Learn about bike insurance jargon and find must-have bike insurance addons for your ride in India. Stay informed and ride confidently.

Bike insurance in India can be confusing. There are many terms and add-ons that sound impressive but are not always easy to understand. If you have ever wondered what these terms mean or which covers are actually useful, you are not alone.

This guide will help explain the confusing terms and highlight the add-ons that truly matter. With this information, you can make confident choices, keep your bike safe, and enjoy your rides without worry.

Key Takeaways

- Learning the basics of bike insurance terms and key add-ons helps you make smarter choices and feel confident if you ever need to make a claim.

- Picking add-ons like Zero Depreciation, Engine Protection, and Roadside Assistance can lower your repair bills and give you peace of mind in tough situations.

- Think about how and where you ride—your daily route, the kind of bike you own, and even your city or village—to choose the add-ons that actually make sense for you.

- Add-ons do raise your yearly cost by 10–30%, but in most cases, they save you much more money if something goes wrong, especially for frequent riders or expensive bikes.

- Check your policy every year, compare what’s on offer, and tweak your coverage as your bike or riding habits change, so you always stay protected.

What is bike insurance jargon and its importance in India?

Bike insurance is essential for owning a two-wheeler in India. It offers financial protection against damages and losses and helps you meet legal requirements. Bike insurance jargon refers to the specific terms used in the insurance industry, especially for motorcycle policies. These terms can be confusing if you are not familiar with insurance language.

Surprisingly, most people do not know the basic terms of bike insurance. Many only learn them after an accident or other issues. Because of this limited knowledge, some people may be taken advantage of by insurance agents.

