Long story short: Explore India’s EV Two-Wheeler Brand Preferences in India in FY25, statewise & regionwise for brands like TVS, Ather, Bajaj, etc. This article examines favourite EV motorcycle and scooter brand preferences in India in FY 25.

India’s electric two-wheeler market saw strong growth in FY25 (April 2024 to March 2025), with 11,49,422 units sold, a 21% increase from FY24’s 9,48,518 units. Electric two-wheelers now account for 6.1% of all two-wheeler sales, nearly double their share in 2020. (India’s Electric Two-Wheeler Market 2025–2030, 2025) However, these figures do not show the important regional differences in consumer choices, brand strength, and product trends across South, North, West, and East India. This article examines these regional patterns using data from FADA, the Vahan Dashboard, and industry reports.

Key Takeaways

- India’s electric two-wheeler market grew by 21% in FY25, with over 1.1 million units sold. However, there are big regional differences in brand preference and buyer behaviour.

- Established brands such as TVS, Bajaj, and Hero Vida gained market share from startups by using their strong dealer networks and manufacturing presence to dominate key regions.

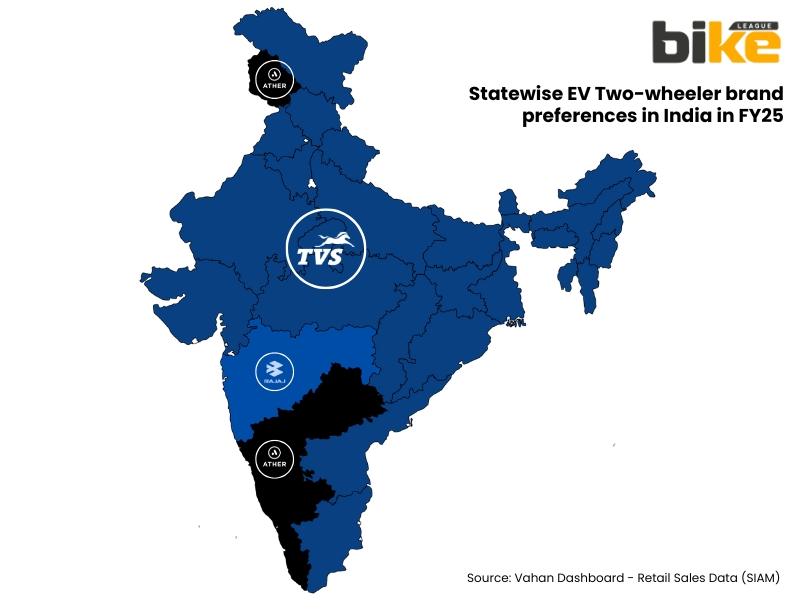

- Regional preferences depend on factors like state subsidies, local manufacturing, consumer income, and after-sales support. As a result, TVS leads in the South, Bajaj in the West, and Hero Vida is growing quickly in the North.

- Rural EV adoption is growing faster than in cities. This is due to affordable entry-level models, low running costs, and more dealer service networks reaching smaller towns.

- As the market matures, regional brand loyalties and government incentives will matter even more. Businesses and analysts need to understand and adapt to local trends, not just national ones.

National EV 2-Wheeler Market: The Consolidated Picture

Before diving into regional details, let’s look at the national picture. In FY25, three main changes shaped India’s EV two-wheeler market:

1. Rapid Consolidation Towards Legacy OEMs

Startups lost ground to established companies. Ola Electric’s market share dropped from 34.79% in FY24 to 29.93% in FY25, even though its sales grew. TVS Motor increased its share from 19.31% to 20.67%, and Bajaj Auto almost doubled its share from 11.30% to 20.08%. Together, TVS and Bajaj now hold 40.75% of all electric two-wheeler sales. Hero MotoCorp’s Vida brand was the fastest-growing, rising from 1.87% to 4.23%, a gain of 2.36 percentage points.

