Long story short: See how regional two-Wheeler Brand Preferences in India shift between metros, tier‑2, rural India and high‑EV states, with detailed tables on market share and buyer priorities.

As the automotive industry evolves, detailed state-level brand data is crucial for planning. India’s two-wheeler market is active, with brands competing for buyers across regions.

Knowing which brands lead in each state helps people make better decisions and stay current. This blog highlights the top two-wheeler brands in every state using the latest Vahan Seva Dashboard 2025 data.

Why State-wise Two-wheeler Brand Preferences Matter in India?

- Regional Market Dynamics: Each state has unique buying habits shaped by local demographics, income levels, and geography.

- Dealer Network Distribution: Availability of certain brands varies widely across regions.

- Consumer Behaviour Differences: Preferences in big cities often differ greatly from those in rural areas.

- Infrastructure Differences: Things like road quality and connectivity have a big impact on the types of two-wheelers people choose.

- Local Brand Loyalty: In many regions, long-standing relationships with certain brands shape which two-wheelers are most popular.

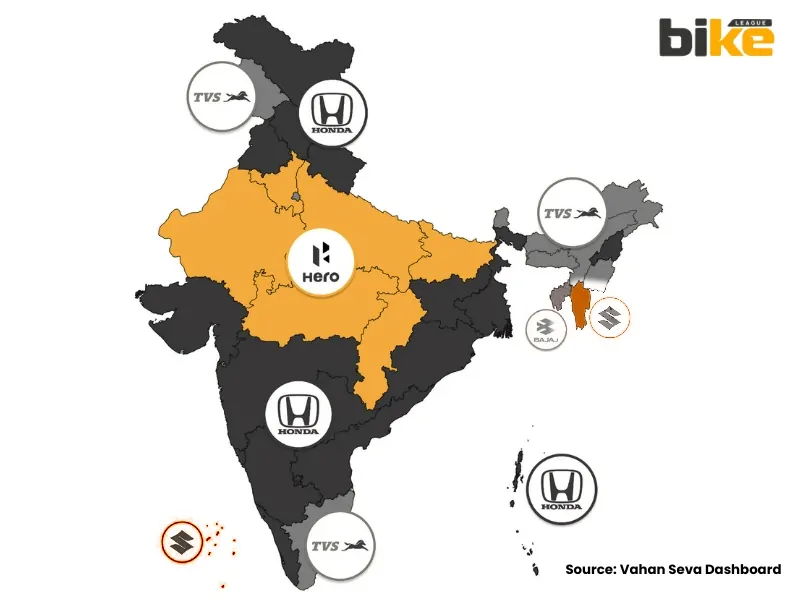

Overview of Regional Analysis in India

1. Key Statistical Overview

The Vahan Seva Dashboard 2025 data shows that some brands are more popular in some areas of India.

| Region | Dominant Brands | Market Characteristics |

|---|---|---|

| Northern India | Hero MotoCorp (Primary), TVS (Secondary) | High rural penetration, cost-conscious buyers |

| Central India | Hero MotoCorp (Dominant) | Splendor-driven sales, largest market share |

| Southern India | Honda (Primary), TVS (Secondary) | Urban preference, scooter dominance, premium positioning |

| Eastern India | TVS (Primary), Honda (Secondary) | Growing urban centers, competitive landscape |

| Western India | Hero MotoCorp (Primary), Honda (Secondary) | Mixed urban-rural, diverse income levels |

A few major brands stand out in India’s two-wheeler market:

- Hero MotoCorp – The market leader with a strong presence

- Honda Motorcycle & Scooter India (HMSI) – The second-largest brand

- TVS Motor Company – Third in the market, with a growing share

- Bajaj Auto – Fourth overall, with strong performance in certain segments

- Suzuki Motorcycle India – Known as a premium brand

- Royal Enfield – Popular for performance and lifestyle bikes

- Others – Includes new electric vehicle makers and niche brands

Detailed Regional Two-wheeler Brand Preferences Analysis in India

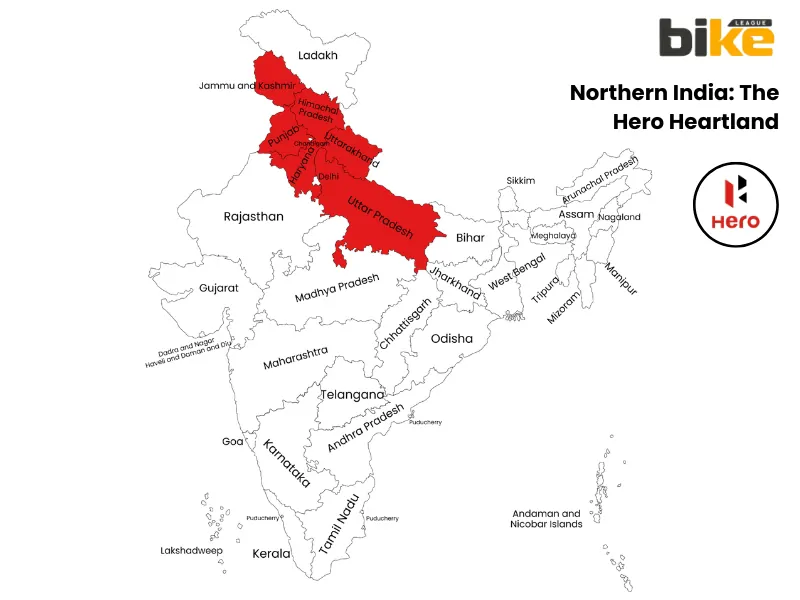

1. Northern India: The Hero Heartland

States Analysed

- Uttar Pradesh

- Haryana

- Punjab

- Himachal Pradesh

- Jammu & Kashmir

- Uttarakhand

Brand Dominance Breakdown

| State | Primary Brand | Market Position | Key Factors |

|---|---|---|---|

| Uttar Pradesh | Hero MotoCorp | Dominantly preferred | Splendor, Passion, HF Deluxe models |

| Haryana | Hero MotoCorp | Strongest market presence | Splendor series, Passion Pro |

| Punjab | TVS | Strong regional presence | Apache, Jupiter, Star |

| Himachal Pradesh | Hero MotoCorp | Mountainous terrain preference | Splendor (fuel efficiency priority) |

| Jammu & Kashmir | Hero MotoCorp | Established dealership network | Multiple Hero variants |

| Uttarakhand | Hero MotoCorp | Rural and hill station demand | Splendor for connectivity |

Why Hero Dominates Northern India

Hero’s strong performance in northern India is due to several key strengths:

- Extensive Dealer Network: Hero has the largest network in tier-2 and tier-3 areas, making its bikes easy to find.

- The Splendor Effect: The well-known Hero Splendor gives over 80 km per litre, making it popular with cost-conscious riders.

- Price Advantage: Hero provides some of the most affordable and reliable bikes in the ₹45,000–70,000 range.

- Service Accessibility: Authorised service centres are easy to find, so owners can maintain their bikes without trouble.

- Spare Parts Availability: Hero parts are affordable and readily available, making ownership simpler.

- Brand Heritage: With over 40 years in the market, Hero has built strong consumer trust.

- Targeted Marketing: Hero’s ads focus on rural connectivity and affordability, which connect well with its audience.

- Resale Value: Hero bikes retain their value because of a strong resale market.

Market Characteristics

The northern market has a few important features:

- Urban Share: About 25-30% of two-wheeler sales come from urban areas, reflecting the growth of city populations.

- Rural Share: Rural regions dominate, accounting for 70-75% of the market, underscoring the importance of two-wheelers in villages and smaller towns.

- Primary Buyers: The typical buyers are farmers, small business owners, and daily commuters who rely on affordable mobility.

- Usage Patterns: Two-wheelers are used for both commercial tasks and personal transportation, making them essential for many households.

- Purchase Drivers: Buyers in this region prioritise fuel efficiency and low operating costs, ensuring their vehicles remain economical over time.