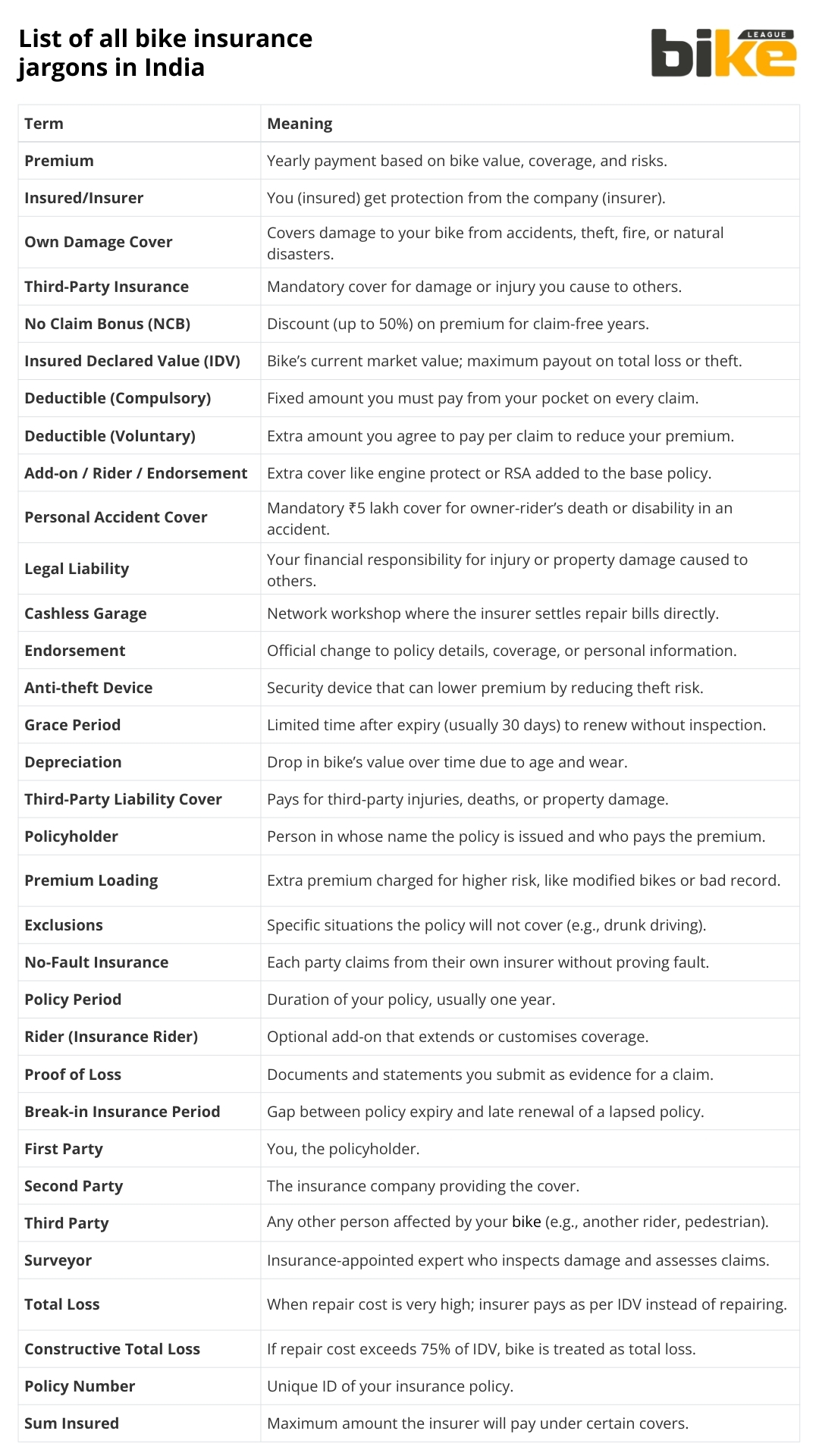

List of all bike insurance jargons

Bike insurance jargon and add-ons are now fully tabulated for quick reference in India 2026—scan to understand terms and pick covers that fit your ride.

| Term | Simple Meaning |

|---|---|

| Premium | Yearly payment based on bike value, coverage, and risks. |

| Insured/Insurer | You (insured) get protection from the company (insurer). |

| Own Damage Cover | Covers damage to your bike from accidents, theft, fire, or natural disasters. |

| Third-Party Insurance | Mandatory cover for damage or injury you cause to others. |

| No Claim Bonus (NCB) | Discount (up to 50%) on premium for claim-free years. |

| Insured Declared Value (IDV) | Bike’s current market value; maximum payout on total loss or theft. |

| Deductible (Compulsory) | Fixed amount you must pay from your pocket on every claim. |

| Deductible (Voluntary) | Extra amount you agree to pay per claim to reduce your premium. |

| Add-on / Rider / Endorsement | Extra cover like engine protect or RSA added to the base policy. |

| Personal Accident Cover | Mandatory ₹5 lakh cover for owner-rider’s death or disability in an accident. |

| Legal Liability | Your financial responsibility for injury or property damage caused to others. |

| Cashless Garage | Network workshop where the insurer settles repair bills directly. |

| Endorsement | Official change to policy details, coverage, or personal information. |

| Anti-theft Device | Security device that can lower premium by reducing theft risk. |

| Grace Period | Limited time after expiry (usually 30 days) to renew without inspection. |

| Depreciation | Drop in bike’s value over time due to age and wear. |

| Third-Party Liability Cover | Pays for third-party injuries, deaths, or property damage. |

| Policyholder | Person in whose name the policy is issued and who pays the premium. |

| Premium Loading | Extra premium charged for higher risk, like modified bikes or bad record. |

| Exclusions | Specific situations the policy will not cover (e.g., drunk driving). |

| No-Fault Insurance | Each party claims from their own insurer without proving fault. |

| Policy Period | Duration of your policy, usually one year. |

| Rider (Insurance Rider) | Optional add-on that extends or customises coverage. |

| Proof of Loss | Documents and statements you submit as evidence for a claim. |

| Break-in Insurance Period | Gap between policy expiry and late renewal of a lapsed policy. |

| First Party | You, the policyholder. |

| Second Party | The insurance company providing the cover. |

| Third Party | Any other person affected by your bike (e.g., another rider, pedestrian). |

| Surveyor | Insurance-appointed expert who inspects damage and assesses claims. |

| Total Loss | When repair cost is very high; insurer pays as per IDV instead of repairing. |

| Constructive Total Loss | If repair cost exceeds 75% of IDV, bike is treated as total loss. |

| Policy Number | Unique ID of your insurance policy. |

| Sum Insured | Maximum amount the insurer will pay under certain covers. |

1. Premium

The premium is the amount you pay annually for your bike insurance policy. It is determined based on various factors, including the type of coverage, the bike’s model, and the insured declared value (IDV).

2. Insured and Insurer

The insured refers to the person or entity covered under the policy. The insurer provides coverage.