2. EVs as the Growth Engine of the Two-Wheeler Market

Petrol two-wheeler sales grew by 7.71% year-on-year, but electric two-wheelers grew even faster at 21%. Rural areas led this growth, with sales up 8.39% compared to 6.77% in cities. This means EVs are now reaching smaller towns and semi-rural areas, where lower costs and easy home charging are major benefits.

3. Price-Driven Market Segmentation Intensifies

Most of the growth came from entry-level and mid-range models. Bajaj Chetak sold 230,806 units, showing strong demand for affordable, sturdy scooters priced between ₹85,000 and ₹1,15,000. TVS iQube led the market with 237,576 units, helped by brand trust and reasonable prices. Ather Energy reported sales of 1,55,394 units in FY25, a 42 per cent year-on-year increase, and continued to focus on premium models priced between ₹1,20,000 and ₹1,50,000 to attract enthusiasts and professional commuters.

Regional Deep-Dive: South, North, West, and East India

1. South India: Technology-First Premium Market Leadership

Southern India, which includes Karnataka, Tamil Nadu, Telangana, Kerala, and Andhra Pradesh, has the most developed EV two-wheeler market in the country. This region accounts for about 28% to 32% of national electric two-wheeler sales. (Electric Two-Wheelers Surge in India as Market Players Adapt to Changing Industry Dynamics, 2025)

State-Wise Performance

| State | Role in National Market | Leading EV 2W Brands | Market Characteristics |

|---|---|---|---|

| Tamil Nadu | 9–10% of national e-2W sales; fastest-growing state with 8.28% CAGR to 2030 | TVS (dominant via Hosur plant), Ola, Ather | Manufacturing hub with established supply chain; strong state policy supporting a 1 million e-2W target by 2030; urban centres (Chennai, Coimbatore) show about 12–14% EV penetration in two-wheelers |

| Karnataka | 10–11% of national market; strong growth trajectory | Ather (Bengaluru origin), TVS, Ola | Tech-driven urban demand centred on Bengaluru’s IT sector; Ather’s dense fast-charging grid drives premium scooter adoption; 12.92% EV penetration recorded in select districts |

| Kerala | 4–4.5% of the national market, but the highest EV penetration per capita | TVS, Ather, Ola with a premium segment focus | Policy-driven excellence with around ₹15K subsidy, tax waivers and toll exemptions; 11.1% EV penetration overall; eco-conscious consumer base favours efficient scooters |

| Telangana | 5–6% of national e-2W sales | Ather, TVS, Ola with balanced presence | Hyderabad’s tech economy and growing middle-class commuters; around 72,806 cumulative EV sales as of March 2025, indicating accelerating adoption |

South India Brand Preference Architecture

In South India, buyers focus on technology and prefer scooters with lots of features, app support, and easy charging, rather than just low prices. TVS’s iQube is the top pick because it’s reliable and backed by a strong dealer network from its petrol vehicle business. Ather appeals to tech-savvy customers with its 450X and Rizta models. Ola still has a solid share, despite some service problems. Bajaj’s Chetak isn’t as popular in big cities but is catching on in tier-2 towns like Salem, Mysore, and Vijayawada, where people want durable scooters.

Rural areas in the South show different trends. Buyers in Rajasthan and Madhya Pradesh usually go for affordable, practical models. In rural Tamil Nadu and Karnataka, people often choose TVS and Ather because these brands have good service networks and easy access to spare parts.

2. North India: Value-Driven, Volume-Heavy Market

Northern India, which includes Uttar Pradesh, Delhi-NCR, Haryana, Punjab, Rajasthan, Uttarakhand, and Bihar, leads the country in electric two-wheeler sales, accounting for about 35% to 40% of the market. Uttar Pradesh alone contributes a large 19%. (Electric 2-wheeler sales cross the 1 million mark in 2024, 2024)