Hero’s Market Leadership Statistics (Northern India)

- Uttar Pradesh alone makes up 12.31% of India’s national two-wheeler market share

- Hero holds around 40–45% market share in northern states

- The Splendor series accounts for over 50% of Hero’s sales in the region

- Year-on-year growth remains steady, driven by strong rural demand

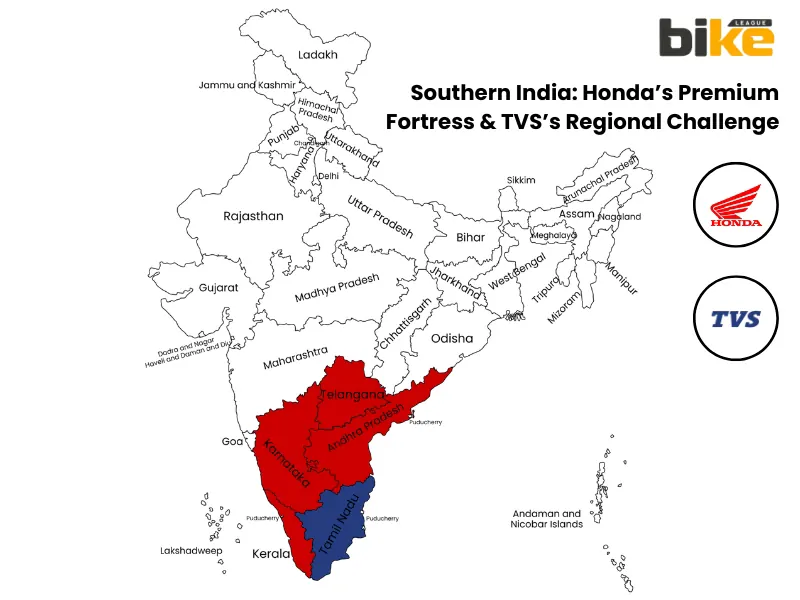

2. Southern India: Honda’s Premium Fortress & TVS’s Regional Challenge

States Analysed

We examine Tamil Nadu, Karnataka, Telangana, Andhra Pradesh, and Kerala to see what makes their two-wheeler markets unique.

- Tamil Nadu

- Karnataka

- Telangana

- Andhra Pradesh

- Kerala

Brand Dominance Breakdown

Southern India’s two-wheeler market is known for strong brand loyalty and a wide range of consumer preferences. Here’s a quick look at how the main brands perform in these five states:

| State | Primary Brand | Secondary Brand | Market Share Characteristics | Key Models |

|---|---|---|---|---|

| Tamil Nadu | TVS | Honda | Home state advantage, local manufacturing | Jupiter, Apache, iQube EV |

| Karnataka | Honda/Suzuki | Ather (EV) | Tech-savvy urban consumers | Activa, Access 125, Avenis |

| Telangana | Suzuki | Honda | Premium positioning growing | Access 125, Burgman Street |

| Andhra Pradesh | Honda | TVS | Activa popularity | Activa, Activa 125 models |

| Kerala | Honda | TVS | Scooter-centric market | Activa dominance in urban areas |

Honda’s Market Strength in Southern India

Honda HMSI Key Achievement: 10 Million Sales Milestone in South

- Activa’s Dominance – With more than 10 million units sold in the southern region alone, the Activa has become a household name.

- Regional Sales Hub – Covers Tamil Nadu, Karnataka, Telangana, Andhra Pradesh, Kerala

- Urban Market Leadership – Honda holds an impressive 40–50% market share in major metropolitan areas.

- Premium Positioning – Honda has built a strong reputation for quality and reliability, giving it a clear edge among discerning buyers.

- Extensive Service Network – With over 400 service centres in Karnataka alone, Honda ensures its customers never have to wait long for support.

- Multiple Product Lines – Activa (scooters), Shine 125 (motorcycles), CB series (performance)

- Customer Loyalty – High repeat-purchase rates and strong brand advocacy reflect Honda’s deep connection with its customers.

Honda’s Regional Sales Milestone – Karnataka

- Honda has reached a major milestone by achieving 5 million sales in Karnataka.

- The main contributors to this success are the Honda Activa and Shine 125, which remain popular choices among buyers.

- A wide network of service centres and showrooms has supported this growth.

- Educated urban consumers show a clear preference for the Honda brand, further strengthening its market position.

Honda’s Southern Presence – Overall Numbers

- Across the southern states, Honda has sold over 20 million vehicles, solidifying its strong regional presence.

- In major cities, Honda holds a 35-40% market share, making it a leader in urban markets.

- Honda dominates the scooter segment, holding more than 60% market share in many urban areas.

TVS’s Tamil Nadu Advantage

- Manufacturing Headquarters – Located in Hosur, Tamil Nadu

- Home State Pride – With more than 70 years of local presence, TVS enjoys a strong sense of community connection in Tamil Nadu.

- Jupiter Scooter – The TVS Jupiter remains one of the most successful two-wheeler launches in the region.

- Apache Series – The Apache bikes have carved out a strong reputation in the performance segment.

- EV Leadership – TVS has established itself as a leader in the electric vehicle segment, leveraging early battery partnerships.

- Competitive Pricing – TVS often beats Honda on price in key market segments, making its products especially attractive to value-conscious buyers.

- Regional Marketing – TVS focuses on connecting with local audiences through Tamil-language advertising and well-known brand ambassadors.

Market Characteristics – Southern India

- Urban Dominance – Two-wheelers have a 50–60% penetration rate in urban markets across the south.

- Premium Focus – The region has a larger share of higher-income buyers who often prefer premium models.

- Scooter Preference – Scooters make up 55–60% of the market, outpacing motorcycles in popularity.

- Better Infrastructure – Good road conditions throughout the region make it easier for scooters to thrive.

- Young and Educated Buyers – The typical buyer is younger and more likely to be college-educated compared to other regions.

- Tech Integration – There is a strong preference for modern features and digital connectivity in two-wheelers.

- EV Adoption – Southern India leads the nation in electric vehicle adoption, with the highest EV penetration rates.

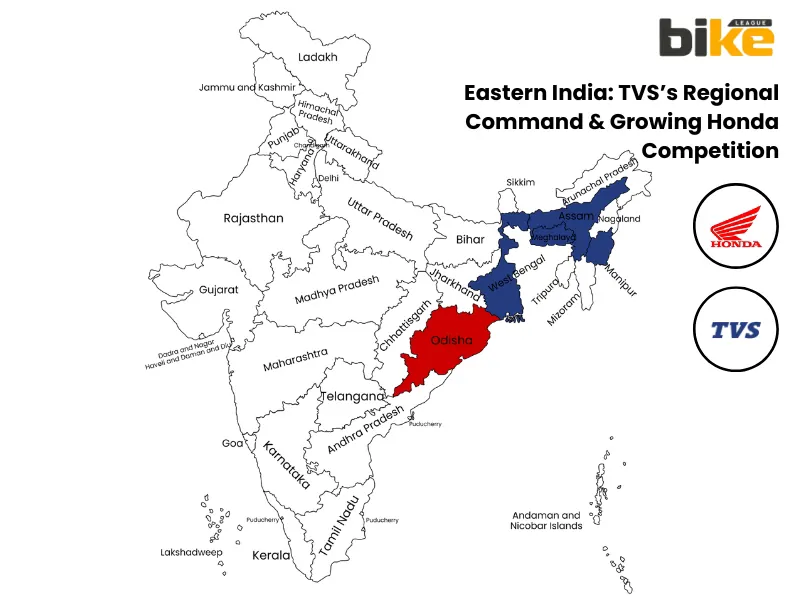

3. Eastern India: TVS’s Regional Command & Growing Honda Competition

States Analysed

- West Bengal

- Odisha

- Assam

- Meghalaya

- Manipur

Brand Dominance Breakdown

| State | Primary Brand | Secondary Brand | Market Characteristics | Key Models |

|---|---|---|---|---|

| West Bengal | TVS | Honda | Competitive market, urban growth | Apache, Jupiter, Activa |

| Odisha | Honda | TVS | Emerging urban centers | Activa, Star |

| Assam | TVS | Honda | Northeast dominance, rural connectivity | Jupiter, Apache, Shine |

| Meghalaya | TVS | Honda | Local preference, mountainous terrain | Jupiter, Apache series |

| Manipur | TVS | Honda | Regional stronghold | Star, Jupiter variants |

Why TVS Leads Eastern India

TVS leads the eastern Indian market for several reasons:

- Manufacturing Presence – The company operates multiple factories in the region, ensuring steady supply and local employment.

- Price Competitiveness – TVS products are competitively priced, often undercutting Hero in key segments.

- Product Diversity – The brand offers a diverse lineup, from commuter bikes to scooters and premium models, appealing to a broad audience.

- Regional Brand Building – TVS invests in regional branding and markets its products in local languages, making the brand feel more relatable.

- Distribution Network – TVS invests in regional branding and markets its products in local languages, making the brand feel more relatable.