3. Own Damage Cover

This cover protects against repair and replacement costs if your bike is damaged by accidents, natural disasters, or riots.

4. Third-party Insurance

Third-party insurance is mandatory and covers damages or losses caused to a third party by the insured bike. It does not cover damages to the insured’s own vehicle.

5. No Claim Bonus (NCB)

NCB is a discount on the premium for not raising any claims during the policy period. It rewards safe driving and can significantly reduce renewal premiums.

6. Insured Declared Value (IDV)

IDV is the maximum amount the insurer will pay if the bike is stolen or damaged beyond repair. It is the bike’s current market value.

7. Deductible

Compulsory Deductible: A fixed amount the policyholder must pay out-of-pocket before the insurer pays the claim.

Voluntary Deductible: The policyholder agrees to pay an additional amount to reduce the premium.

8. Addon Cover

Addons are additional coverages that provide specific protections beyond the standard policy, such as engine or roadside assistance.

9. Personal Accident Cover

This mandatory cover protects against physical injuries or death from an accident involving the insured bike.

10. Legal Liability

This term refers to the policyholder’s responsibility for third-party liabilities, including property damage or bodily injuries caused by the insured bike.

11. Cashless Garage

A cashless garage is an authorised repair shop where the insurer directly settles the repair bills, reducing the hassle for the policyholder.

12. Endorsement

An endorsement is a formal change to the insurance policy, such as updating personal information or modifying coverage terms.

13. Anti-theft Device

Installing an anti-theft device can reduce insurance premiums by lowering the risk of theft.

14. Grace Period

A grace period allows the policyholder to renew the policy within a specified time (usually 30 days) after it expires without requiring a vehicle inspection.

15. Depreciation

Depreciation is the reduction in a bike’s value over time due to wear and tear.

16. Third-party Liability Cover

This cover protects against financial liabilities from damages or injuries the insured bike caused to a third party.

17. Policyholder

The person who holds the bike insurance policy is responsible for paying the premium.

18. Endorsement

You can change your insurance policy by adding or removing coverage, updating personal information, or modifying vehicle details.

19. Premium Loading

An additional premium is charged if the insurance company perceives a higher risk, such as a modified bike or an inexperienced rider.

20. Exclusions

These are specific situations or conditions that the insurance policy does not cover. Knowing about exclusions helps you avoid surprises when making a claim.

21. No-Fault Insurance

Specific policies cover accidents where no one is at fault. In these cases, both parties involved in the accident can make claims from their respective insurance policies without assigning blame.

22. Policy Period

The insurance policy typically lasts one year.

23. Rider

An optional addon to the base policy that provides extra coverage for specific situations, such as a personal accident or pillion rider cover.

24. Proof of loss

Submit a formal documentation or statement called proof of loss to the insurance company to provide evidence of your claim. This is a crucial part of the claims process as it helps the insurer evaluate the validity and extent of your claim.

25. Break-in insurance

Renew your bike insurance annually to continue enjoying its benefits. If you miss the due date, your policy will be suspended. When you renew a lapsed policy, the time between the due date and the renewal date is called the break-in period in bike insurance.

26. First Party, Second Party, Third Party

These terms describe who is involved in an insurance claim:

- First party: You, the policyholder

- Second party: The insurance company

- Third party: Someone else affected by the claim, like another driver

27. Surveyor

A surveyor is an expert who visits after an accident to inspect the damage and help decide if your claim should be approved.

28. Total/Constructive Total Loss

If it would cost more than 75% of your bike’s insured value (IDV) to repair it, the insurer pays you the IDV instead of fixing it. If you don’t have Return to Invoice (RTI) cover, you won’t get the full invoice price.

29. Policy Number, Sum Insured

Your policy number is your insurance ID, while the sum insured is the maximum amount your insurer will pay, which may exceed your bike’s market value.

What are bike insurance addons and their importance in bike insurance in India?

In bike insurance, an add-on is an extra coverage option you can buy along with your standard policy. This lets you customise your coverage to fit your needs. Add-ons are also called riders or endorsements.

Bike insurance add-ons give you extra protection and benefits beyond the basic policy. You pay a little more for these add-ons, which are added to your base premium. Most customers are not aware of the available add-ons, which can make things more confusing.