State-Wise Performance

| State | Role in National Market | Leading EV 2W Brands | Market Characteristics |

|---|---|---|---|

| Uttar Pradesh | 19% of national e-2W sales; largest by absolute volume | TVS, Ola, Hero Vida, mix of local/budget brands | Massive population base; rapid urbanisation of Tier-2 cities (Lucknow, Kanpur, Varanasi); heavy e-rickshaw adoption (around 81% of state EV sales); e-2W penetration growing fastest in Noida–Ghaziabad NCR extension |

| Delhi-NCR | ~4–5% of national market; 11–12% of state vehicle market is EV | Ather, TVS (urban preference); Ola, Hero Vida (price-sensitive); Bajaj (fleet operators) | Aggressive state subsidies (up to ₹30K); dense charging network (~3,800 public stations); pollution norms drive EV adoption; office commuters prefer connected scooters |

| Bihar | Emerged in top 5 FY25 contributors (replacing Delhi), ~5–6% of national e-2W sales | TVS, Ola, Hero Vida (growing) | Rapid expansion from a low base; government focus on EV manufacturing hubs; affordable segment drives adoption and early rural penetration |

| Rajasthan | 5–6% of national e-2W market | Mix of TVS, Ola, Hero Vida, budget models | Urban centres (Jaipur, Udaipur) show higher EV adoption; rural adoption supported by government fleet and school-transport initiatives |

North India Brand Preference Architecture

In North India, buyers focus on value and high sales volumes. They pay close attention to the total cost of ownership, affordable monthly payments, and low running costs. Ola Electric maintained a strong market share by offering easy financing and zero-down payment options, even amid some service issues. Hero Vida increased its share from 1.87% to 4.23% nationally by selling VX2 models priced under ₹1 lakh with family-friendly features. TVS sold many mid-range iQube LR models priced between ₹1,10,000 and ₹1,25,000.

Delhi-NCR is unique in North India. Government incentives and concerns about pollution encourage people to buy premium, connected scooters. Ather and TVS’s app-enabled models, which offer real-time charging updates and navigation, are popular in Gurgaon, Noida, and central Delhi. In smaller towns, buyers usually choose more affordable Ola and Vida models.

According to Autocar India, Bajaj Auto had its highest monthly retail sales for the Chetak electric scooter in March 2025. This points to growing popularity among buyers, including fleet and delivery companies in cities like Lucknow and Kanpur. Fleet buyers are becoming more important, along with regular commuters.

3. West India: Bajaj and Premium-Tier Dominance

Western India, which includes Maharashtra, Gujarat, Goa, and Rajasthan, makes up about 22% to 25% of national electric two-wheeler sales. Maharashtra leads with a 12.52% share, helped by strong EV manufacturing policies. (Maharashtra Introduces New EV Policy, Aims To Achieve 30 Per cent EV Adoption By 2030, 2025)

State-Wise Performance

| State | Role in National Market | Leading EV 2W Brands | Market Characteristics |

|---|---|---|---|

| Maharashtra | 12.52% of national e-2W sales; second-largest state market | Bajaj (Pune manufacturing, strong brand equity), TVS, Ola | Urban-driven (Mumbai, Pune, Nagpur); parking premiums favour scooters; Bajaj Chetak dominates premium commuter segment; state subsidy (₹25–40K) enables mid-tier EV adoption |

| Gujarat | 5–6% of national e-2W market; about 22% YoY decline in FY25 | TVS, Ola, Bajaj present but with smaller share | Moderate EV penetration; traditional 2W manufacturing base slower to transition; state subsidy (up to ₹20K) supports adoption |

| Goa | Niche market with high EV penetration; tourism-driven demand | Bajaj, TVS, Ola (limited due to regulatory ban mid-2025) | Fleet operators for tourist rentals; December 2025 Ola ban accelerated shift toward Bajaj and TVS |

West India Brand Preference Architecture

In Western India, especially Maharashtra, buyers want premium features and stylish scooters. They look for strong metal bodies, good suspension, and trusted brands. Bajaj Chetak meets these needs with its heritage and solid build. TVS and Ola compete for value-focused buyers. In big cities like Mumbai and Pune, higher incomes mean more people can afford scooters priced between ₹1,10,000 and ₹1,30,000, helping TVS and Bajaj sell more mid- to premium-range models.