- Service Excellence – Their extensive dealer and service network ensures that even customers in smaller towns and rural areas have easy access to sales and support.

- Product Innovation – Popular models such as the Jupiter scooter and the Apache series are especially well-received by buyers in this region.

Key Characteristics of Eastern India

- Growing Urbanisation – Urbanization is on the rise, with tier-2 and tier-3 cities growing quickly and changing the market landscape.

- Cost Sensitivity – Price plays a major role in buying decisions, as many customers remain highly cost-conscious.

- Rural Markets – Rural areas continue to account for a significant share of two-wheeler sales.

- Infrastructure Development – Improvements in road infrastructure are making it easier for people to choose two-wheelers for everyday use.

- Mixed Buyer Profile – Buyers in this region are a mix of commercial users and individuals purchasing for personal transportation, reflecting the diverse needs of Western India.

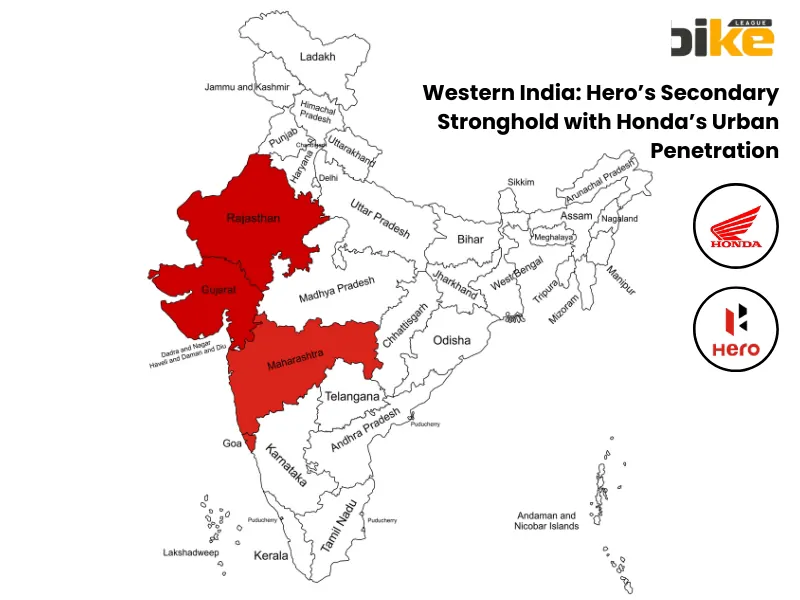

4. Western India: Hero’s Secondary Stronghold with Honda’s Urban Penetration

States Analysed

- Maharashtra

- Gujarat

- Rajasthan

- Goa

Brand Dominance Breakdown

| State | Primary Brand | Secondary Brand | Market Dynamics |

|---|---|---|---|

| Maharashtra | Hero/Honda | Mixed | Metropolitan and rural balance |

| Gujarat | Hero MotoCorp | Honda | Industrial growth driving demand |

| Rajasthan | Hero MotoCorp | TVS | Largest state-level dealer network |

| Goa | Honda | Hero | Premium, tourist-influenced market |

Key Characteristics of Western India

- Maharashtra’s Dual Dominance – Maharashtra stands out for its dual brand dominance, with both Hero and Honda enjoying strong market presence.

- Gujarat’s Growth Story – Gujarat is the fastest-growing state in the region, showing an impressive 18.63% year-on-year growth as of June 2025.

- Rajasthan’s Hero Monopoly – Rajasthan is a stronghold for Hero, boasting the highest Hero market share outside Uttar Pradesh.

- EV Leadership – Maharashtra – 1Maharashtra leads the nation in electric two-wheeler sales, with 155,183 units sold—the highest among all Indian states.

Maharashtra Market Details

- Highest EV Penetration – Maharashtra leads the nation in electric vehicle adoption, with an impressive 16.47% EV penetration—the highest of any Indian state.

- Urban-Rural Mix – The market features a healthy mix of bustling metro cities and vast agricultural areas, offering something for every customer type.

- Bajaj Presence – Bajaj, headquartered in Maharashtra, benefits from strong local loyalty and recognition.

- YoY Growth (June 2025) – Growth remains strong, with a 12.19% year-on-year increase in registrations as of June 2025.

Gujarat Market Details

- Fastest Growing State – Gujarat is India’s fastest-growing state for two-wheeler sales, achieving an outstanding 18.63% year-on-year growth as of June 2025.

- Industrial Economy – The state’s booming industrial sector drives demand for commercial vehicles and supports dealership expansion.

- Urban Expansion – Rapid development in tier-2 cities is reshaping markets and customer buying habits.

- EV Adoption – Interest in electric vehicles is also rising, with a growing secondary market for EVs and sustainable mobility solutions.

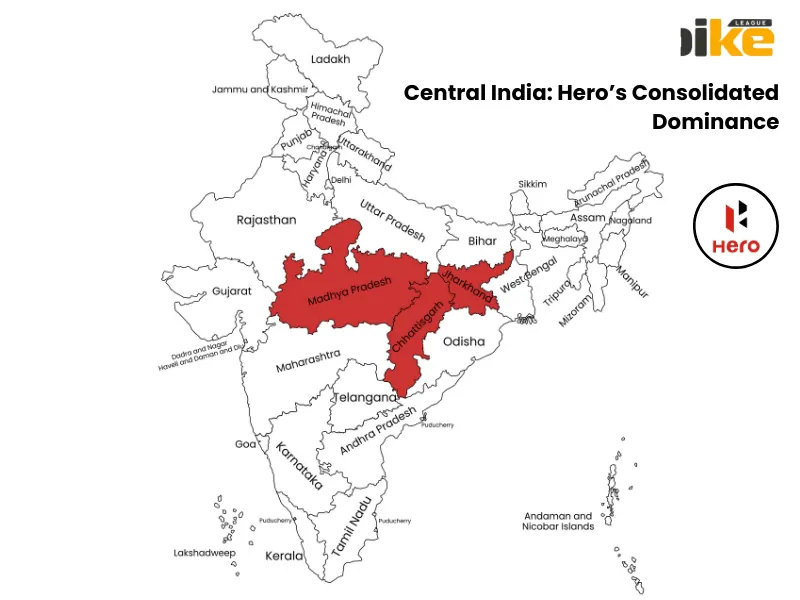

5. Central India: Hero’s Consolidated Dominance

States Analysed

This section covers the central Indian states of Madhya Pradesh, Chhattisgarh, and Jharkhand.

- Madhya Pradesh

- Chhattisgarh

- Jharkhand

Brand Dominance Breakdown

| State | Dominant Brand | Market Share Characteristics |

|---|---|---|

| Madhya Pradesh | Hero MotoCorp | Overwhelmingly preferred by most buyers |

| Chhattisgarh | Hero MotoCorp | Essential for rural connectivity across the state |

| Jharkhand | Hero MotoCorp | Strong presence in mining and for commercial use |

Key Characteristics of Central India

- Agricultural Economy – Agriculture is the backbone of the region, with farmers making up the majority of two-wheeler buyers.

- Industrial Presence – The mining sector, especially in Jharkhand, significantly drives commercial demand.

- Rural Dominance – More than 80% of purchases are from rural areas, highlighting a strong rural preference.

- Cost Sensitivity – Cost sensitivity is high, so buyers are careful to seek value for money.

- Splendor Preference – The Hero Splendor is especially popular throughout these states due to its reliability and affordability.

What is the national market share of the leading two-wheeler brands in India?

Latest Market Share Statistics (November 2025)

| Brand | Units Sold | Market Share % | YoY Growth | Position |

|---|---|---|---|---|

| Hero MotoCorp | 8,86,002 | 34.80% | Stable | 1st |

| Honda MSCI | 6,06,284 | 23.81% | -1.2% | 2nd |

| TVS Motor | 4,45,617 | 17.50% | +1.4% | 3rd |

| Bajaj Auto | 2,58,585 | 10.16% | -1.46% | 4th |

| Royal Enfield | 1,15,353 | 4.53% | Growing | 5th |

| Suzuki Motorcycle | 1,04,638 | 4.11% | Stable | 6th |

| Yamaha Motor | 70,929 | 2.78% | – | 7th |

Source: Based on retail data from the Federation of Automobile Dealers Associations (FADA)

Market Share Trends Throughout 2025

| Month/Period | Hero | Honda | TVS | Bajaj | Others |

|---|---|---|---|---|---|

| April 2025 | 30.34% | 23.09% | 17.60% | 10.41% | 18.56% |

| May 2025 | 29.85% | 25.50% | 18.90% | 9.29% | 16.46% |

| August 2025 | 32.10% | 26.68% | 17.21% | 10.01% | 14.00% |

| November 2025 | 34.80% | 23.81% | 17.50% | 10.16% | 13.73% |

What are the key two-wheeler Brand Dominance Patterns in India?