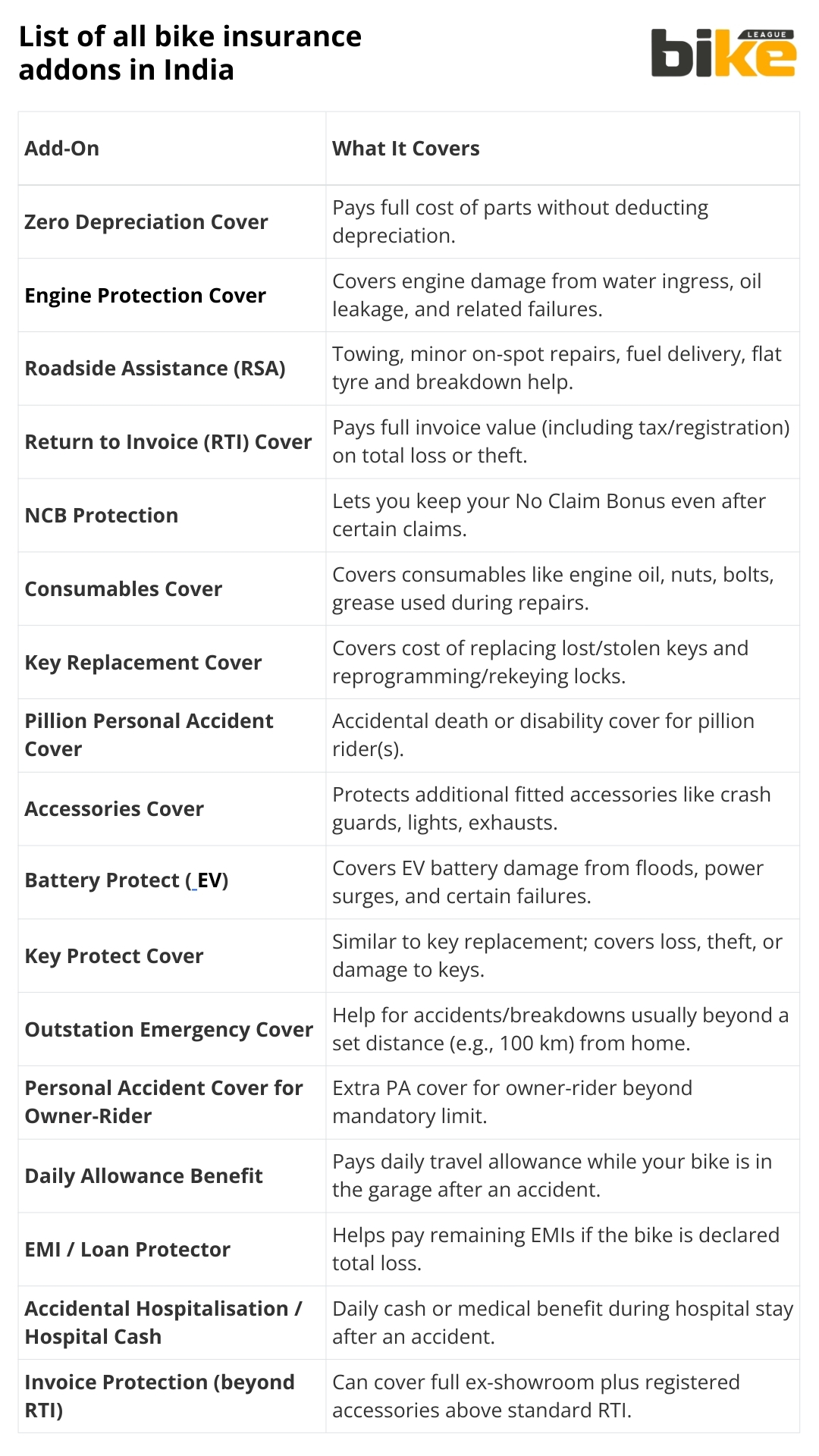

List of all bike insurance addons in India

| Add-On | What It Covers | Avg Extra Cost (₹/yr) |

|---|---|---|

| Zero Depreciation Cover | Pays full cost of parts without deducting depreciation. | 400–1,000 |

| Engine Protection Cover | Covers engine damage from water ingress, oil leakage, and related failures. | 500–1,200 |