In mid-2025, Goa took action against Ola Electric because of service failures and abandoned scooters at service centers. This showed how important after-sales support is for buyers in the region. As a result, more people chose Bajaj and TVS, which have strong service networks from their petrol vehicle business.

4. East and North-East India: High-Growth Frontier Market

Eastern and North-Eastern India, including West Bengal, Bihar, Odisha, Assam, Tripura, Mizoram, and Meghalaya, is the fastest-growing region for electric two-wheelers. Sales are rising quickly from a low base, with year-on-year growth rates in the triple digits. (REF: WIML/BSE/IP/SEPTEMBER-2025, n.d.)

State-Wise Performance

| State / Region | Role in National Market | Leading EV 2W Brands | Market Characteristics |

|---|---|---|---|

| Bihar | Surged to top-5 in FY25 (~5–6% share), replacing Delhi | TVS, Ola, Hero Vida (rapid adoption) | Government focus on EV manufacturing; affordable segment drives uptake; rural adoption catching up |

| West Bengal | ~3–4% of national market; steady growth | TVS, Ather (limited), Ola, local brands | Kolkata urban market favours reliable brands; semi-urban adoption is highly price-sensitive |

| Assam & Meghalaya | Combined ~2–3% of national e-2W; emerging markets | TVS, basic entry-level models, local brands | Hilly terrain favours lightweight, removable-battery scooters; many first-time vehicle buyers move directly to EVs |

| Mizoram | Exceptional growth with about 139% EV growth across categories in FY25 | Mix of organized and local brands; TVS gaining share | Low absolute numbers but fastest relative growth; hilly terrain and home-charging convenience support EV uptake |

East & North-East Brand Preference Architecture

The East and North-East are fast-growing markets where brand preferences are still developing. Established brands like TVS, and to a lesser extent Ather, are gaining ground, but local and smaller manufacturers still sell many scooters, especially in hilly and semi-rural areas. Buyers here focus on low prices and scooters with removable batteries, which are helpful for apartment living without shared charging stations.

National and state EV policies are improving, and more charging stations are being added. Still, The Economic Times reports that even large brands like Hero MotoCorp have lost market share, with Hero’s share dropping to 29 per cent in Q3 FY25. If East India reached adoption rates similar to those in the South or West, its share of national electric two-wheeler sales could increase significantly. According to EVreporter, the electric two-wheeler market in India reached a 6.4 per cent share in January 2025, showing that regions like East India have strong growth potential as adoption rises.

Rural vs. Urban EV 2-Wheeler Dynamics

A key point often missed in state-by-state analysis is the difference between rural and urban markets. FADA’s FY25 data shows that rural two-wheeler sales grew by 8.39% year-on-year, while city sales grew by 6.77%. This means EVs are spreading faster in smaller towns and villages. (FADA Releases FY 2025 and March 2025 Vehicle Retail Data, 2025)

This rural strength is particularly pronounced in:

- In UP and Bihar, where agricultural zones are adopting e-scooters for “last-mile” delivery and local commuting, low electricity costs and minimal charging infrastructure requirements support this adoption.

- Rajasthan and Madhya Pradesh, where rural electrification initiatives are enabling home-charging and reducing dependence on centralised fuel supply chains.

- Tamil Nadu and Karnataka, where tier-2 towns (Salem, Mysore, Belgaum) show faster EV adoption than metros due to lower congestion and simpler parking.

Most rural growth comes from affordable, entry-level scooters priced between ₹70,000 and ₹90,000, mainly from Ola, Hero Vida, and the lower-end TVS iQube models. (Electric Two-Wheeler Sales June 2025 & FY25: TVS, Bajaj, Ola, Ather, Hero Lead the Charge, 2025) According to Economic Times Auto, TVS, Hero, and Bajaj now have a strong advantage, making up 51 per cent of all registrations in the first half of this fiscal year. Their strong dealer networks make these brands especially appealing to rural buyers who want a good range, low running costs, and reliable after-sales service.