1. Hero MotoCorp’s Strategic Dominance

Geographic Footprint

- Northern States – 40–45% combined market share, led by Splendor and HF Deluxe in Uttar Pradesh, Haryana, Bihar and Rajasthan.

- Central States – 50%+ dominance in Madhya Pradesh and Chhattisgarh, where commuter motorcycles are the default choice.

- Western States – 30–35% competitive presence in Gujarat and Maharashtra, especially in rural and small‑town belts.

- Southern States – 15–20% more limited presence, as Honda and TVS scooters dominate metros.

- Eastern States – 20–25% and growing in states like Jharkhand, Odisha and West Bengal, supported by rural network strength.

- National Average – About 28.8–29% overall two‑wheeler retail share in FY25, keeping Hero clearly at No.1.

Market Share Expansion

Hero MotoCorp’s market share and volume growth in FY25:

- FY24: ~25–26% national share on FADA data.[web:105]

- FY25: 28.84–29% share with 54.45 lakh retail units, gaining roughly 3 percentage points year‑on‑year.

- October 2025: Retail share spikes to about 31.6% as Hero crosses the 1‑million monthly sales mark for the first time.

Product Strategy

- Hero Splendor – Core entry‑level commuter and single biggest model, regularly above 3.1 lakh units a month in 2025.

- Hero HF Deluxe / HF 100 – Value commuter line, powerful in rural markets and now with “HF Deluxe Pro” to refresh appeal.

- Hero Passion / Glamour / Xtreme 125R – Mid‑range and 125 cc sports‑commuter portfolio, used to defend share as buyers move slightly upmarket.

- Scooter range (Destini, Pleasure, Xoom) – Growing urban/scooter play, with FY25 scooter volumes up 25–50% in several models.

- VIDA Electric (V1 / V2 / VX2 Go & Plus) – Dedicated EV sub‑brand; cumulative Vida sales crossed 100,000 units by late 2025, with calendar‑year sales above 100,000 targeted for the first time.

Market Strengths

| Factor | Impact | Details |

|---|---|---|

| Dealer Network | Critical | 10,000+ touchpoints nationwide, deepest rural reach among two‑wheeler OEMs. |

| Fuel Efficiency | High | Core 97.2 cc family (Splendor, HF Deluxe, Passion Plus) is optimised for mileage, driving repeat rural demand. |

| Price Point | Essential | Hero controls the ₹45,000–90,000 commuter band, balancing low EMI with nationwide parts availability. |

| Brand Recognition | Dominant | 125+ million units produced; Splendor and Hero brands are synonymous with “bike” in many rural markets. |

| Service Network | Extensive | Largest authorised service footprint in India, keeping maintenance costs low and uptime high. |

| Resale Value | Strong | High demand in the used‑bike market; Splendor and HF Deluxe often command the best resale in their segments. |

| Rural Appeal | Strongest | Rural and semi‑urban regions contribute a disproportionate share of Hero’s volumes and grew faster than urban India in FY25. |

| EV Foray (VIDA) | Rising | VIDA e‑scooters reached about 8% share of India’s E2W market by late 2025, with over 100,000 units sold in the year. |

Record Achievement – October 2025

- 1 Million‑Plus Monthly Sales: In October 2025, Hero retailed nearly 1 million two‑wheelers, the highest ever for any single OEM in India.

- Market Share Spike: Retail market share climbed to around 31.6%, up from roughly 27.8% a year earlier.

- Key Drivers: Strong rural sentiment after a good monsoon, festive‑season schemes and favourable GST/tax environment on commuters.

- Future Outlook: FADA and industry commentary suggest continued rural‑led strength, with Hero well‑positioned to defend ~29–30% share even as EV adoption accelerates.

Summary

Hero MotoCorp’s FY25 dominance is built on unmatched rural penetration (50%+ share in central states), the unbeatable Splendor commuter franchise, and the largest dealer/service network in India. With ~29% national share and a historic 1-million monthly sales milestone in October 2025, Hero remains the undisputed volume leader. The brand balances core commuter strength with growing scooter/EV plays (VIDA reaching 100K+ units), ensuring it captures both traditional rural demand and emerging urban opportunities while maintaining the highest resale values and lowest ownership costs in the industry.

2. Honda’s Urban & Premium Dominance

Geographic Footprint

- Southern States – 40–50% share in key metros such as Chennai, Bengaluru, Hyderabad and Kochi, driven primarily by Activa scooters.

- Western Urban Centres – Around 30–40% share in tier‑1 cities like Mumbai and Pune, where scooters dominate commuting.

- Eastern Metros – 20–30% and rising presence in Kolkata and other eastern cities as Honda pushes commuter bikes and scooters.

- Northern Metros – 10–15% but steadily growing with new 100–125 cc motorcycles (Shine 100 DX, CB125) and refreshed Activa range.

- National Average – About 23.8% retail share in May 2025 and roughly 23–24% across FY25, keeping Honda firmly at No.2 in India.

Market Share & Role in FY25

- Honda sold around 3.93 lakh units in May 2025, translating to 23.8% share, down from 25.5% a year earlier, indicating mild share pressure even as absolute volumes grew slightly.

- Across FY25, Honda’s national share hovered in the 23–24% band, with management targeting a medium‑term move toward 30% by 2030, led by women and family scooter buyers.

Product Strategy

- Honda Activa – Core family scooter; has crossed 10 million units in South India alone and over 2 crore two‑wheelers cumulatively in the southern region, cementing scooter leadership.

- Honda Shine (100 & 125) – Main commuter motorcycles used to close the gap with Hero in the entry and 125 cc spaces.

- CB Series – Includes CB Unicorn, CB200/300 and Hornet 2.0 as performance and premium options for urban riders.

- CB750 / BigWing Portfolio – Mid‑capacity and large‑capacity premium bikes retailed via the BigWing network to build brand halo in the performance space.

- Activa E / EV Line – Honda has begun piloting the Activa E and related EV plans. Still, electric penetration in its Indian two‑wheeler mix remains negligible at about 0.1%.

Market Strengths

| Factor | Impact | Details |

|---|---|---|

| Premium Positioning | High | Perceived as a high‑quality, refined brand in both scooters and motorcycles, supporting slightly higher pricing. |

| Activa Dominance | Critical | Over 10 million Activas sold in South India and more than 2 crore Honda two‑wheelers in the region overall, making Activa the default scooter choice. |

| Urban Focus | Strong | Highest concentration in tier‑1 and big tier‑2 cities where scooters account for a majority of two‑wheeler sales. |

| Service Quality | Excellent | Dense authorised service network with a reputation for consistent quality boosts loyalty and repeat purchases |

| Feature Integration | Strong | Early adoption of features like silent‑start, LED lighting, and smart key on Activa and premium motorcycles appeals to urban buyers. |

| Scooter Segment Leadership | Market Leader | Dominates the scooter category in metros, with the Activa family accounting for well over half of scooter registrations in many large cities. |

| Brand Loyalty | High | Strong repeat‑purchase trends, especially among family and women riders who value reliability and comfort. |

| EV Penetration | Very Low | EVs currently form only about 0.1% of Honda’s Indian 2W sales, far behind TVS and Bajaj, indicating EVs are still at a pilot stage for the brand. |

Southern & Regional Milestones

- Honda has surpassed 2 crore cumulative two‑wheeler sales in South India, with the second crore achieved in just seven years, underscoring deep penetration and loyalty in this region.

- The Activa alone has crossed 10 million units sold in the southern states and UTs, including Tamil Nadu, Karnataka, Telangana, Kerala, Andhra Pradesh, Puducherry and Andaman & Nicobar Islands.

- Honda is targeting a 30% national market share by 2030, banking on continued scooter strength and increased participation from women riders, while gradually layering in EVs.

Summary

Honda’s FY25 positioning represents urban premium dominance anchored by the unbeatable Activa franchise (10M+ units in South India alone) and a 23–24% national share that makes it India’s clear No.2. The brand excels in tier-1 metros (40–50% southern share) through superior build quality, service excellence, and family-oriented scooters, while gradually expanding its commuter motorcycle presence. With 2 crore+ cumulative southern sales and ambitious 30% share targets by 2030, Honda balances entrenched ICE leadership with a cautious EV pilot (0.1% penetration), prioritising reliability over rapid electrification.

