Long story short: Are you looking to finance your dream bike through a two-wheeler loan? This guide will walk you through obtaining a bike loan, explore the factors that influence bike loan interest rates, needed documents for bike loan, learn how to calculate EMI for bike loan, tips for securing the best deal, and how to navigate the financing process smoothly making your dreams of hitting the road a reality.

In this current era, most motorcycle purchases, especially in India, are all based on loans. Yes, that is a reality. Everyone is willing to take out a two-wheeler loan to fulfil their dream of getting the desired bike. A bike loan is now a norm for motorcycle purchases.

However, most people do not know several aspects of bike loans, and there are several unknown things about them. In this article, we aim to discuss topics about bike loans, ranging from what bike loan documents required, things to know, misconceptions, and FAQs.

Key Takeaways

- There are two types of motorcycle loan – Secured and Unsecured

- The formula to calculate EMI for a bike loan manually is as follows: EMI = [P x R x (1+R)^N] / [(1+R)^N-1]

- There are also online two-wheeler loan calculators, especially on banking websites, to check for, which will provide you with approximate details.

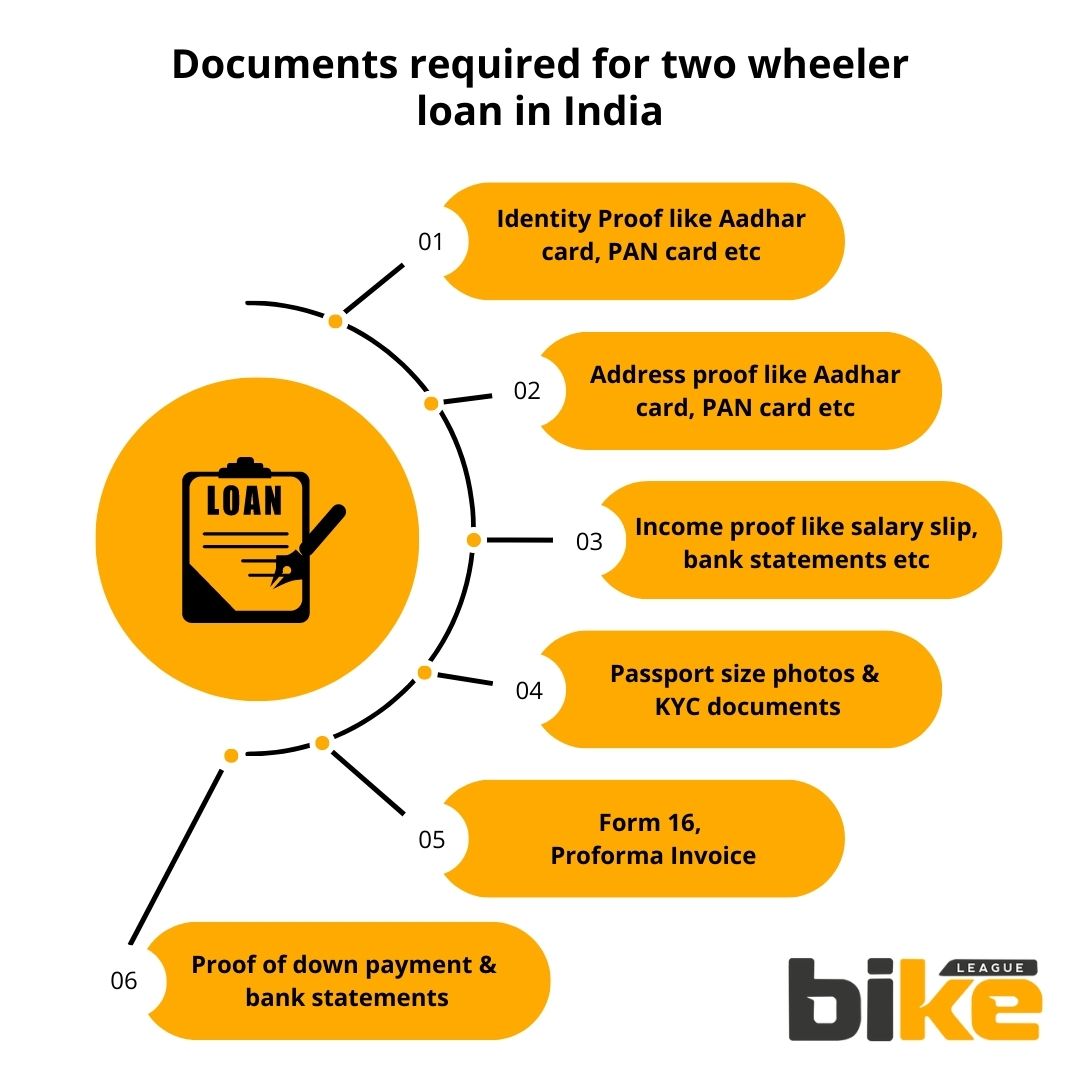

- There are more than 10+ documents required from motorcycle owner to avail the loan

- There are a lot of myths and misconceptions about motorcycle loans in India

What is a two-wheeler or motorcycle loan?