Regional EV Two-wheeler dominant Brand Share Summary Table

To sum up the regional analysis, here is an overview of which brands lead in each zone in FY25:

| Zone | Dominant Brand #1 | Dominant Brand #2 | Dominant Brand #3 | Market Segment Profile |

|---|---|---|---|---|

| South | TVS (iQube – reliability + dealer density) | Ather (450X – tech-first premium) | Ola (volume player, declining) | Tech-first, feature-rich, willing to pay premium for quality |

| North | TVS (mid-range iQube) | Hero Vida (value + affordability) | Ola (financing-driven) | Value-conscious, EMI-sensitive, large population base |

| West | Bajaj (Chetak – premium metal-body) | TVS (mixed segments) | Ola (declining due to service) | Premium styling, brand prestige, Bajaj heritage strong in Maharashtra |

| East & NE | TVS (expanding from low base) | Ola (established presence) | Local/budget brands (still significant) | Frontier growth, affordability-driven, brand preferences still forming |

Statewise EV Two-wheeler dominant brand share summary table

To sum up the analysis, here is an overview of which brands are dominant in each state in India in FY25:

| State | National Market Share | Dominant EV 2W Brand | 2nd Brand | 3rd Brand | Key Market Characteristics |

|---|---|---|---|---|---|

| Uttar Pradesh | 19% (Largest) | TVS | Ola | Hero Vida | Massive population; rapid Tier-2 urbanization (Lucknow, Kanpur, Varanasi); 81% e-rickshaw adoption; NCR extension premium growth |

| Maharashtra | 12.52% (2nd) | Bajaj | TVS | Ola | Urban metros (Mumbai, Pune, Nagpur); parking premiums; Chetak premium metal-body dominance; ₹25–40K state subsidy |

| Karnataka | 10–11% | Ather (urban) / TVS (tier-2) | TVS / Ola | Ola | Tech-driven Bengaluru IT sector; Ather fast-charging grid; 12.92% penetration in Bengaluru districts; tier-2 towns favor TVS |

| Tamil Nadu | 9–10% | TVS | Ola | Ather | Fastest-growing state (8.28% CAGR); Hosur manufacturing hub; 1M e-2W target by 2030; Chennai–Coimbatore tech centers |

| Bihar | 5–6% (top-5) | TVS | Ola | Hero Vida | Surged to top-5 (replaced Delhi); affordable segment dominance; government EV manufacturing focus; rapid rural expansion |

| Rajasthan | 5–6% | TVS | Ola | Hero Vida | Jaipur and Udaipur urban centers lead; government school-transport and fleet initiatives; rural adoption growing |

| Delhi-NCR | 4–5% | Ather/TVS (urban) | Ola/Vida (value) | Bajaj (fleets) | Highest EV penetration nationally; ₹30K subsidy; 3,800+ charging stations; pollution norms; office commuters prefer connected scooters |

| Telangana | 5–6% | Ather | TVS | Ola | Hyderabad tech economy; 72,806 cumulative EV sales (March 2025); balanced tri-brand competition; middle-class commuters |

| Kerala | 4–4.5% | Ather | TVS | Ola | Policy excellence (₹15K subsidy, tax waivers, toll exemptions); 11.1% overall EV penetration; eco-conscious premium buyers |

| Gujarat | 5–6% | TVS | Ola | Bajaj | Moderate EV penetration; traditional 2W manufacturing slower to EV transition; ₹20K state subsidy |

| Goa | Niche | Bajaj | TVS | Ola (banned Dec 2025) | Tourism-driven; fleet rental operators; December 2025 Ola regulatory ban shifted demand to Bajaj and TVS |

| West Bengal | 3–4% | TVS | Ather (limited) | Ola/Local | Kolkata urban favors reliability; semi-urban adoption highly price-sensitive; local brands still significant |

| Assam | Part of 2–3% | TVS | Entry-level | Local brands | Hilly terrain; lightweight removable-battery preference; first-time buyers migrating directly to EVs |