3. TVS Motor’s Growing Challenge & Regional Leadership

Geographic Footprint

- Southern states: TVS commands roughly 35–40% share in Tamil Nadu, supported by its Hosur manufacturing base and dense dealer network, and holds strong secondary presence in other southern markets.

- Eastern & North‑East: Around 30–35% share in multiple eastern and North‑Eastern states, driven by competitive pricing and scooters like Jupiter.

- West & Central: Thinner presence in western (15–20%) and central (10–15%) India, treated as an emerging opportunity zone with targeted expansion in FY25.

- National average: About 17.5–18.7% market share in FY25, making TVS the only top‑four OEM with clear year‑on‑year share gains.

Market Share Expansion

- April 2024: ~17.08% national two‑wheeler retail share.

- H1 2025: Share rises to about 18.71%, a gain of ~1.63 percentage points while some rivals lose ground.

- November 2025: Stands near 17.5% monthly share on FADA data, still above year‑ago levels despite a softer market.

Product Strategy

- TVS Jupiter: Core volume scooter directly rivalling Honda Activa in family/commuter use; anchors TVS in urban and semi‑urban homes.

- TVS Apache series: Performance‑oriented RTR and RR motorcycles that build a sporty brand image, especially in southern and eastern India.

- TVS Star / Radeon line: Budget commuters aimed at price‑sensitive rural and tier‑3 buyers.

- TVS iQube: Flagship electric scooter, consistently among India’s top‑selling E2Ws and central to the EV strategy.

- Premium Apache derivatives: Higher‑displacement, racing‑inspired versions used for halo and enthusiast appeal in metros.

Market Strengths

| Factor | Impact | Details |

|---|---|---|

| EV Leadership | Growing | iQube ranks among India’s best‑selling electric two‑wheelers. |

| Regional Manufacturing | Strong | Tamil Nadu home‑state advantage with major plants at Hosur. |

| Product Innovation | High | Frequent new launches and updates across ICE and EV portfolios. |

| Price Competitiveness | Strong | Often undercuts or matches Hero and Honda in equivalent segments. |

| Market Share Growth | Positive | Only top‑four brand with clear, sustained share gains in FY25. |

| EV Penetration | Highest | EVs contribute ~9% of total TVS two‑wheeler sales. |

| Emerging Market Focus | Targeted | Strategic push into North‑East and eastern India. |

TVS Regional & EV Statistics

- Tamil Nadu home‑state dominance: Hosur motorcycle and scooter plants make Tamil Nadu TVS’s strongest market, with clear leadership in ICE scooters and early EV adoption.

- EV sales leadership: From January to September 2025, TVS sold roughly 23,000+ iQube scooters in Tamil Nadu alone, putting the state among India’s top three EV two‑wheeler markets.

- EV penetration comparison: EVs form about 9% of TVS’s total two‑wheeler sales, slightly below Bajaj’s ~9.1% but well ahead of Hero (~3.9%) and Honda (~0.1%), highlighting TVS’s aggressive early move into electric scooters.

4. Bajaj Auto’s Niche & Strategic Positioning

Geographic Footprint

- Pan‑India Value and Performance Presence: Bajaj Auto holds just over 10% of India’s two‑wheeler retail market in FY25, ranking fourth after Hero, Honda, and TVS. With a much higher proportion of motorcycles than scooters, it is a heavyweight in volume and value within the motorcycle segment.

- Western and Export Hub: Corporate headquarters and R&D in and around Pune, with major plants at Chakan, Aurangabad, and Pantnagar, give Bajaj a strong presence across Maharashtra and western India. Proximity to ports supports one of the industry’s largest export operations.

- Semi‑Urban and Rural Reach: Platina and CT commuter models provide deep access to semi‑urban and rural markets, where fuel efficiency and durability are key, keeping domestic motorcycle sales resilient even as overall share softens slightly in FY25.

- Export and Emerging Market Leadership: Strong demand from Africa, Latin America, and ASEAN drove significant export growth in FY25, so that over 40% of Bajaj’s total two‑wheeler volumes now come from international markets.

- EV Corridors and Metro Focus: The Chetak EV network is concentrated in EV‑friendly states and large cities. With 300+ dedicated Chetak Experience Centres and thousands of sales touchpoints, Bajaj has one of the most extensive branded EV footprints among established OEMs.

Product Strategy

- Pulsar Family: The Pulsar lineup (125, 150/160, NS/RS 200 and above) is the cornerstone of the portfolio, accounting for well over 60% of domestic motorcycle sales and anchoring Bajaj in sporty‑commuter and entry‑performance categories.

- Platina: Platina 100/110 targets the 100–110 cc value segment with a focus on high fuel economy and low running costs, remaining a top seller in rural and commuter‑heavy markets despite some YoY pressure in early 2025.

- CT Series: CT 100 and CT 110 are rugged, budget‑friendly bikes for commercial and utility use (delivery, rural transport, fleet buyers), reinforcing Bajaj’s tough, no‑nonsense image in small towns and villages.

- Chetak: Flagship EV brand with a metal‑bodied scooter positioned above many plastic‑bodied rivals. By mid‑2025, Chetak accounts for roughly 20–22% of India’s electric two‑wheeler market and a notable share of Bajaj’s domestic volumes.

- Emerging EV Line: A new entry‑level Chetak, planned for FY26, is designed to make the brand more accessible and expand beyond early‑adopter metros, with EVs expected to reach about 20% of domestic two‑wheeler revenue in the near term.

- Avenger & Dominar: Avenger cruisers and Dominar tourers fill lifestyle and long‑distance niches, serving as upgrade options for Pulsar customers and export buyers, though their volumes are smaller than Pulsar, Platina and Chetak.

Market Characteristics

| Segment | Products / Platforms | Market Position in India 2025 |

|---|---|---|

| Performance Commuter / Sports | Pulsar 125, Pulsar 150/160/180, Pulsar NS/RS range, N‑series | Strong enthusiast and value‑performance following; core of Bajaj’s domestic bike volumes and a reference name in sporty commuters. |

| Budget & Utility Commuter | Platina 100/110, CT 100/110 | Fuel‑efficient, low‑cost commuter and utility bikes with deep rural reach; key choice for price‑sensitive daily riders and small businesses. |

| Electric Scooter (EV) | Chetak Premium, Chetak Urbane, upcoming entry‑level Chetak | One of the top two electric scooter brands; metal‑bodied, higher‑quality positioning with ~20–22% E2W share and a rapidly expanding city network. |

| Export‑Focused Mid‑Capacity | Pulsar 200+/NS400, Dominar, Boxer (export models) | High volumes in Africa, Latin America and ASEAN; exports growing faster than domestic, making Bajaj one of India’s most export‑reliant OEMs. |

| Commercial / Fleet Niche | CT series (for goods/pillion), plus separate 3‑wheelers | Niche but strategic utility role; widely used by fleet and commercial operators, reinforcing Bajaj’s rugged, value‑driven brand image. |

| Premium Lifestyle (Small Share) | Avenger, Dominar 250/400 | Modest but visible presence in cruiser and touring segments; used to retain aspirational buyers within the Bajaj portfolio instead of losing them to rivals. |

Summary

Bajaj Auto’s 2025 niche rests on high‑value, performance‑driven motorcycles (Pulsar, Platina and CT), a powerful export engine, and a rapidly scaling Chetak EV lineup. Together, these pillars position Bajaj as one of India’s most dynamic and forward‑looking legacy manufacturers in the shift toward electric two‑wheelers.

5. Suzuki Motorcycle India’s Premium Niche

Geographic Footprint

- Haryana Manufacturing Hub: Operations are centred in Manesar, Gurgaon, which currently serves as the primary production base. A second large facility at IMT Kharkhoda, Haryana (foundation laid in 2025), is under development and is expected to push combined capacity beyond 1 million units annually by around 2027.

- Global Export Base: India serves as a key export hub for Suzuki, shipping models such as the Gixxer and Burgman to markets including Japan, Latin America, and Southeast Asia. Exports surged by roughly 62% year‑on‑year in late 2025, underscoring this strategic role.

- Digital‑First Retail: A strategic tie‑up with Flipkart enables digital booking and retail across eight states (including Karnataka, Maharashtra and Tamil Nadu), extending reach beyond traditional dealerships.

