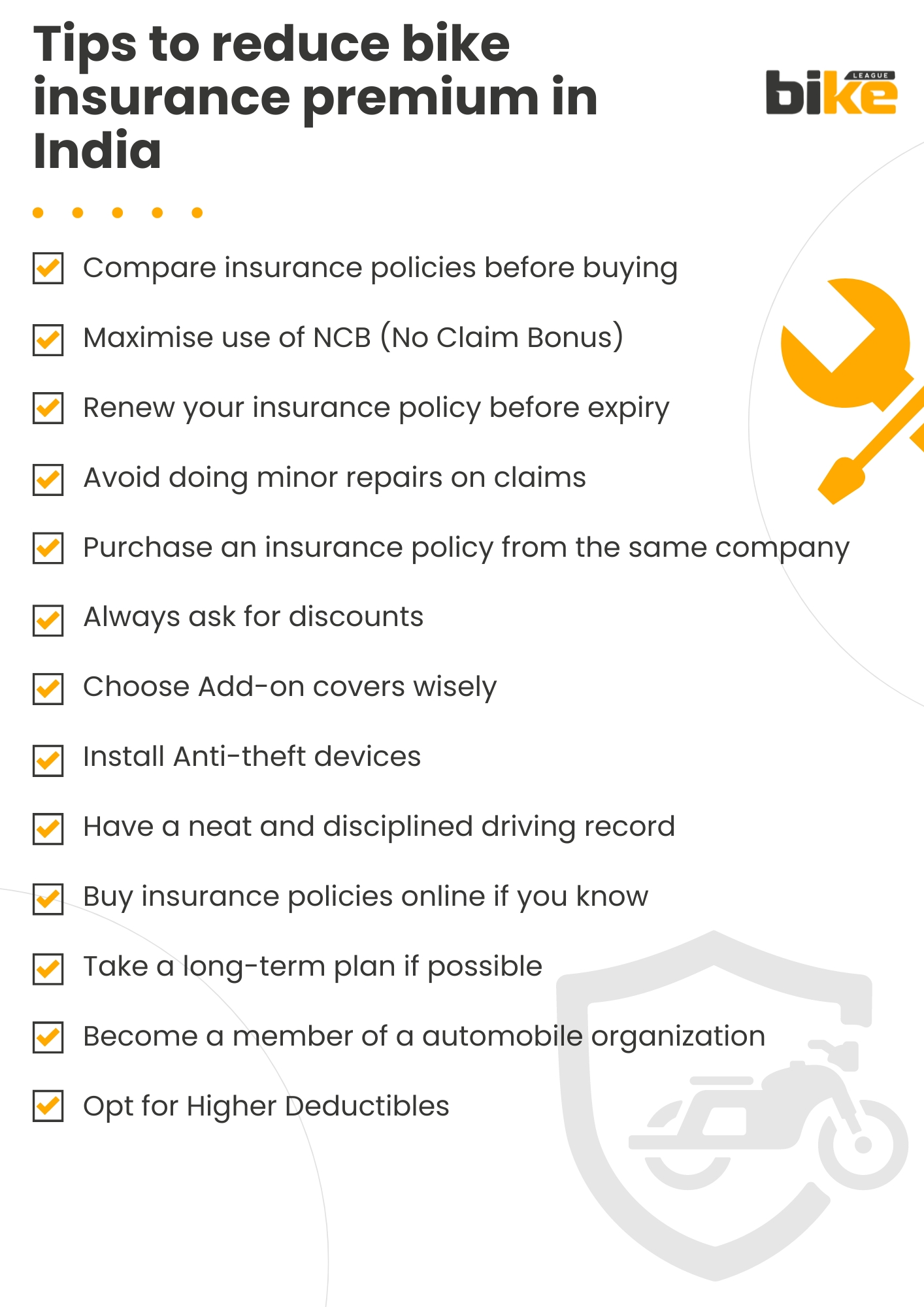

Long story short: Here are tips to reduce your yearly bike insurance premium and save money.

In India, motorcycle insurance is required by law for all two-wheeler owners under the Motor Vehicles Act 1988. For more on buying and selecting two-wheeler insurance, see this article.

Many bike owners buy insurance only for compliance. Insurance companies offer useful features, but many buyers simply follow their agent’s advice without understanding the details.

Your motorcycle driving behaviour and other factors affect insurance premiums. We’ll discuss these and common misconceptions among two-wheeler owners throughout this article. Let’s learn how to lower your bike insurance premium.

Key Takeways

- While purchasing bike insurance, start by comparing different policies. Online comparison tools offer clear information about features, coverage, and price, helping you choose the best option to save money.

- The No Claim Bonus (NCB) lowers your yearly premium if you haven’t made claims, rewarding careful driving.

- Making frequent small claims can raise next year’s premium, so consider paying for minor repairs out of pocket.