A bike loan, also known as a two-wheeler loan, is a type of loan that allows individuals to finance the purchase of a motorcycle or scooter. It is a popular financing option for those who want to buy a two-wheeler but may not have the total amount available upfront.

When you take a bike loan, the lender (usually a bank or a financial institution) provides the required funds to purchase the bike. You repay the loan monthly over a specified period, including interest and sometimes other charges. The tenure of a bike loan can vary from a few months to several years, depending on the terms offered by the lender and the borrower’s preference.

Types of Motorcycle Loan

1. Secured Motorcycle Loan

Secured motorcycle loans require the borrower to pledge an asset, typically the motorcycle itself, as collateral. If the borrower defaults on the loan, the lender has the right to seize the bike to recover the outstanding amount.

Benefits of Secured Motorcycle Loans

- Lower bike loan Interest Rates: Secured loans generally offer lower bike loan interest rates compared to unsecured loans because the collateral reduces the lender’s risk.

- Higher Loan Amounts: Borrowers can often secure larger loan amounts with a secured loan, as the collateral provides additional security for the lender.

- Improved Credit Score: Successfully repaying a secured loan can help improve the borrower’s credit score.

- Longer Repayment Terms: Secured loans typically come with longer repayment terms, providing more flexibility in managing monthly payments.

Drawbacks of Secured Motorcycle Loans

- Risk of Asset Forfeiture: If the borrower fails to repay the loan, the lender can seize the collateral, which in this case is the motorcycle.

- Additional Fees: Secured loans may include various fees, such as origination fees, appraisal fees, and other charges, which can add to the overall cost of the loan.

- Higher Processing Time: The process of evaluating and approving a secured loan can take longer due to the need to appraise the collateral.

2. Unsecured Motorcycle Loan

Unsecured motorcycle loans do not require collateral. They are granted based on the borrower’s creditworthiness and ability to repay without the need to pledge any assets.

Benefits of Unsecured Motorcycle Loans

- Faster Approval: Unsecured loans typically have a quicker approval process since there is no need to appraise collateral.

- No Risk of Repossession: Since no asset is pledged, there is no risk of losing the motorcycle in case of default.

- Flexibility in Purchase: Unsecured loans can be used to purchase motorcycles from private sellers, providing more flexibility in choosing the bike.

Drawbacks of Unsecured Motorcycle Loans

- Higher bike loan Interest Rates: Unsecured loans generally come with higher bike loan interest rates due to the increased risk for the lender.

- Lower Loan Amounts: The loan amounts for unsecured loans are usually lower compared to secured loans, as there is no collateral to back the loan.

- Credit Score Dependency: Approval for unsecured loans heavily depends on the borrower’s credit score and credit history.

How to calculate bike loan EMI in India?

When considering purchasing a new bike, it’s essential to calculate the EMI for a bike loan to determine your monthly repayment amount. This calculation helps you assess whether the loan fits your budget, allowing you to enjoy your dream bike without financial strain. Understanding how to calculate the EMI for a bike loan empowers you to make sound decisions and choose the best financing option for your needs.

1. Manual motorcycle loan calculation using a formula

The Equated Monthly Installment (EMI) formula calculates EMI for a bike loan in India. The EMI is the fixed monthly amount a borrower must pay to repay the bike loan.

The formula to calculate EMI for a bike loan is as follows:

EMI = [P x R x (1+R)^N] / [(1+R)^N-1]

Where: EMI = Equated Monthly Installment P = Principal amount (bike loan amount) R = Monthly interest rate (annual interest rate divided by 12 and converted to decimal) N = Loan tenure in months

2. Automatic two-wheeler loan calculation with a bike EMI calculator

Also, there are a plethora of online two-wheeler loan calculators, especially on banking websites, to check for, which will provide you with approximate details about the same.

Also, you can use our in-house Bike loan EMI calculator to calculate bike loans for Bikeleague India using the link below.

Bike Loan EMI calculator

Documents required for a bike loan in India

1. Identity Proof

To verify your identity, lenders require one of the following documents for applying for a bike loan:

- Passport: A widely accepted form of identity proof.

- Driving License: Serves as both identity and address proof.

- Voter ID Card: Another common form of identity verification.

- PAN Card: Often used for both identity and financial verification.

- Aadhaar Card: Increasingly used for identity verification due to its widespread acceptance.