Strategic Focus

- 125cc Scooter Specialist: Rather than competing aggressively in the crowded 100cc commuter bike segment, Suzuki concentrates on the 125cc premium scooter space. Access 125 and Burgman Street form the backbone of the volume, targeting higher‑margin, urban‑family buyers.

- Premium EV Entry: From 2025, Suzuki has entered the EV arena with e‑Access and Burgman Electric, aimed at the “family premium” EV customer instead of fleet or pure utility use, in line with its ICE image of reliability and solid build.

- Big Bike Localisation: Local assembly of halo products like the Hayabusa and V‑Strom 800DE keeps superbikes relatively more accessible and strengthens brand prestige.

- Carbon‑Neutral Pathways: A multi‑path approach that includes Flex Fuel (E85) motorcycles such as Gixxer SF 250, alongside EVs, to address varied future fuel and regulatory scenarios.

Product Strategy

- Suzuki Access 125: Core volume model and “all‑new” 2025 OBD‑2B‑compliant family scooter, blending retro‑inspired styling with everyday practicality; widely perceived as a default 125cc family choice.

- Suzuki Burgman Street: Mass‑market maxi‑scooter that targets comfort‑seeking and style‑conscious upgrade buyers, and serves as the base for the flagship EV derivative.

- Gixxer Series (155/250): Sporty‑commuter platform for riders who want more character than a standard commuter but less extremity than a full supersport; 2025 updates include flex‑fuel capability and fresh colour options.

- V‑Strom SX: “Sport Adventure Tourer” using Gixxer 250 underpinnings, providing a dependable, relatively affordable entry into the ADV‑touring space.

- Hayabusa & 800cc Twins: Flagship halo line – Hayabusa as an iconic hyper‑tourer, supported by GSX‑8R and V‑Strom 800DE to cover sport and adventure‑touring enthusiasts.

Market Characteristics

| Segment | Products | Market Role |

|---|---|---|

| Family Scooter | Access 125 | Segment leader and default 125cc family scooter choice, known for trust, practicality and strong resale. |

| Maxi‑Scooter | Burgman Street | Category‑defining affordable maxi‑scooter with a strong urban following and “upgrade” image. |

| Sport Scooter | Avenis 125 | Sporty 125cc challenger aimed at Gen‑Z buyers with sharp design and youth‑centric positioning. |

| Street Sport | Gixxer 155/250, SF Series | Premium niche focused on build quality and balanced dynamics, appealing to mature enthusiasts over spec‑sheet races. |

| Electric | e‑Access, Burgman Electric | Premium family EV scooters focused on comfort, reliability and battery tech rather than outright performance. |

| Superbike | Hayabusa, V‑Strom 800DE | Cult‑icon halo products; Hayabusa effectively owns heavyweight sport‑touring mindshare, with V‑Strom 800DE complementing ADV credentials. |

Summary

Suzuki Motorcycle India’s 2025 playbook is built around dominance in the 125cc premium scooter space, selective but meaningful participation in sporty motorcycles and ADVs, and a carefully positioned “family premium” EV lineup. By combining a focused ICE portfolio, export‑oriented manufacturing in Haryana, and locally assembled halo superbikes, Suzuki reinforces a high‑quality, urban‑leaning image instead of chasing ultra‑low‑cost commuter volumes.

6. Royal Enfield’s Niche & Strategic Positioning

Geographic Footprint

- Tamil Nadu Manufacturing Hub: Global production centred in Chennai across Oragadam, Vallam Vadagal, and Thiruvottiyur plants, creating a concentrated, efficient supply chain ecosystem.

- Mid-Size Segment Monopolisation: Commands >90% market share in the 250cc–750cc category, effectively defining the Indian middle-weight motorcycle segment.

- Global Lifestyle Presence: Operates as a global lifestyle brand with strong footholds in the UK, Thailand, and Latin America, all managed from its Indian headquarters—unlike mass-market commuters.

Strategic Focus

- “Pure Motorcycling” Philosophy: Emphasises un-intimidating, accessible, and emotive machines rather than spec-sheet dominance or raw performance metrics.

- Customisation Ecosystem: “Make It Yours” (MIY) platform drives high-margin accessory sales, positioning each bike as a canvas for personal expression.

- Premium EV Entry: Strategic launch of the Flying Flea sub-brand (C6 & S6 models) targeting premium urban mobility, distinct from mass-market EV clutter.

Product Strategy

- J-Series Platform (350cc): Volume engine powering Classic, Bullet, and Hunter models with refined retro-thump and high torque suited for city/highway use.

- Sherpa 450 Platform: Modern liquid-cooled performance lineup including Himalayan 450 and Guerrilla 450, targeting adventure and contemporary roadster buyers seeking higher revs and technology.

- 650cc Twin Platform: Diverse “big bike” portfolio (Interceptor, GT, Super Meteor, Shotgun, Bear 650, Classic 650) providing affordable upgrade paths for existing 350cc owners.

- Flying Flea (EV): Dedicated electric sub-brand focused on “City+” mobility with retro-futuristic styling and lightweight magnesium components, avoiding range anxiety battles.

Market Characteristics

| Segment | Products | Market Role |

|---|---|---|

| Retro Classic | Classic 350, Bullet 350, Classic 650 | Category definer and absolute benchmark for retro motorcycles; dominant volume drivers. |

| Urban Lifestyle | Hunter 350, Guerrilla 450 | New-age entry point attracting younger, first-time premium buyers with compact, modern geometry. |

| Adventure | Himalayan 450 | Global ADV contender with serious liquid-cooled off-road capability competing on international specs. |

| Cruiser/Bobber | Meteor 350, Super Meteor 650, Goan Classic 350 | Highway specialists focused on long-distance comfort with specialised cruiser/bobber styling. |

| Scrambler | Bear 650 | Niche performance offering: rugged, off-road capable retro-scrambler for dedicated enthusiasts. |

| Electric | Flying Flea C6 | Premium urban lifestyle electric mobility, distinct from utility e-scooters with retro-futuristic appeal. |

Summary

Royal Enfield’s 2025 positioning represents a masterclass in niche monopolisation—dominating India’s mid-size motorcycle segment (>90% share) through a philosophy of accessible, emotive “pure motorcycling” rather than chasing mass commuter volumes. The brand balances high-volume retro classics (J-Series 350cc), performance upgrades (Sherpa 450, 650cc twins), and forward-looking premium EVs (Flying Flea) while leveraging a global lifestyle image, customisation ecosystem, and Chennai manufacturing efficiency. This creates unmatched brand loyalty, high margins, and a defensible moat in the premium middle-weight space.

What are the consumer preferences by region for two-wheeler brands in India?

1. Purchase Decision Factors by Region

Northern India: The Hero Stronghold

Top 5 Factors Influencing Purchase Decisions:

- Fuel Efficiency – 45% importance. Crucial for cost-conscious buyers relying on two-wheelers for daily commuting and business.

- Affordability – 35% importance. A highly price-sensitive market prioritises affordable options.

- Reliability – 15% importance. Vehicles are viewed as long-term investments that must endure.

- Dealer Network – 3% importance. Easy access to dealerships and service centres for maintenance.

- Brand Name – 2% importance. Established reputation provides peace of mind.

Typical Buyer Profile:

- Age: 25–45 years

- Income: ₹2–5 lakh annually

- Usage: Commercial and daily commuting

- Priority: Value for money

Southern India: Honda/TVS Territory

Top 5 Factors Influencing Purchase Decisions:

- Brand Reputation – 30% importance. High trust in quality and reliability.

- Modern Features – 25% importance. Advanced technology valued by urban buyers.

- Comfort & Design – 20% importance. Sleek styling for commuting and lifestyle use.

- Performance – 15% importance. Reliability and power for younger riders.

- After-Sales Service – 10% importance. Quality support is expected.

Typical Buyer Profile:

- Age: 20–40 years

- Income: ₹5–15 lakh annually

- Usage: Urban commuting and lifestyle riding

- Priority: Quality and modern features

Eastern India: TVS/Honda Battleground

Top 5 Factors Influencing Purchase Decisions:

- Price Competitiveness – 40% importance. Highly attuned to price differences.

- Fuel Economy – 30% importance. Economical vehicles attract amid rising fuel costs.

- Local Brand Presence – 15% importance. Strong local dealers build trust.

- Resale Value – 10% importance. Future value is considered in purchases.

- Service Availability – 5% importance. Reliable networks ensure satisfaction.