| Roadside Assistance (RSA) | Towing, minor on-spot repairs, fuel delivery, flat tyre and breakdown help. | 300–700 |

| Return to Invoice (RTI) Cover | Pays full invoice value (including tax/registration) on total loss or theft. | 800–2,000 |

| NCB Protection | Lets you keep your No Claim Bonus even after certain claims. | 400–900 |

| Consumables Cover | Covers consumables like engine oil, nuts, bolts, grease used during repairs. | 300–600 |

| Key Replacement Cover | Covers cost of replacing lost/stolen keys and reprogramming/rekeying locks. | 200–500 |

| Pillion Personal Accident Cover | Accidental death or disability cover for pillion rider(s). | 200–400 |

| Accessories Cover | Protects additional fitted accessories like crash guards, lights, exhausts. | 500–1,500 |

| Battery Protect (EV) | Covers EV battery damage from floods, power surges, and certain failures. | 500–1,000 |

| Key Protect Cover | Similar to key replacement; covers loss, theft, or damage to keys. | Varies by insurer |

| Outstation Emergency Cover | Help for accidents/breakdowns usually beyond a set distance (e.g., 100 km) from home. | Varies by insurer |

| Personal Accident Cover for Owner-Rider | Extra PA cover for owner-rider beyond mandatory limit. | Varies by insurer |

| Daily Allowance Benefit | Pays daily travel allowance while your bike is in the garage after an accident. | Varies by insurer |

| EMI / Loan Protector | Helps pay remaining EMIs if the bike is declared total loss. | Varies by insurer |

| Accidental Hospitalisation / Hospital Cash | Daily cash or medical benefit during hospital stay after an accident. | Varies by insurer |

| Invoice Protection (beyond RTI) | Can cover full ex-showroom plus registered accessories above standard RTI. | Varies by insurer |

1. Key Protect Cover

This addon covers the cost of replacing the bike’s key if lost, damaged, or stolen, providing peace of mind to the policyholder.

2. Outstation Emergency Cover

This addon provides assistance if the bike breaks down or is involved in an accident within 100 km of the policyholder’s residence, ensuring help is available even when far from home.

3. Personal Accident Cover for the Owner-Rider

This provides coverage for accidental injury or death of the policyholder (the bike owner) while riding the insured motorcycle.

4. Pillion Rider Cover

This extends personal accident coverage to the bike’s pillion rider(s).

5. Zero Depreciation Cover

This addon ensures the policyholder receives the full claim amount, with no depreciation deductions, making it highly beneficial for new bikes.

6. Engine Protection Cover

This addon covers the costs of repairing or replacing the bike’s engine and parts, often excluded from standard policies.

7. Roadside Assistance (RSA) Cover

RSA cover provides emergency services like towing, fuel delivery, and on-site repairs, which can be invaluable during unexpected breakdowns

8. Consumables Cover

This addon covers the cost of consumable items, such as engine oil and nuts and bolts used during repairs, which are not covered under standard policies.

9. Return to Invoice (RTI) Cover

In the event of a total loss (e.g., theft or severe damage), this addon pays the difference between the insured declared value (IDV) and the bike’s invoice value.

10. Key Replacement Cover

It covers the cost of replacing lost or stolen keys, including crucial programming and rekeying the bike’s locks.

11. NCB Protection

This addon ensures you retain your accumulated No Claim Bonus (NCB) even if you make a claim during the policy period.

12. Accessories Cover

It covers additional accessories or modifications not included in the standard policy, such as customised seats, helmets, or exhaust systems.

13. Daily Allowance Benefit

For time-consuming repairs, this addon provides a daily allowance to cover the cost of alternative transportation while your bike is being repaired.

14. EMI/Loan Protector

If your bike is declared a total loss, this addon helps pay any remaining loan EMIs so you’re not left with debt after losing your bike.

15. Accidental Hospitalisation/Hospital Cash

If you have to stay in the hospital after an accident, this addon gives you a daily cash allowance while your bike is being repaired.

16. Invoice Protection (beyond RTI)

This addon sometimes extends beyond RTI, covering the full ex-showroom price of your bike plus the cost of any added accessories.

What specific addons should be considered essential for bike insurance in India?

1. Zero Depreciation Cover

This addon is one of India’s most essential and popular bike insurance options. Its importance stems from the following benefits:

- Ensures the policyholder receives the full claim amount without any deductions for depreciation.