| Meghalaya | Part of 2–3% | TVS | Entry-level | Local brands | Hilly region; lightweight scooters preferred; home-charging advantage; frontier growth |

| Mizoram | Frontier (139% EV growth) | TVS | Local brands | – | Fastest-growing EV market nationally; low absolute numbers, highest relative growth; hilly terrain, home-charging advantage |

| Haryana | Part of NCR | TVS | Ola | Ather | Part of NCR high-penetration zone; mixed brand presence; similar adoption drivers to Delhi-NCR |

| Punjab | Moderate | TVS | Honda | Bajaj | Value-conscious market; TVS dealer network strength; moderate EV adoption trajectory |

| Himachal Pradesh | Emerging | TVS | Entry-level | Local | Hilly terrain; lightweight and removable-battery scooters preferred; early-stage adoption |

| Uttarakhand | Emerging | TVS | Entry-level | Local | Hilly region; home-charging advantage; early-stage adoption; favorable terrain for lightweight scooters |

| Madhya Pradesh | Secondary | TVS | Ola | Bajaj | Secondary market; growing adoption; state incentives supporting penetration; manufacturing spillover from Chhattisgarh |

| Andhra Pradesh | Secondary | TVS | Ola | Ather | Secondary market; Hyderabad spillover demand from Telangana; growing tech economy; affordable segment focus |

| Tripura | Frontier | TVS | Local brands | – | Northeast frontier; among top EV penetration states; highest relative growth from low base |

| Odisha | Secondary | TVS | Ola | Local | Secondary market; growing awareness; affordable segment dominance; emerging adoption |

| Chhattisgarh | Secondary | TVS | Ola | Entry-level | Secondary market; manufacturing spillover effect; affordable segment focus; growing adoption |

| Jharkhand | Emerging | TVS | Ola | Local | Emerging market; affordable adoption; rural expansion; early-stage penetration |

Key Drivers of Regional EV Brand Preferences

Five structural factors explain why brands perform differently across regions:

1. Manufacturing Footprint & Logistics Advantage

States with major EV factories benefit from faster inventory turnover, quicker deliveries, and better warranty support. (Electric Two-Wheeler Industry in India: Charging Up Fast, n.d.) TVS’s plant in Hosur (Tamil Nadu) helps it lead in the South. Ola’s plant in Krishnagiri (Tamil Nadu) also boosts its presence in the South. According to the Economic Times, Bajaj Auto’s Chakan facility in Pune has adopted Total Productive Maintenance practices, which strengthen its manufacturing capabilities in the western region.

2. State Policy & Subsidy Architecture

Maharashtra (₹25,000–₹40,000 subsidy), Delhi (₹30,000), Kerala (₹15,000 plus toll waivers), and Tamil Nadu (₹20,000) all encourage EV adoption, helping buyers afford mid- to premium-level scooters where established brands do well. According to a report from DatumIntell, states like Rajasthan and Gujarat, which offer lower or less consistent incentives, are seeing slower growth in electric two-wheelers, and their buyers tend to be more price-sensitive.

3. Dealer Network Density & After-Sales Infrastructure

TVS, Bajaj, and Hero use their large petrol two-wheeler dealer networks, each with over 5,000 to 8,000 outlets across India, to offer strong service coverage. (Rai, 2025) Ather has about 300 experience centres, while Ola mainly sells directly to customers and has fewer physical locations. In remote or smaller towns, having many dealers is a big advantage. Ola Electric has achieved significant success, particularly in large cities, while Bajaj Auto and TVS continue to outperform Ola in overall sales, especially in smaller cities, according to a report from StartupTalky.

4. Consumer Income & Purchasing Power

South and West India, including Maharashtra, Karnataka, and Tamil Nadu, have higher average incomes. According to Motoshare, buyers in India can choose EV scooters with premium features priced between ₹1,15,000 and ₹1,50,000. The report also notes that customers in North India tend to be more price-sensitive and prefer entry-level models, which typically cost between ₹70,000 and ₹95,000. According to a report from IBEF, electric two-wheeler buyers in East India tend to prefer more affordable models, reflecting the region’s lower average income levels.

