Long story short: Here’s a quick look at TVS Motors growth in India’s two-wheeler market, including key milestones in electric vehicles and segment-wise growth statistics from 2021 to 2025.

In the past five years, TVS Motor Company has emerged as a key player in the Indian automotive sector. Despite the challenges of FY 2020-21, which included the pandemic’s impact on consumer sentiment and supply chains, TVS more than doubled its domestic two-wheeler sales by the end of FY 2024-25, a remarkable achievement.

The company expanded its product range and became a leader in India’s growing electric vehicle market. This article explains how TVS reached this point, focusing on its strategies and the economic factors that supported its growth.

Key Takeaways

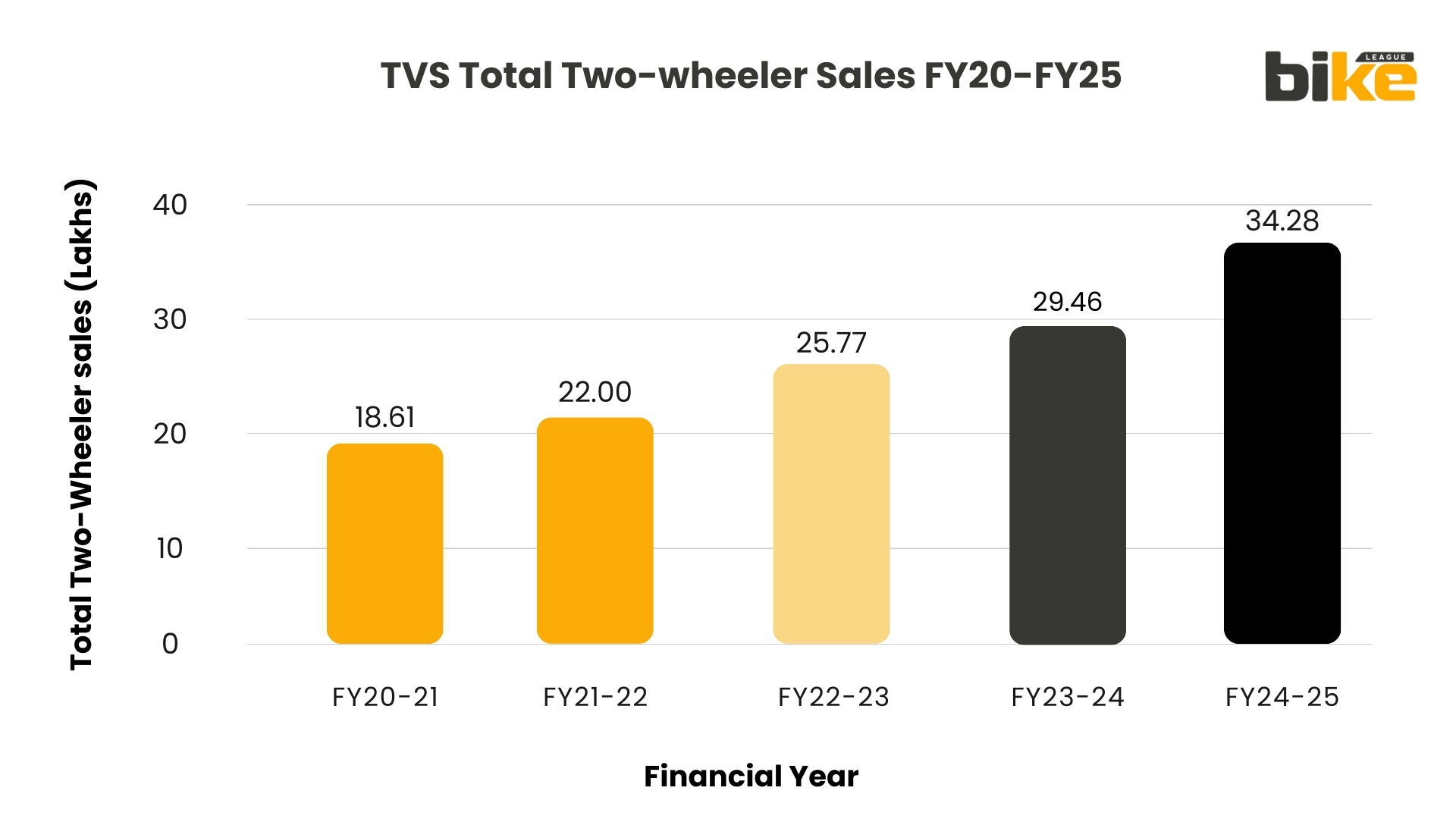

- TVS’s domestic two-wheeler sales grew from 18.61 lakh in FY 2021 to 34.28 lakh in FY 2025, while keeping profits and brand value strong.