- Particularly beneficial for new bikes or those with expensive parts.

- Covers the full replacement cost of bike parts, maximising the claim payout.

- Reduces out-of-pocket expenses during claims, making it a valuable option for all bike owners.

2. Roadside Assistance Cover

This addon is essential for its practical benefits, especially for frequent travellers or those in remote areas. Key advantages include:

- Provides emergency services, including towing, fuel delivery, and on-site repairs.

- Offers peace of mind by ensuring help is available during unexpected breakdowns.

- Particularly valuable for long-distance travellers or those in areas with a higher risk of breakdowns.

3. Engine Protection Cover

This addon is crucial for safeguarding against costly engine repairs, which are often excluded from standard policies. Its importance is highlighted by:

- Covers the cost of repairing or replacing engine components due to water ingress or oil leakage damage.

- Especially recommended for those living in flood-prone areas or regions with poor road conditions.

- Protects against one of the most expensive potential repairs for a bike.

4. Personal Accident Cover

While often mandatory, this cover is sometimes listed as an addon essential for comprehensive protection. Its significance lies in:

- Provides financial support for medical expenses or compensation in case of injuries, permanent disability, or accidental death while riding the bike.

- Can be extended to cover the pillion rider, offering broader protection.

- Offers significant financial protection for the rider and their family.

5. Return to Invoice (RTI) Cover

This addon is particularly beneficial for new and high-value bike owners. Its importance is due to:

- Covers the gap between the insured declared value (IDV) and the bike’s invoice value in case of total loss or theft.

- Ensures that the policyholder can recover the full purchase price of the bike, including registration and road tax. It provides peace of mind, especially for those with significant bike investments.

6. Consumables Cover

This addon is essential for reducing the bike’s overall maintenance costs. Its benefits include:

- Covers the cost of consumable items like engine oil, nuts, bolts, and other materials used during repairs.

- Helps reduce out-of-pocket expenses during repairs, especially for frequent riders.

- Particularly useful for maintaining the bike without incurring additional costs.

7. No Claim Bonus (NCB) Protection

This addon is crucial for maintaining lower premiums over time. Its importance is highlighted by:

- Allows policyholders to retain their accumulated NCB even if they make a claim during the policy period.

- Helps maintain lower premiums in the future, rewarding safe driving habits.

- Particularly beneficial for experienced riders with a good claim history.

How to choose motorcycle addons based on their usage patterns, bike type, region (urban/rural), or personal needs in India?

Choosing the best bike insurance add-ons depends on your needs. Consider where and how you ride, your bike type, and the risks you face. Spending a bit more (usually ₹500 to ₹3,000 a year) on the right add-ons can save you money and trouble later.

1. By Usage Patterns

Choose add-ons that match your routine. Daily commuters, weekend adventurers, and long-distance riders all have different needs.

- Daily Urban Commuters: Prioritise Zero Depreciation (full parts cover, no 50% deduction on plastics), Consumables Cover (oils, bolts), and Roadside Assistance (RSA) for traffic breakdowns—essential in high-accident cities like Delhi/Mumbai.

- Long-Distance Tourers: For long-distance travellers, Engine Protection (for things like water damage), Outstation Emergency Cover (help if you’re far from home), and NCB Protection (so you don’t lose your no-claim discount if something goes wrong on a trip) are smart choices.

- Occasional/Weekend Riders: If you only ride on weekends or occasionally, Key Replacement and Return to Invoice (RTI) covers make sense. You can even consider usage-based insurance if you don’t clock many miles.

2. By Bike Type

High-end bikes and EVs often need more protection because repairs can be expensive.

- Commuter Scooters (e.g., Activa, Access 125): For commuter scooters (like Activa or Access 125), Zero Depreciation and Consumables Cover are handy for small repairs, but you can usually skip engine covers unless you ride in harsh conditions.

- Performance/Adventure (e.g., Pulsar NS200, RE Himalayan): If you own a performance or adventure bike (think Pulsar NS200 or Royal Enfield Himalayan), Engine Protection, Accessories Cover (for those custom parts), and Zero Depreciation are especially valuable for tough rides.

- Luxury/Superbikes (e.g., Ninja ZX-10R): Owners of luxury or superbikes (like the Ninja ZX-10R) should go for the full suite: RTI, EMI Protector, Pillion Rider Cover, and more. Premiums are higher, but they’re worth the peace of mind.