- Only choose add-on covers that add value, as unnecessary ones increase your premium.

- Installing an ARAI-approved anti-theft device can reduce your premium. Practising safe driving reduces accidents and keeps your premium low.

What is a bike insurance premium?

A bike insurance premium is the amount you pay to get protection for your two-wheeler. The key benefit is that it covers expenses for accidents, theft, damage, and third-party liability, providing you with financial security for a year.

What are the major components of Bike Insurance Premium?

The major components of a bike insurance premium in India are:

1. Own Damage (OD) Premium

This component covers damage to your bike due to accidents, fire, theft, natural disasters, or vandalism. The rate is based on your bike’s Insured Declared Value (IDV), age, make, and model.

2. Third-Party Liability Premium

Mandatory by law, this covers financial liability for injuries, death, or property damage to third parties caused by your vehicle. The premium is regulated by the IRDAI and set according to the bike’s engine capacity (cc).

3. Personal Accident Cover

This is a compulsory add-on, covering injury or death of the owner-driver. The sum insured is typically ₹15 lakh.

4. Add-on Covers (Optional)

You can choose additional benefits for an extra premium, such as:

- Zero depreciation cover

- Roadside assistance

- Engine protection

- Consumables cover

- Return to invoice cover

5. No Claim Bonus (NCB)

This is a discount given if no claims were made in previous policy years. It reduces your premium on renewal.

6. Deductibles

These are fixed amounts that you pay out of pocket at the time of a claim. Higher deductibles can lower the premium.

7. GST and Taxes

GST at 18% (or applicable rate) is added to the insurance premium for both basic and add-on covers.

8. Insured Declared Value (IDV)

The current market value of your bike, which is the maximum sum assured by the insurer, is a direct factor in premium calculation.

Each insurance policy’s overall premium is determined by a combination of these elements, customised according to the specific bike, usage, location, and chosen features.

What are the tips to reduce bike insurance premiums to save money in India?

Tip 1: Compare insurance policies before buying a bike

Start by comparing two different two-wheeler insurance policies available in the market. Online website comparison tools provide transparency in coverage options and pricing, enabling you to make well-informed decisions that can lead to significant savings.

Compare policies based on your requirements to get the best deal. Consider features and renewal amounts, not just the first-year premium. A low first-year premium can lead to a higher renewal premium.

Tip 2: Maximise use of NCB (No Claim Bonus)

The No Claim Bonus (NCB) is a key way to save on insurance. If you make no claims during a policy year, you earn an NCB, which reduces future premiums. Protect this benefit by reporting only major accidents and transferring your NCB if you change insurers to ensure ongoing discounts.

If you have not made a claim in a year, you will receive an NCB. This gives you a 20-50% discount on your next year’s premium.

Tip 3: Renew your bike insurance policy before expiry

Renewing your policy before expiry helps avoid unnecessary paperwork, such as taking photographs of the vehicle and other documentation, and ensures your NCB (No-Claim Bonus) benefits are not lost.

Tip 4: Avoid doing minor repairs on claims

Showrooms often suggest filing claims for minor repairs and damage to avoid out-of-pocket expenses. However, doing so can increase your premium the following year. While the cost increase may seem small, frequent claims for minor repairs can result in a much higher premium over time.

Tip 5: Purchase a bike insurance policy from the same company

Renewing your motorcycle insurance with the same company for several years increases your chances of earning rewards, discounts, or loyalty points for being a loyal customer, which all companies love.

Tip 6: Always ask for discounts

Some motorcycle insurance companies may not offer discounts right away, so always ask about them. Do not hesitate to inquire, as some personnel may not mention discounts due to inexperience or company policies.

Tip 7: Choose Add-on covers wisely

Insurance companies provide several add-on covers, but carefully evaluate which ones truly add value for your bike. These covers only increase your premium, never decrease it. Be cautious of sales tactics and make considered decisions.

Tip 8: Install Anti-theft devices

Motorcycle insurance companies offer lower insurance premiums if you secure your two-wheeler with security devices such as anti-theft alarms. Ensure the anti-theft device you install is approved by the Automotive Research Association of India (ARAI) to avail of the discount on the bike insurance premium.

Tip 9: Have a neat and disciplined driving record

A clean driving record is crucial in reducing your insurance premium. Insurers favour drivers with fewer accidents and violations, as they pose a lower risk. Safe riding practices, such as adhering to traffic rules and avoiding risky manoeuvres, can significantly reduce the likelihood of accidents.

Tip 10: Buy bike insurance policies online if you know

Buy bike insurance online to save on commission. If you are unfamiliar with insurance, buy offline to avoid mistakes.

Tip 11: Take a long-term bike insurance plan if possible

Instead of paying a premium for 1 year, consider taking the policy for 3-5 years at a time, as there will be a considerable discount. However, one thing to note here is that you need more flexibility to change the policy.

