the loan’s tenure.

5. Low Down Payment

A reduced initial payment results in an elevated loan-to-value (LTV) ratio, increasing the interest rates the lender charges due to the heightened risk involved.

6. Market Conditions

In the event of unfavourable economic conditions characterized by high inflation rates and stringent monetary policies, interest rates will likely increase generally.

7. Type of Bike

Certain bicycles, particularly those of high-end or imported varieties, may incur elevated interest rates owing to their high cost and perceived risk.

8. Negative Credit History

Instances of prior defaults, delayed payments, or a track record of missed payments may lead to elevated interest rates or the denial of a loan application.

9. Market Competition

The presence of competition among lenders may result in reduced interest rates; however, it may only sometimes be advantageous for borrowers, particularly if lenders adopt more stringent risk assessment criteria.

10. Regulatory Changes

Alterations to lending regulations or state or national policies can affect interest rates and loan conditions.

FAQ related to key factors affecting bike loan interest rate

1. Is a motorcycle loan interest tax deductible?

In India, motorcycle loan interest is usually not tax-deductible. Unlike home loans or education loans, which may provide tax benefits under specific sections of the Income Tax Act, motorcycle loans are personal loans. Therefore, the interest paid on them is not eligible for income tax deductions or exemptions.

2. Which bank is low interest for a bike loan?

Different factors, such as your credit score, loan amount, tenure, and current market conditions, can affect which bank offers the lowest interest rate for a bike loan. Additionally, interest rates on bike loans can fluctuate over time.

3. What is the standard bike loan interest rate in India?

Bike loan interest rates in India vary depending on several factors, including the lender, the applicant’s creditworthiness, the loan tenure, and the prevailing market conditions. Interest rates for bike loans in India range from 9% to 24% annually.

4. What is the most important factor that affects my bike loan interest rate?

The borrower’s credit score is the most critical factor influencing bike loan interest rates. A high credit score can lead to more favourable loan terms, reflecting the borrower’s creditworthiness and ability to repay the loan.

5. How does my income affect my bike loan interest rate?

Your monthly income and employment stability are significant factors in determining your bike loan interest rate. Lenders assess your repayment capacity based on your income level and job stability, which can influence the interest rate offered.

6. Does the type of bike I want to buy affect the interest rate?

Yes, the type of bike you intend to purchase can impact the interest rate. Different models may have varying risk profiles, which lenders consider when setting interest rates.

7. Will making a bigger down payment lower my interest rate?

Making a larger down payment could lower your interest rate. A substantial down payment reduces the loan amount and the lender’s risk, which may result in a more favourable interest rate.

8. How do market conditions affect bike loan interest rates?

Market conditions, including RBI policy rates and inflation, are crucial in determining bike loan interest rates. Changes in these economic factors can lead to fluctuations in interest rates offered by lenders.

9. What role does the lending institution play in determining interest rates?

The lending institution’s policies and relationship with the borrower can influence the interest rate. Different lenders may offer varying rates based on their internal credit policies and the borrower’s history with them.

10. How does loan tenure affect the interest rate?

The tenure of the loan is a key factor in determining the interest rate. Generally, shorter loan tenures attract lower interest rates as they pose less risk to the lender.

11. Are there any additional charges associated with bike loans?

Yes, bike loans often come with additional charges such as processing fees, documentation charges, and penalties for late payments or prepayment. These fees can affect the overall cost of the loan.

12. What is the impact of competition among lenders on interest rates?

Competition among lenders can lead to more competitive interest rates. When multiple lenders vie for customers, they may offer lower rates to attract borrowers.

Other related articles from Bikeleague India

- Motorcycle loan – How to finance your dream bike

- Bike Loan EMI calculator

- State wise Road Tax: Navigating India’s Two Wheeler Tax

- Two Wheeler Road Tax in India: A Detailed Explanation

- Bike insurance tips in India – Tips to get a lower premium

Conclusion

Throughout this article, we have discussed all key factors affecting and impacting bike loan interest rates, whether positive or negative. Let’s conclude by stating these facts in a nutshell. If you have any other doubts or queries, email us at bikeleague2017@gmail.com. You can also share your doubts or opinions in the comments section below. We are always eager to help and assist you. Also, here are several social media platforms of Bikeleague India to raise your suspicions.