- Electric Two-Wheelers: For electric bikes, Battery Protection (especially during monsoons) and Zero Depreciation for those pricey lithium batteries are a must.

3. By Region

Where you live matters. City riders deal with more theft and floods, while rural riders face rougher roads. For example, Kerala often sees high flood claims.

- Urban (e.g., Kochi, Bangalore): In cities like Kochi or Bangalore, consider Anti-Theft discounts (like using an ARAI-approved GPS), Key Loss cover, and choosing insurers with plenty of cashless garages. Theft rates are higher here, so premiums can be 20–30% more.

- Rural/Highways: If you ride mostly on highways or in rural areas, Engine Protection and Roadside Assistance (especially towing) are essential, since potholes and monsoons can cause unexpected breakdowns. The base premium is usually lower, so you can add these covers affordably.

4. By Personal Needs

Think about your own situation—do you have a loan, or regularly carry a pillion rider? Customise your add-ons to fit your life.

- New Riders/Families: For new riders and families, Pillion Personal Accident Cover (up to ₹15 lakh) and a Daily Allowance (for transport while your bike is in the shop) can be a real help.

- High-Investment Owners: If you’ve invested a lot in your bike, NCB Protection (so you keep your 50% discount even after a claim) and RTI are smart choices, especially if your bike is financed.

- Flood-Prone (Kerala): Live in a flood-prone area like Kerala? Engine Protection and Zero Depreciation are a must. Also, keep an eye on upcoming insurance changes from IRDAI, especially if you have an electric bike.

How do bike addons affect total premium, or cost-benefit analysis for different rider profiles in India?

Bike insurance add-ons in India usually bump up your total premium by about 10-30%, or ₹300 to ₹3,000 extra each year, on top of a base policy that might run ₹2,000-10,000 depending on your bike. The real win? They often save you 5-10 times that in repair or claim costs, making them a smart pick if you ride often or in risky spots like Kerala monsoons.

1. How Add-Ons Affect Your Premium

- Standalone Pricing: Each extra cover typically adds about 5–20% to your own-damage premium, and there’s 18% GST on top. For example, if you have a commuter bike insured for ₹1 lakh with a base premium of ₹3,000, adding Zero Depreciation will cost you just ₹500 more—and that covers the full cost of parts in a claim, with no deductions.

- Bundling Effect: If you choose 4–5 add-ons, your total premium might rise by 15–25%. For bigger bikes (over 350cc) or if you live in a city, expect a bigger jump—especially with new GST rules coming in 2026.

- Offsets and Discounts: But you can also bring costs down: anti-lock braking systems (ABS) are now standard and can save you 2–5% on premiums, anti-theft devices can cut 2.5%, and multi-year renewals might give you up to 30% off.

2. Cost-Benefit for Everyday Riders

- Urban Commuter (Scooter, 50 km daily): For just ₹1,200 more a year (about a 25% increase), you can get Zero Depreciation, Roadside Assistance, and Consumables Cover. This usually saves you over ₹10,000 on typical city mishaps—so it pays for itself with even one minor accident.

- Highway Tourer (Himalayan, rough roads): If you’re racking up highway miles on tougher roads, paying ₹1,850 extra (25% more) for Engine Protection, Outstation Emergency, and NCB Protection makes sense. One pothole or flood repair can run up to ₹30,000, so this addon bundle often pays for itself after just one incident.

- Luxury Financed Bike (Ninja): For high-end bikes, adding ₹2,500 (25% hike) for Return to Invoice, Accessories Cover, and EMI protection is a smart move. It can save you from a ₹50,000 loss in case of theft—making it a great return on your investment.

- EV Owner (Ampere in flood zones): Electric bike owners in flood-prone areas can get Battery Protection and Zero Depreciation for just ₹1,000 more (30% increase). This covers you against costly monsoon damage, and with a lower base premium, it’s still affordable.

- Weekend Warrior ( If you only ride occasionally, spending ₹500 extra (15% more) for Key Loss and Pillion Personal Accident cover gives peace of mind for rare but costly claims. Unless your risks go up, you can skip most other addons and look into usage-based insurance apps.