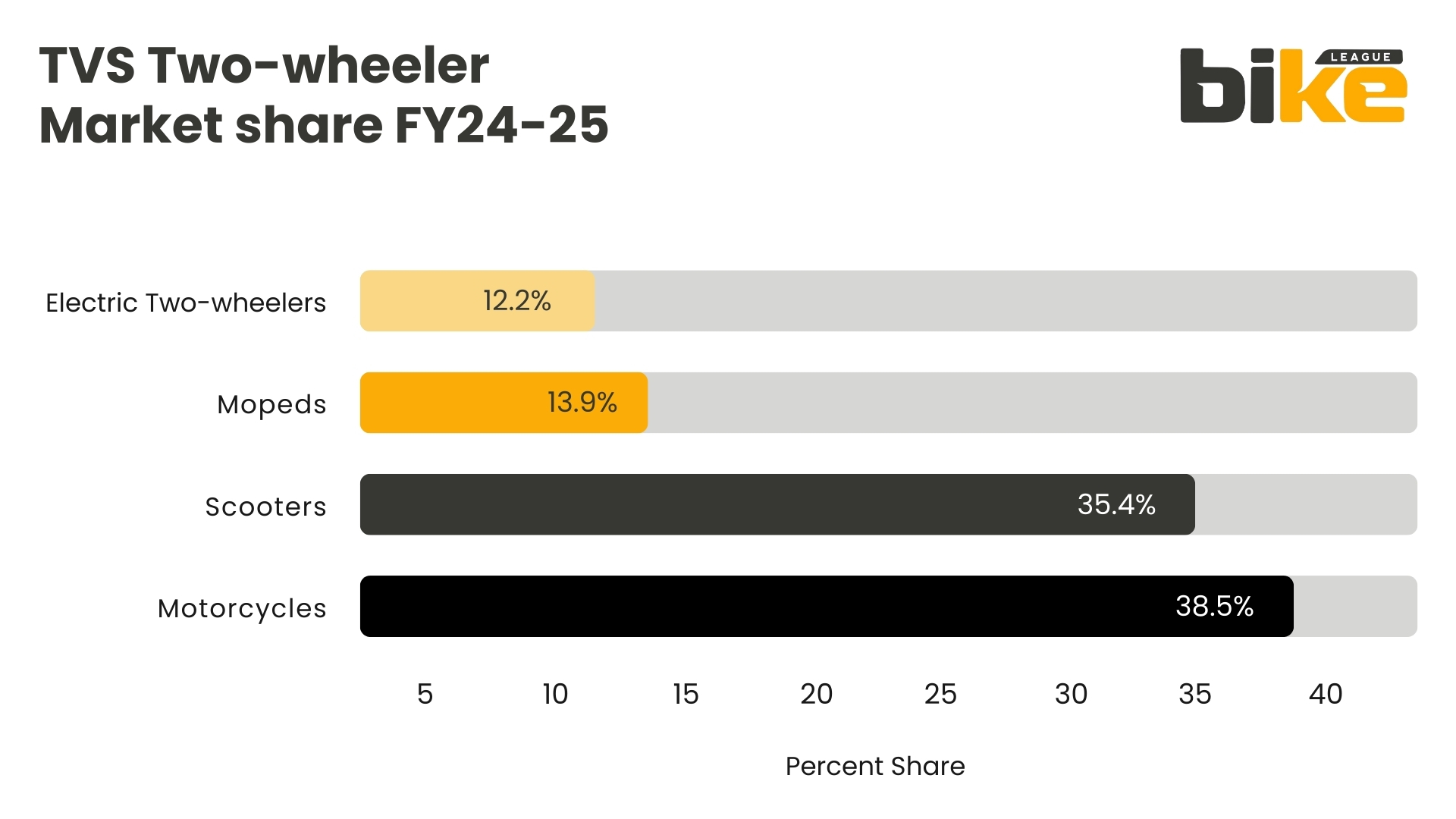

- Moped sales peaked in FY 2022 and have dipped slightly since then. This change is not because mopeds are less competitive, but because TVS is now focusing more on higher-value motorcycles and scooters, which sell for ₹18,000 to ₹22,000 more per unit.

- Internal-combustion models grew by 12.2% each year, while electric two-wheelers saw a much faster 147.9% growth.

- Even with the rise of electric vehicles, 59% of the growth still came from traditional models, showing that TVS balanced new innovations with steady sales of its existing products.