5. Regulatory & Environmental Policy

Delhi’s strict pollution and parking rules encourage buyers to choose small, eco-friendly scooters, especially connected models from Ather and TVS. According to CRISIL, South Indian states like Kerala and Goa have the highest electric two-wheeler adoption rates in the country, driven by environmental awareness and supportive infrastructure, while western states such as Maharashtra also show strong uptake for similar reasons.

FY25 Market Share Trajectory: Winners and Losers by Region

Clear Winners

- TVS Motor: Consolidated leadership in South; strong growth in North and East; leveraged iQube platform across all segments.

- Bajaj Auto: Explosive growth (+8.78% share nationally); dominant in West; expanding East; Chetak resonates across metros and premium-conscious buyers.

- Hero Vida: Fastest-growing challenger (+2.36% share); strong in North India’s value segment; appealing to first-time vehicle buyers in semi-urban zones.

Under Pressure

- Ola Electric: Lost 4.86% share; service crisis (spare parts, warranty delays) eroded consumer confidence; regulatory scrutiny in multiple states; struggling in South and West; competing aggressively on price in North.

Stable Niche Players

- Ather Energy: Maintained 11.39% share; strong in Karnataka, Kerala, and urban South; premium positioning insulates from mass-market decline; widened loss but improved margins.

Outlook and Strategic Implications for FY26

As India’s electric two-wheeler market shifts from early adopters to mainstream buyers, regional brand preferences are likely to become even stronger:

- South India will remain a stronghold for TVS and Ather; tech-driven buyers will continue to favour premium, connected models despite high prices.

- North India will intensify competition on affordability; Hero Vida and Ola’s financing models will compete head-to-head; TVS will defend mid-tier share with iQube variants.

- West India will consolidate as Bajaj territory, particularly in Maharashtra; Bajaj’s brand equity, service network, and Chetak’s appeal make it formidable against TVS and Ola.

- East & North-East will emerge as the fastest-growing frontier; TVS and Hero Vida are best positioned to capitalise via aggressive dealer expansion; Bajaj’s premium positioning may limit reach in price-sensitive markets.

- Rural penetration will accelerate as charging infrastructure (targeting 1 charger per 3 km in urban areas and 25 km on highways) improves; legacy OEMs’ dealer networks will prove decisive in capturing rural-first-time buyers.

FAQ about EV two-wheeler brand preferences in India

1. How much did India’s EV two-wheeler market grow in FY25, and what is its share of total two-wheeler sales?

India’s electric two-wheeler market reached 11,49,422 units in FY25, up 21% from 9,48,518 units in FY24. EVs now account for about 6.1% of all two-wheeler sales, nearly double their share in 2020.

2. Which brands gained the most market share in FY25, and who lost ground?

TVS Motor increased its market share from 19.31% to 20.67%, and Bajaj Auto almost doubled its share from 11.30% to 20.08% in FY25. Ola Electric’s share fell from 34.79% to 29.93%, while Hero MotoCorp’s Vida rose from 1.87% to 4.23%, making it the fastest-growing brand.

3. Why are legacy OEMs like TVS, Bajaj, and Hero outperforming startups such as Ola in FY25?

Legacy OEMs leverage dense dealer networks (5,000–8,000+ outlets), proven after-sales service, and localised manufacturing to win trust and coverage in both metros and smaller towns. Startups, especially Ola, face challenges with service capacity, spare parts availability, and limited physical touchpoints, which are eroding their share despite strong online sales.

4. How do EV brand preferences differ across South, North, West, and East India?

The South is technology-first, with TVS and Ather leading due to premium, feature-rich scooters and strong charging networks. The North is value-driven, where TVS, Ola, and Hero Vida compete on EMI, TCO, and affordability; the West leans toward the premium, with Bajaj Chetak and TVS dominating; the East and North-East are high-growth frontier markets where TVS, Ola, and local brands share space.