2. Address Proof

Lenders need to confirm your residential address through one of the following documents for applying for a bike loan:

- Passport: Can serve as both identity and address proof.

- Driving License: Dual-purpose document for identity and address verification.

- Electricity Bill: Commonly used utility bill for address proof.

- Rental Agreement: Valid for tenants as address proof.

- Gas Bill with Gas Book: Another utility bill option for address verification.

3. Income Proof

Proof of income is crucial for lenders to assess your repayment capacity. The required documents vary based on your employment status. These documents are essential for applying for a bike loan:

Salaried Employees

- Latest Salary Slip: Shows your current income.

- Form 16: Provides a summary of your income and tax deductions.

- Bank Statements: Typically from the last six months, to verify salary credits.

- Income Tax Returns (ITR): For the latest year, to confirm your income and tax compliance.

Self-Employed Individuals

- Income Tax Returns (ITR): To verify income and tax compliance for the latest year.

- Bank Statements: Show business transactions from the last six months.

- Business Stability Proof: Documents like business registration or ownership proof.

- Cancelled Cheque: For bank account verification.

4. Age Proof

Lenders require age-proof documents for bike loans to ensure the applicant meets the legal age requirement for riding a two-wheeler:

- Birth Certificate

- Aadhaar Card

- PAN Card

- Passport

5. Application Form

A completed loan application form is mandatory for processing your loan request.

6. Photographs

Passport-sized photographs are required to complete the application process.

7. Signature Verification

Lenders may require a signature verification document to match your signature with the one on your official documents.

8. Employment Stability Proof

For salaried employees, proof of employment stability, such as an employment certificate, may be required.

9. Bank Statements

You may be asked to provide bank statements for the last three to six months as part of the documentation.

10. Proforma Invoice

You must provide a proforma invoice from the bike dealer specifying the bike on-road price of the bike you intend to purchase.

11. Proof of Down Payment:

You must provide proof of the down payment made for the bike.

12. KYC Documents

To apply for a bike loan, submit Know Your Customer (KYC) documents, including self-attested copies of your PAN and Aadhar cards.

Things to check and know about motorcycle loans in India

- Loan Eligibility: Check the lender’s eligibility criteria before applying for a two-wheeler loan. Generally, lenders consider factors like age, income, employment status, credit score, and existing loan obligations.

- bike loan Interest Rates: Compare the bike loan interest rates offered by various lenders. A lower interest rate will reduce the overall cost of the loan.

- Loan Amount and Down Payment: Decide on the loan amount you need and the down payment you can afford. A higher down payment will lower your loan amount and subsequent EMIs.

- Loan Tenure: Choose a loan tenure that suits your financial situation. Longer tenures may reduce the EMI amount but can increase the total interest paid over the loan term.

- Processing Fees and Other Charges: Before finalizing the loan, inquire about processing fees, administrative charges, and prepayment penalties, if any.

- Repayment Schedule: Understand the repayment schedule, including the EMI amount, due date, and modes of payment (cheque, online transfer, auto-debit, etc.).

- Prepayment and Foreclosure: Check if the lender allows prepayment or foreclosure without additional charges. Prepaying the loan can help you save on interest costs.

- Documentation: Prepare all the necessary documents for the loan application, such as ID proof, address proof, income proof, bank statements, and photographs.

- Loan Approval Time: Enquire the time taken for loan approval and disbursal. Some lenders offer instant approval, while others may take a few days.

- Credit Score: A good credit score enhances your chances of getting a favourable loan offer. Ensure you have a healthy credit history before applying.

- Two-Wheeler Insurance: Most lenders require you to have comprehensive insurance coverage for the two-wheeler during the loan tenure.

- Check for Offers and Discounts: Some lenders might have promotional offers or tie-ups with dealers that could provide benefits like reduced bike loan interest rates or processing fee waivers.

- Loan Default Consequences: Understand the consequences of loan default, as it can negatively impact your credit score and may lead to legal actions by the lender.

- Loan Agreement: Read and understand the terms and conditions mentioned in the loan agreement before signing it.

- Customer Support: Choose a lender with good customer support to assist you in case of any queries or issues during your loan tenure.

Some myths & misconceptions about motorcycle loan in India

- High Down Payment Required: Many believe a bike loan requires a significant down payment. While a down payment is typical, it’s not always substantial. Some lenders offer bike loans with lower down payment options, depending on the borrower’s eligibility and creditworthiness.

- Lengthy Loan Approval Process: Some assume that getting a bike loan involves a lengthy and cumbersome approval process. However, with the advent of digitalization, many lenders now offer quick and seamless online loan approval, making the process relatively faster and more efficient.

- Only New Bikes Can Be Financed: There’s a misconception that bike loans are only available for new motorcycles. In reality, most lenders offer loans for new and used bikes, depending on the bike’s age and condition.