If any issue arises with the insurance company, you may lose your money while trying to change the policy. Again, you must be very sure of the insurance company’s performance, the benefits they provide, etc., while selecting.

Tip 12: Become a member of a recognised automobile association or organisation

Some motorcycle organisations or clubs offer their members discounts on vehicle insurance. If you are part of organisations such as a touring club or an automobile association, take advantage of the deal to reduce your bike insurance premium. Please note that only a few insurance companies provide the same.

Tip 13: Opt for Higher bike insurance deductibles

A bike insurance deductible is the amount the policyholder agrees to pay out of pocket when settling a claim with the insurance company. It’s like a contribution from the bike owner toward the cost of repairs or replacements in the event of an accident or damage to your bike.

Choosing a higher deductible can lower your premium by reducing the insurer’s risk. However, ensure that the deductible amount is something you can afford to pay out of pocket in the event of a claim.

What specific discounts can I ask for when purchasing bike insurance in India?

When purchasing bike insurance in India, you can ask for or look for the following specific discounts to get a lower premium:

- No Claim Bonus (NCB): The most significant discount, rewarding claim-free years. Starts at 20% after the first claim-free year and increases to a maximum of 50% after five consecutive claim-free years.

- Voluntary Deductible: Opting for a higher voluntary deductible (the amount you pay out of pocket before insurance kicks in) typically lowers your premium.

- Anti-theft Device Discount: Installing an ARAI-approved anti-theft device on your bike can get you a discount on the Own Damage component of your premium, usually around 2.5%.

- Long-term Policy Discount: Buying insurance for two or three years at once often comes with a discount compared to annual renewals, plus it protects you from premium hikes on third-party cover during the policy tenure.

- Online Purchase Discount: Many insurers offer lower premiums or special discounts for buying or renewing your bike insurance online due to lower administrative costs.

- Automobile Association Membership: Some insurers provide a small discount if you are a member of recognised automobile associations.

What factors affect bike insurance premiums in India?

Several factors affect the bike insurance premium in India, shaping the final amount you pay for coverage:

- Make, Model, and Variant of Bike: Premiums are higher for expensive, performance-oriented, or sports models, and lower for standard commuter bikes.

- Engine Capacity (CC): Larger engine capacity results in a higher premium due to increased risk and repair costs; for example, bikes above 350cc attract significantly higher rates.

- Age of Vehicle: New bikes have higher premiums, while older bikes benefit from reduced rates because their Insured Declared Value (IDV) depreciates over time.

- Location: Urban areas and regions with high accident or theft rates see higher premiums. In contrast, rural locations may offer reduced premium costs.

- Type of Insurance Policy: Comprehensive policies cost more than third-party only policies because they cover both own-damage and third-party liabilities.

- Rider’s Profile: Younger or inexperienced riders generally pay higher premiums due to perceived risk, while experienced riders may get better rates.

- Claim History (No Claim Bonus): If you have made no claims in previous years, you receive a No Claim Bonus discount on your premium upon renewal.

- Deductibles: Opting for a higher voluntary deductible lowers your premium. Still, it increases out-of-pocket expenses at the time of claim.

- Add-on Covers: Including additional benefits (zero depreciation, roadside assistance, engine protection, etc.) increases the overall premium.

- Installed Security/Anti-theft Devices: Approved anti-theft devices, such as GPS trackers and alarms, can earn discounts on your premium because they reduce theft risk.

- Usage and Frequency: The frequency of use and whether the bike is for personal or commercial purposes influences premiums due to varying risk profiles.

Each insurer may weigh these factors slightly differently, but together they determine the amount you pay for bike insurance annually.

How do I transfer my No Claim Bonus if I switch bike insurers in India?

To transfer your No Claim Bonus (NCB) when switching bike insurers in India, follow these steps:

- Obtain NCB Certificate from Your Current Insurer: Before your existing policy expires or when you plan to switch, request an official NCB certificate from your current insurer. This certificate confirms your claim-free status and the discount percentage you have earned. It is valid for up to 3 years after your policy expires.

- Submit NCB Certificate to New Insurer: When purchasing your new bike insurance, provide this NCB certificate to the new insurer. This enables the latest insurer to apply the appropriate discount on your premium based on your claim-free years.

- Provide Required Documents: Along with the NCB certificate, you may need to submit your previous policy documents, bike registration certificate (RC), and valid identity proofs to the new insurer for verification.

- Buy/Renew Policy Within Validity Period: Ensure you buy or renew your new policy within 3 years of your previous policy’s expiry to retain the NCB. Otherwise, the bonus lapses.

- Verification and Activation:The new insurer will verify the NCB certificate and apply the discount before issuing your new policy.