Typical Buyer Profile:

- Age: 22–50 years

- Income: ₹2–8 lakh annually

- Usage: Both urban and rural commuting

- Priority: Balance between cost and quality

2. Price Sensitivity Analysis

Budget Segment (₹45,000-70,000)

| Brand | Primary Model | Regional Dominance | Market Share |

|---|---|---|---|

| Hero | Splendor | Northern/Central | 50%+ |

| Bajaj | Platina | Pan-India | 20-25% |

| TVS | Star | Eastern/Southern | 15-20% |

| Honda | CD110 Dream | Limited | <5% |

Mid-Range Segment (₹70,000-1,00,000)

| Brand | Primary Model | Regional Dominance | Market Share |

|---|---|---|---|

| Hero | Passion Pro | Northern | 30-35% |

| TVS | Apache RTR | Southern/Eastern | 25-30% |

| Bajaj | Pulsar | Pan-India | 20-25% |

| Honda | CB Shine | Southern | 15-20% |

Premium Segment (₹1,00,000+)

| Brand | Primary Model | Regional Dominance | Market Share |

|---|---|---|---|

| Honda | Activa, Burgman | Southern/Metropolitan | 35-40% |

| TVS | Jupiter | Southern | 25-30% |

| Royal Enfield | Classics | Pan-India | 15-20% |

| Bajaj | Chetak (EV) | Metro areas | 10-15% |

3. Usage Pattern Variations by Region

Commercial and Delivery Use (60–70% in rural regions)

Most Commonly Used Vehicles:

- Hero Splendor – Top choice for rural delivery and commercial use

- Bajaj Platina – Popular budget-friendly alternative

- TVS Star – Favoured in specific regions for reliability

- Hero Passion – Reliable mid-range option

Key Requirements for Rural Buyers:

- Maximum fuel efficiency for long distances

- Durability to withstand rough roads

- Low maintenance costs

- Easy access to spare parts

Urban Commuting (60–70% in metropolitan areas)

Preferred Vehicles:

- Honda Activa – Most preferred city scooter

- TVS Jupiter – Strong scooter competitor

- Hero Splendor – Economical urban choice

- Honda CB Shine – Popular daily commuter motorcycle

Key Requirements for Urban Commuters:

- Easy manoeuvrability in traffic

- Comfort for everyday use

- Modern styling

- Convenient parking

Leisure and Weekend Use (15–20% in metropolitan areas)

Popular Choices:

- Royal Enfield – Classic cruiser appeal

- Bajaj Pulsar – Performance and sporty rides

- Honda CB Series – Sporty image

- KTM – High-performance motorcycles

Key Requirements for Leisure Riders:

- High-performance engines

- Comfort for long distances

- Stylish design

- Brand prestige

Frequently Asked Questions About State-wise Two-Wheeler Brand Preferences in India

1. Why does Hero MotoCorp dominate in northern India?

Hero’s dominance in northern India is driven by several key factors:

- Splendor’s Fuel Efficiency – Delivers over 80 km per litre, making it especially attractive to buyers who need to keep fuel costs low.

- Extensive Rural Network – Hero boasts the densest network of dealers and service centres in rural areas, ensuring bikes are always accessible and easy to maintain.

- Affordability – Hero offers some of the most competitively priced bikes in the entry-level segment, putting them within reach of budget-focused customers.

- Brand Heritage – More than 40 years in the market have helped Hero build deep trust and loyalty among consumers.

- Agricultural Economy – Hero’s offerings are well aligned with the needs of the farming community, who depend on reliable and affordable transport for daily work.

- Regional Manufacturing – Multiple local production facilities guarantee a steady supply and quick availability of bikes.

The Splendor’s dominance is so strong that it’s become almost synonymous with daily commuting in Uttar Pradesh, Haryana, and neighbouring states, accounting for a large share of Hero’s 40–45% market share in northern India.

2: What makes the Honda Activa so successful in southern India?

The reasons behind Honda Activa’s outstanding success in southern India are varied and compelling:

- 10 Million Sales Milestone – Achieving this massive milestone highlights just how popular the Activa is in the region.

- Scooter Preference – Around 55–60% of buyers in the south prefer scooters over motorcycles, giving the Activa a natural edge.

- Urban-Friendly Design – The Activa is perfectly suited to city commuting and the parking challenges of crowded urban areas.

- Premium Positioning – Honda’s focus on quality allows the Activa to command a higher price, which urban professionals are willing to pay for reliability and comfort.

- Extensive Network – With over 400 service centres in Karnataka alone, Honda ensures that Activa owners can easily access support and maintenance.

- Consistent Features – The Activa’s modern technology and comfort features make it especially attractive to the region’s educated buyers.

- Lifestyle Positioning – The Activa has become synonymous with modern urban living, reflecting the aspirations of many southern buyers.

The Activa’s 10 million sales in southern India alone—more than the entire two-wheeler markets of many countries—show just how deeply it has penetrated the market.

3: Why is TVS gaining market share when larger players are losing ground?

TVS Motor is the only top-four brand currently gaining market share, with year-on-year growth of +1.4%. This momentum is fueled by several strengths:

- EV Leadership – TVS leads with a 9% EV penetration rate, outpacing competitors that have lower adoption rates.

- Product Innovation – TVS consistently launches new models across different segments, keeping its lineup fresh and appealing.

- Price Competitiveness – Strategic pricing allows TVS to undercut competitors in key segments, offering buyers greater value.

- Regional Expansion – TVS continues to see strong growth in both Eastern and Southern regions, expanding its footprint nationwide.

- Jupiter Scooter – The TVS Jupiter is successfully challenging the Activa, especially on price.

- iQube EV Success – The TVS iQube is now one of India’s best-selling electric two-wheelers.

- Manufacturing Advantage – With its manufacturing headquarters in Tamil Nadu, TVS enjoys a strong home-state advantage.

TVS’s market share has expanded from 17.08% in 2024 to 18.71% in the first half of 2025, reflecting the company’s successful growth strategy.

4: What role does electric vehicle adoption play in two-wheeler regional brand preferences?

Electric Vehicle Impact on Regional Brand Preferences

States with High EV Adoption in 2025

- Maharashtra: 16.47% of new two-wheelers are EVs, with Bajaj leading the market (62,834 units).

- Karnataka: 12.92% EV penetration, dominated by Ather (32,271 units).

- Tamil Nadu: 10.26% EV penetration, led by TVS (23,403 units).

How This Affects Brand Preferences

New EV brands are rapidly reshaping brand preferences across different regions in India. These new entrants, such as Ather and Ola, are challenging traditional two-wheeler companies by offering innovative electric solutions tailored to modern needs.

- New Opportunities for Challengers: Over half of the EV market is held by new brands, compared to the ICE market, where established players control over 90%.

- Regional Differences: Each state develops its own favourite EV brands, creating a more diverse market landscape.

- Looking Ahead: McKinsey projects EVs could account for 60–70% of all two-wheeler sales by 2030.

- Challenges for Traditional Brands: Well-established brands must move quickly to maintain relevance in the rapid shift toward electric vehicles.

5. How does infrastructure shape two-wheeler regional brand preferences?

Infrastructure has a significant impact on which two-wheeler brands and vehicle types people prefer in different regions of India.

How infrastructure affects preferences:

| Infrastructure Factor | Impact | Regional Example |

|---|---|---|

| Road Quality | High | Smooth roads in southern metros make scooters a top choice. In contrast, rougher rural roads lead buyers to prefer motorcycles. |

| Traffic Density | High | Heavy traffic in metro areas makes scooters more convenient. In contrast, motorcycles remain practical for less congested rural roads. |

| Fuel Station Density | Medium | In rural areas, fuel efficiency is a top priority due to fewer fuel stations. In cities, this concern is less critical because of better access. |

| Parking Availability | High | Limited parking in cities makes compact scooters the go-to choice. At the same time, suburban areas with more space can accommodate larger vehicles. |

| Service Center Proximity | High | In rural regions, the presence of an extensive service franchise network is essential for maintenance. In contrast, in cities, this is less of a concern due to the abundance of service centres. |

6: What is the forecast for regional brand preferences in the next 2-3 years?

Regional Brand Preferences Outlook (2025–2028)

Key Changes to Watch

- Hero’s Position: Expected to maintain dominance but face growing TVS competition as the latter accelerates its electric vehicle focus.

- Honda’s Challenge: Scooter stronghold under threat from EV rise; launch of electric Activa becomes increasingly critical.

- TVS’s Opportunity: Well-positioned to lead in EV space, potentially emerging as future market leader.