5. Which states are the most important for EV two-wheeler sales in FY25?

Uttar Pradesh, Maharashtra, Karnataka, Tamil Nadu, and Bihar together contribute roughly half of India’s EV two-wheeler sales in FY25. UP alone accounts for about 19% of national e‑2W volume, while Maharashtra contributes 12.52%, and Karnataka and Tamil Nadu each add around 9–11%.

6. What role do state policies and subsidies play in shaping EV adoption and brand dominance?

States like Maharashtra (₹25–40k), Delhi (₹30k), Kerala (₹15k + waivers), and Tamil Nadu (₹20k) reduce upfront prices enough for buyers to upgrade into mid- and premium-tier EVs from brands such as TVS, Ather, and Bajaj. In contrast, states with weaker or inconsistent incentives, such as Rajasthan and Gujarat, exhibit slower EV growth and more price-sensitive buying, which limits premium EV penetration.

7. How are rural and urban EV adoption trends different in FY25?

FADA data shows rural two-wheeler sales growing 8.39% YoY, versus 6.77% in cities, indicating faster EV adoption in smaller towns and villages. Rural buyers focus on affordable scooters priced ₹70,000–₹90,000, favouring Ola, Hero Vida, and lower-end TVS iQube variants, while urban buyers increasingly choose connected, premium EVs from Ather and TVS.

8. Which states show the highest EV penetration and why?

Delhi-NCR records an EV share of around 11–12% in its vehicle market, supported by strong subsidies and 3,800+ public charging points. Kerala has about 11.1% overall EV penetration thanks to a ₹15k subsidy, tax waivers, and toll exemptions, while select districts of Karnataka reach 12.92% penetration driven by Bengaluru’s tech-led demand.

9. How does brand dominance look at the state level in FY25?

TVS is the dominant or leading brand in large states like Uttar Pradesh, Tamil Nadu, West Bengal, Bihar, and several North-Eastern states, giving it the widest geographic footprint. Bajaj leads in Maharashtra (and strongly in Goa), Ather dominates premium urban pockets in Karnataka, Kerala, and Telangana, while Ola and Hero Vida share value-segment leadership in states like UP, Bihar, and Rajasthan.

10. What are the key strategic implications of these regional patterns for FY26 and beyond?

South India is likely to remain a TVS–Ather stronghold for premium, connected scooters, while North India becomes the main affordability battleground between Hero Vida, Ola, and TVS. West India should consolidate as the Bajaj territory, and East/North-East will be the fastest-growing frontier, where dealer expansion and pricing discipline will decide whether TVS and Hero Vida can outpace local and low-cost competitors.

Other related links from Bikeleague India

- Top 10 bike / scooter brands as per India’s market share

- Two-Wheeler Brand Preferences in India

- Top 10 sold petrol two-wheelers in India in FY25

- Electric two-wheeler sales figures in India FY23 & FY24

- Ola

Official Sources

Conclusion

India’s electric two-wheeler landscape in FY25 demonstrates that the era of rapid, startup-led disruption has transitioned into a phase of consolidation and regional specialisation. Legacy manufacturers like TVS and Bajaj have harnessed their deep dealer networks, manufacturing capabilities, and brand trust to unseat early market leaders and establish dominance across diverse regions. Meanwhile, new challengers such as Hero Vida are gaining ground, especially in the value-focused North.

Regional differences now define the market. The South prefers tech-focused, premium brands. The West values heritage and build quality. The North puts affordability and access first. The East and North-East are still growing fast and have a lot of potential. These trends are shaped by consumer preferences, state incentives, local infrastructure, income levels, and after-sales support.

Looking ahead, manufacturers and analysts need to see that a one-size-fits-all approach no longer works. Success in FY26 and beyond will depend on understanding and adapting to these regional trends. This means investing in local dealer networks, making products that fit local needs, and responding quickly to changing government policies. As the market matures, brands with flexible strategies and strong local presence will lead the next wave of electric mobility in India.

If you have questions or want more information, email us at bikeleague2017@gmail.com or leave a comment below. We’re here to help. You can also follow Bikeleague India on social media for updates.