- Higher Interest Rates: While interest rates for bike loans can vary based on the lender, loan amount, and tenure, some believe these loans always come with high interest rates. In truth, bike loan interest rates can be competitive, especially if you have a good credit score and choose the right lender.

- No Need for Credit Check: Some believe bike loans do not require a credit check, especially for small loans. However, like any other loan, lenders assess the borrower’s creditworthiness through credit checks before approving the loan.

- No Prepayment Penalty: Some bike loans may have no prepayment penalty, but not all loans follow this rule. Reviewing the loan terms and conditions to understand if prepayment is allowed without incurring additional charges is essential.

- No Need for Income Proof: Another misconception is that bike loans don’t require income proof, especially for lower loan amounts. However, lenders typically require income verification to ensure the borrower can repay the loan.

- Easy to Get Multiple Loans: Some assume getting multiple bike loans simultaneously is easy. In reality, multiple loan applications within a short period can negatively impact the borrower’s credit score and reduce the chances of loan approval.

- Loan Approved Equals Affordability: Just because a lender approves your bike loan application doesn’t necessarily mean you can comfortably afford the loan. Borrowers must assess their capacity to repay the loan and other financial obligations.

FAQ about motorcycle loans in India

1. Is the loan interest rate for all bikes, superbikes, and scooters the same?

No, the interest rate for superbikes will be lower than for bikes and scooters. For scooters, it will be the highest, and bikes in between. Contact a bank or use an online EMI calculator to know the interest rate.

2. Can bike loans be used for tax exemption?

Bike loans are not tax-deductible for individual taxpayers in India. This means that the interest paid on a bike loan cannot be claimed as a deduction from taxable income while filing income tax returns.

3. Can we prepay a motorcycle loan?

Yes, you can prepay a bike loan in India. By prepaying the loan, you can reduce the overall interest burden and close the loan account earlier. Before deciding to prepay your bike loan, it’s essential to carefully read the terms and conditions of the loan agreement and check with your lender about any applicable prepayment charges or restrictions.

4. Can we close a motorcycle loan early?

Yes, you can close a bike loan in India. By closing the loan early, you can reduce the overall interest burden and close the loan account earlier.

5. Can I get a motorcycle loan with a bad credit score?

Getting a bike loan with a bad credit score in India can be challenging, but it’s not impossible. Some lenders may still consider providing loans to individuals with bad credit scores. Still, the terms and conditions might be less favourable than borrowers with good credit.

6. What is the maximum bike loan duration in India?

India’s maximum two-wheeler loan duration is 5 years. Bike loan tenure is usually 3-4 years, while we can extend loan tenure to 5 years by submitting an ITR.

7. Which bank loan is better for bikes, private or public banks in India?

Both private and public sector banks offer bike loans, and each category has advantages and disadvantages.

Private Banks

Pros:

- Faster Loan Processing

- Personalized Services

- Attractive Offers

Cons:

- Higher interest rates

- Stringent eligibility criteria

- Limited branch network

Public Sector Banks

Pros:

- Lower interest rates

- Wide branch network

- Reliability

Cons:

- Slower loan processing

- Less personalized services

- Limited offers

8. Can a student get a motorcycle loan in India?

Yes, students in India can get a bike loan. Still, the eligibility criteria and terms may vary depending on the lender and the student’s circumstances. Students cannot be expected to repay two-wheeler loans in 2-3 years, so they can apply for a loan with a co-applicant or guarantor. For this reason, the minimum age to apply for a student bike loan is 18 years.

9. Can we get a loan for a second-hand bike in India?

Yes, you can get a loan for a second-hand bike in India. Many banks, financial institutions, and non-banking financial companies (NBFCs) offer loans for used or second-hand bikes. These are known as “used bike loans” or “pre-owned bike loans.”

10. What are the good and bad credit scores for a bike loan in India?

A good credit score typically falls within approximately 750 to 900 points. A fair credit score may range from around 650 to 749. A bad credit score generally falls below approximately 650.

11. Can a motorcycle loan be transferred from one person to another in India?

Yes, bike loans can be transferred in India, just like other types of loans. Loan transfer, also known as loan refinancing or balance transfer, allows borrowers to shift their existing bike loan from one lender to another.

Other related articles from Bikeleague India

- Bike Loan EMI calculator

- Unlocking the secrets: Factors that impact bike loan interest rate

- Two Wheeler Road Tax in India: A Detailed Explanation

- Must have bike documents for travel in India

- Motorcycle RC book in India: Exploring Book vs Digital

Conclusion

If you have any other doubts or queries, email us at bikeleague2017@gmail.com or share your doubts or opinions in the comments section below. We are always eager to help and assist you. Also, here are several social media platforms of Bikeleague India to raise your suspicions.