- Regional Shifts: Southern India likely to see faster brand consolidation and preference changes with accelerated EV adoption.

- Rural Dynamics: Northern India remains Hero-dominated longer due to slower rural EV penetration.

What’s Driving Growth

- Key government incentives and policies are playing an increasingly crucial role in the growth of the two-wheeler market in India.

- The Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, for example, provides financial support for the purchase of electric vehicles (EVs), significantly boosting the appeal of electric two-wheelers.

- Additionally, several states offer specific incentives, such as reduced road taxes and registration fees for EVs, which further encourage consumers to opt for environmentally friendly options.

- Policies promoting the establishment of EV charging infrastructure are also gaining traction, making ownership more practical.

- As urban migration continues, demand for modern mobility solutions is expected to grow.

- Rising rural incomes are also driving strong motorcycle demand, underscoring the importance of understanding these policy impacts for strategic planning.

Which brands have the strongest networks in specific states or regions?

Below are the main dealer network strengths by state and region.

Brand Network Strength by State & Region

Dealer Network Coverage & Dominance

| Region | State Examples | Network Leader | Estimated Dealer Count | Strength Factor |

|---|---|---|---|---|

| Northern Zone | Uttar Pradesh, Haryana, Bihar, Rajasthan | Hero MotoCorp | 3,000+ outlets | Deepest rural penetration; 40–45% market share |

| Central Zone | Madhya Pradesh, Chhattisgarh, Jharkhand | Hero MotoCorp | 2,500+ outlets | 50%+ market dominance; mining/commercial focus |

| Western Zone | Gujarat, Maharashtra | Hero / Honda (mixed) | 2,000+ outlets (combined) | 30–40% competitive zone; metro + rural split |

| Southern Zone | Tamil Nadu, Karnataka, Telangana, Kerala | Honda / TVS | 2,500+ outlets (combined) | 40–50% share in metros; scooter-dominated |

| Eastern Zone | West Bengal, Odisha, Assam, Meghalaya | TVS / Honda | 1,500+ outlets (combined) | 30–35% share; growing presence; rural connectivity |

State-Level Network Concentration

| State | Primary Brand | Market Share | Network Type | Key Strength |

|---|---|---|---|---|

| Maharashtra | Hero/Honda (Mixed) | Hero: 30–35%, Honda: 25–30% | Metro hubs + rural franchise | Bajaj HQ in Pune; export hub logistics |

| Tamil Nadu | TVS / Honda | TVS: 35–40%, Honda: 30–35% | Hosur manufacturing advantage | Royal Enfield also HQ’d here; 1,000+ outlets |

| Uttar Pradesh | Hero MotoCorp | 40–45% | Largest rural franchise | Splendor dominance; 2,000+ dealer touchpoints |

| Gujarat | Hero MotoCorp | Hero: 35–40%, Honda: 25–30% | Mixed urban/rural | Industrial growth driving demand |

| Karnataka | Honda / Ather (EV) | Honda: 35–40%, Ather: 12.92% EV share | Urban metro + EV charging | Bangalore tech hub; 400+ service centres |

| West Bengal | TVS | 30–35% | Competitive urban + rural | Kolkata metro presence; emerging tier-2 focus |

| Assam & North-East | TVS / Honda | TVS: 30–35%, Honda: 20–25% | Scattered rural studios | Regional brand loyalty; Northeast expansion target |

Network Competitive Advantages by Brand

| Brand | Total Network Size | Strongest Regions | Weakest Regions | Unique Advantage |

|---|---|---|---|---|

| Hero MotoCorp | 10,000+ dealers nationwide | North, Central (50%+ share) | Southern metros (15–20%) | Deepest rural penetration; largest service network |

| Honda MSCI | 2,500+ dealers focused on metros | South (40–50%), West metros (30–40%) | Rural/North (10–15%) | Premium service experience; BigWing network for premiums |

| TVS Motor | 3,000+ dealers | South, East (30–40%) | West, Central (10–20%) | Hosur manufacturing edge; EV expansion leadership |

| Bajaj Auto | 2,500+ dealers pan-India | Pan-India (10% avg); export hubs | Rural tier-3 (vs Hero) | 300+ Chetak EV Experience Centres; export partnerships |

| Royal Enfield | 2,000+ dealers (premium focus) | Metro cities (6–8%); pan-India aspirational | Ultra-rural (low volume) | Lifestyle ecosystem; highest resale value; studio outlets |

Key Insights on Network Strategy

- Hero’s Rural Fortress: 10,000+ dealer touchpoints give unmatched access in northern and central India, especially in villages and small towns where Splendor is the default choice.

- Honda’s Urban Premium Moat: Concentrated 2,500+ metro-focused dealers in tier-1 cities provide superior service experience and brand perception, especially in the south.

- TVS’s Regional Specialisation: Strong 3,000+ network in south and east leverages Hosur manufacturing and regional brand loyalty, expanding into EV charging.

- Bajaj’s Export-Led Model: Lean 2,500+ network compensates with aggressive Chetak EV expansion (300+ dedicated centres) and strong port-proximity logistics in west.

- Royal Enfield’s Lifestyle Niche: 2,000+ premium-focused dealers and 1,000+ “studio” outlets in tier-2/3 cater to aspirational buyers, not volume commuters.

- EV Shift Impact: Ather (Karnataka), Bajaj Chetak, and TVS iQube launching dedicated EV experience centres, fragmenting traditional dealer networks by geography.

In response, many traditional dealers are adapting by integrating hybrid service models that cater to both conventional and electric vehicles. This adaptation strategy involves retraining staff, expanding service capabilities, and investing in EV charging infrastructure to stay competitive and maintain their market relevance.

Sources & References

1. Primary Sources

- Vahan Seva Dashboard

- FADA (Federation of Automobile Dealers Associations)

- SIAM (Society of Indian Automobile Manufacturers)

- McKinsey: Indian Consumers’ Embrace of Electric Two-Wheelers

- Mordor Intelligence: India Two-Wheeler Market Analysis

- Market Research Future: India Two-Wheeler Market Outlook

- Honda HMSI: 10 Million Sales in South India (2024)

- Honda HMSI: 5 Million Sales in Karnataka (2024)

- Hero MotoCorp: 1 Million Monthly Sales Record (October 2025)

- TVS Motor: Market Share Growth H1 2025

2. Secondary Sources

- Regional automotive publications and dealer associations

- State-level registration and licensing data

- EV adoption tracking from Clean Mobility Shift and EV Vahan Dashboard

- Consumer preference surveys and buying behaviour studies

Other related links from Bikeleague India

- Top 10 bike / scooter brands as per India’s market share

- Yamaha vs Honda vs Kawasaki: Which Bike Brand Is Best?

- Electric two-wheeler sales figures in India FY23 & FY24

- Bajaj Chetak 3503

- Honda Activa 125

Conclusion

Market Leadership by Region and City Type

1. Tier-1 Metropolitan Areas: Mumbai, Delhi, Bangalore, and Chennai

- Primary Brand: Honda – Leads these metropolitan cities with Activa, capturing 40–50% market share due to strong urban commuter appeal.

- Secondary Brand: TVS – Solid 20–25% share driven by widespread Jupiter scooter popularity among city dwellers.

- Tertiary Brand: Hero – Maintains 15–20% share with Splendor as the budget-conscious urban choice.

2. Tier-2 Urban Centres: Spanning over 50 growing cities

- Primary Brand: Hero MotoCorp – Leading brand holding 30–35% market share in tier-2 cities.

- Secondary Brand: Honda – Close second with 25–30% market capture.

- Tertiary Brand: TVS – Completes top three with 20–25% sales from accessible, reliable models.

3. Tier-3 and Rural Markets: Encompassing the majority of India’s towns and villages

- Primary Brand: Hero MotoCorp – Far and foremost popular brand capturing 50–60% market share in rural/small-town India.

- Secondary Brand: Bajaj – Top budget-friendly alternative with 20–25% rural share.

- Tertiary Brand: TVS – Steady 10–15% share through strong regional loyalty.

India’s two-wheeler market is shaped by regional dynamics that affect brand leadership and consumer preferences. Hero MotoCorp leads in rural areas due to strong brand loyalty, while Honda dominates metropolitan regions with its premium scooters. TVS is gaining market share through innovation and a focus on electric vehicles.

The market will continue to change as urbanisation, government policies, and infrastructure improvements impact consumer behaviour. Brands that embrace these trends, invest in innovation, and expand their dealer and service networks will be best positioned for su