3. Quick Tips to Maximise Value

- Pick Add-Ons That Fit Your Life: If you’re worried about theft, start with Key Loss or Theft Cover. If your bike breaks down often, Roadside Assistance is your friend. For those who want to keep their premium discounts intact, NCB Protection helps you lock in 20–50% savings, even after a claim.

- Be a Smart Shopper: Always compare different insurers—look for high claim settlement ratios (like HDFC’s 95%+). Renew before your policy lapses to grab extra bonuses and avoid any coverage gaps.

- Play the Long Game: Add-ons really show their value over a few years. If your insurer offers usage-based insurance (UBI), use their app to track safe driving habits and earn refunds or lower premiums.

This approach keeps you protected without sudden premium increases. Use an online calculator to adjust your coverage for your rides in Kerala.

Essential links for bike insurance in India

- Insurance Regulatory Authority Of India (IRDAI)

- Institute of Actuaries of India

- Insurance Brokers Association of India (IBAI)

- Indian Institute of Insurance Surveyors & Loss Assessors

- Insurance Information Bureau of India

FAQ about bike insurance jargon and addons in India

1. What is Zero Depreciation cover, and is it worth buying for my bike?

If your bike is ever damaged, Zero Depreciation (or “Zero Dep”) cover means the insurer pays for new parts—no matter how old your bike is—without deducting depreciation. It’s a great choice for new or high-value bikes, or if you never want a surprise bill after a repair.

2. Can I add extra covers (add-ons) to my existing bike insurance policy?

Most of the time, you can add or remove extra covers (add-ons) when your policy is up for renewal. Some insurers even let you add them in the middle of your policy period, but it’s best to ask your insurer just to be sure.

3. How do I choose which add-ons are right for me?

Pick add-ons that match how you use your bike. Ride in the city? Roadside Assistance and Consumables Cover are handy. Have a pricey or new bike? Try Return to Invoice or Engine Protection. Think about your daily risks and what makes you feel secure—there’s no one-size-fits-all answer.

4. Are all add-ons available for every bike or with every insurer?

Not always. Some add-ons are only for specific bikes (like battery covers for EVs), and not every insurer offers the same options. Always check what’s available for your bike directly with your insurer or on their official website.

5. Will add-ons make my insurance premium much more expensive?

Add-ons do make your insurance a bit pricier—usually 5–30% more, depending on which ones you pick. But in most cases, they’ll save you a lot if you ever have a big repair bill or your bike gets stolen. It’s about spending a little for peace of mind.

6. Is No Claim Bonus (NCB) Protection worth it?

If you’re a careful rider and haven’t made any claims, NCB Protection is a smart way to keep your discount, even if you have a small mishap. It’s like a safety net for your premium savings.

7. What should I do if my bike is stolen or in an accident?

Act fast: tell the police and your insurer right away. For theft, file an FIR. Keep all your documents handy and follow your insurer’s claim steps. If you have add-ons like Key Loss or RTI, your claim will likely be smoother, and you’ll likely lose less money.

8. Can I transfer my add-ons to a new bike?

No, your add-ons stick with your old bike and policy. If you get a new bike, you’ll need to pick new add-ons with your new insurance.

9. Does bike insurance cover accessories and customisations?

Standard bike insurance doesn’t cover your fancy extras. For things like custom seats or special headlights, get an Accessories Add-On to keep them protected.

10. Are there special add-ons or covers for electric bikes (EVs)?

Absolutely! Many insurers now have add-ons just for EVs—like battery protection, charger cover, and special roadside help. These are super useful if you ride an electric bike, especially where floods or power cuts are common.

Other related links from Bikeleague India

- Two-wheeler insurance in India – How to buy and select

- Must have bike documents for travel in India

- Tips to reduce your bike insurance premium in India

- Things to know while buying second hand motorcycle

- How to choose the perfect motorcycle for your riding style in India

Conclusion

We hope this article explains the main bike insurance terms and must-have add-ons in India. Bike insurance does not have to be confusing. By learning the key terms and choosing the right add-ons for your needs, you can protect both your bike and your finances from unexpected problems.

No matter if you commute daily, ride on weekends, or have a new electric bike, making smart choices now will give you peace of mind on every ride. If you have questions or want to share your insurance experiences, email us at bikeleague2017@gmail.com or join the conversation in the comments. We are here to help riders make better decisions.