By following these steps, you can successfully retain and transfer your No Claim Bonus to your new bike insurance policy, helping you enjoy lower premiums even when switching insurers.

What types of anti-theft devices are recognised by bike insurance companies for premium discounts in India?

Bike insurance companies in India recognise anti-theft devices that are certified by the Automotive Research Association of India (ARAI) for premium discounts, typically up to 2.5% on the own-damage premium component.

Common Recognised Anti-Theft Devices

- Electronic Immobilisers: Prevent the bike from starting without the correct key or electronic code. These are widely accepted and very effective.

- GPS-based Security Systems: Devices that enable real-time location tracking and unauthorised movement alerts. Several ARAI-approved models from brands like Autocop, Pricol, and KPIT Technologies are accepted.

- Alarm Systems: Electronic siren-based alarms that activate with forced movement or tampering. Bike alarms with ARAI certification are eligible for discounts.

- Central Locking Systems: Advanced systems for two-wheelers that disable ignition or lock wheels with electronic controls. These are usually part of multi-feature security solutions.

- Disc Brake Locks and Handlebar Locks: While useful as deterrents, these mechanical devices alone are generally not enough for discounts unless combined with electronically certified locking systems.

Certification Requirement

- The device must be ARAI-approved and fitted by an authorised dealer or service centre.

- Insurers may require the ARAI certificate or fitting bill as proof before offering the premium discount.

Examples of some Recognised Brands

By installing these certified anti-theft devices, you can lower your bike insurance premium while improving your motorcycle’s security in India.

What are some specific examples of anti-theft devices that are approved by the Automotive Research Association of India (ARAI) for motorcycles?

To get the detailed official list of all ARAI-approved devices, please visit this link.

https://www.araiindia.com/pages/downloads

Though these devices are approved by ARAI under AIS 140, always check with the manufacturer or installer for suitability and exact model compatibility for your motorcycle or scooter—size, wiring, and mounting points may vary by two-wheeler model.

FAQ about tips to reduce bike insurance premiums in India

1. What role does the No Claim Bonus (NCB) play in reducing premiums?

The No Claim Bonus (NCB) is a discount offered by insurers for not making any claims during the policy period. Accumulating NCB over the years can substantially lower your premium costs. It’s essential to ensure that your NCB is transferred if you switch insurers.

2. Is it beneficial to avoid making small claims?

Avoiding small claims helps preserve your No Claim Bonus, which is a critical factor in reducing your bike insurance premiums over time and saves money. Holding back on minor claims can lead to significant savings in the long run.

3. How does timely policy renewal affect insurance costs?

Renewing your policy on time ensures continuous coverage and prevents the premium spike that comes with lapses. Timely renewal is crucial for maintaining your No Claim Bonus and avoiding penalties.

4. What is the impact of choosing a higher deductible on premiums?

Opting for a higher deductible can lower your premium by reducing the insurer’s risk. However, it’s essential to choose a deductible amount that you can afford to pay out of pocket in the event of a claim.

5. How does maintaining a clean driving record affect insurance premiums?

A clean driving record is crucial for reducing insurance premiums. Insurers favour drivers with fewer accidents and violations, as they pose a lower risk. Safe riding practices, such as adhering to traffic rules and avoiding risky manoeuvres, can significantly reduce the likelihood of accidents and, consequently, your premiums.

6. Why should I consider installing anti-theft devices on my bike?

Installing anti-theft devices can deter theft and vandalism, reducing the need for insurance claims. Insurers often offer discounts for bikes equipped with security features such as alarms, immobilisers, and GPS trackers, as these reduce the risk of theft.

7. Is it beneficial to avoid making small claims?

Avoiding small claims helps preserve your No Claim Bonus, which is a critical factor in reducing your insurance premiums over time. Holding back on minor claims can lead to significant savings in the long run.

8. How does the age of the bike affect the insurance premium?

As a bike ages, its market value decreases, which lowers insurance costs. The depreciation of a bike’s value over time reduces premiums, making it more affordable to insure older bikes.

9. How can comparing insurance policies help reduce premiums?

Comparing different two-wheeler insurance policies is a fundamental step in finding the best deal. By evaluating options, you can identify policies that provide the necessary coverage at competitive rates, resulting in significant savings.

Other related articles from Bikeleague India

- Two wheeler insurance in India – How to buy and select

- Mileage in Two wheelers – Proven & useful tips

- Bike loan Interest rate – Factors that have an impact in India

- Understanding bike insurance jargons & Essential Addons

- Third party Bike Insurance Calculator – Calculate your insurance

Conclusion

I hope you understand all the tips and tricks to reduce your bike insurance premium. If you have any other doubts or queries, email us at bikeleague2017@gmail.com. You can also share your doubts or opinions in the comments section below. We are always eager to help and assist you. Also, here are several social media accounts for Bikeleague India that should raise your suspicions.