Comparative Sales Analysis and Data Interpretation from FY21 TO FY25 for TVS in India

The table below shows TVS’s domestic two-wheeler sales volumes in exact numbers, making it easy to see year-on-year changes.

| Financial Year | Motorcycles (Lakhs) | Scooters (Lakhs) | Mopeds (Lakhs) | Electric Two-Wheelers (Lakhs) | Total Two-Wheelers (Lakhs) | YoY Growth (Lakhs) | YoY Growth (%) |

|---|---|---|---|---|---|---|---|

| FY 2020-21 | 8.30 | 6.42 | 3.81 | 0.08 | 18.61 | – | – |

| FY 2021-22 | 9.57 | 7.58 | 4.71 | 0.13 | 22.00 | 3.39 | 18.23 |

| FY 2022-23 | 10.32 | 9.55 | 4.83 | 1.07 | 25.77 | 3.77 | 17.14 |

| FY 2023-24 | 11.60 | 10.75 | 4.92 | 2.19 | 29.46 | 3.69 | 14.31 |

| FY 2024-25 | 13.20 | 12.14 | 4.75 | 4.19 | 34.28 | 4.82 | 16.36 |

The accompanying table shows two key trends:

- First, motorcycles and scooters have grown consistently, maintaining a balanced portfolio.

- Second, mopeds, although losing market share, continue to deliver steady profits in rural areas.

Between 2021 and 2025, TVS’s domestic two-wheeler sales grew at a compound annual rate of 16.7%. Internal-combustion models grew by 12.2% each year, while electric two-wheelers saw a much faster 147.9% growth. Even with the rise of electric vehicles, 59% of the growth still came from traditional models, showing that TVS balanced new innovations with steady sales of its existing products.

Moped sales peaked in FY 2022 and have dipped slightly since then. This change is not because mopeds are less competitive, but because TVS is now focusing more on higher-value motorcycles and scooters, which sell for ₹18,000 to ₹22,000 more per unit. Even so, steady moped sales help TVS keep production efficient and support future product development.

Ownership trends for motorcycles and scooters are changing. Scooters, once chosen mainly by women in cities, are now becoming popular in smaller towns too. More people are also buying motorcycles, thanks to features like lower seats and clutch-less gearboxes. TVS is well-positioned to benefit from these changes, thanks to its wide range of products.

The following five sections will analyse each fiscal year to explain the drivers behind these trends.

FY 2021: Resilience and Recovery Amid Uncertainty

- India implemented a strict nationwide lockdown.

- Dealerships were forced to close, and supply chains were disrupted.

- Resulted in over a 60% drop in retail finance disbursements.

1.Impact of Nationwide Lockdown (Q1 FY 2020-21)

- Launched to adapt to the new market conditions.

- Provided contactless sales consultations.

- Offered doorstep test rides.

- Implemented real-time inventory tracking.

- Aim: To lower access barriers, especially for rural customers, via hyperlocal logistics.

2.TVS Arogya Path Initiative

- TVS restored 95% of pre-pandemic production capacity.

- Achieved through proactive vendor financing.

- Helped ease working-capital challenges for tier-II and tier-III suppliers.

3.Production Recovery by December 2020

- Strong kharif harvest increased rural income.

- High minimum support prices bolstered disposable income.

- 3. Limited public transport accelerated the replacement cycle for commuter motorcycles and mopeds.

4.Demand Side Factors

- The TVS XL100 moped saw an 18% volume increase in H2 FY 2020-21.

- Its popularity is attributed to its reliability for agricultural and small-business usage.

5.TVS Moped Performance

- The model featured a lighter chassis and advanced ride modes.

- Attracted many young riders in the competitive 150-cc segment.

6.Popularity of Apache RTR 160 4V

- The TVS iQube scooter sold 8,000 units.

- Signified TVS’s commitment to the EV market.

- Strategic launches in Bengaluru and Delhi gathered essential customer usage data.

- Data used to inform future software and battery management improvements.

7.Commitment to Electric Vehicles (EVs)

FY 2022: Consolidation Through Product Diversification

- FY 2022 served as a consolidation phase for TVS, building on the resilience demonstrated in FY 2021 during global semiconductor shortages.

1.Consolidation Year

- TVS managed to avoid severe impacts from supply chain disruptions due to lower chip intensity in its commuter motorcycle lineup.

2.Resilience to Supply Chain Issues

- Introduced the Raider 125 motorcycle, strategically positioned between the budget 110-cc bikes and premium 150-cc models.

- 2. Achieved significant market penetration, capturing an 11% share of the 125-cc sub-segment within nine months, with sales surpassing 200,000 units.

3.Launch of Raider 125

- Notable growth in scooter sales, particularly with the introduction of the smartphone-connected Jupiter 125.

- The Jupiter 125 features a newly designed chassis, enhancing storage capacity and fuel efficiency.

- Strong appeal to key demographics, especially working women and college students, who represent nearly 40% of India’s scooter market.

4.Increase in Scooter Sales

- Expanded the electric iQube presence to 33 cities, further supported by mobile service units to enhance customer service.

- Although electric vehicle sales were lower than internal combustion models, the iQube’s domestic value addition reached 84% due to a focus on local sourcing.

- This strategy helped mitigate the impact of global fluctuations in lithium-ion battery prices.

5.Expansion of Electric iQube

- The growth in sales of premium motorcycles and scooters contributed to an increase in the company’s EBITDA margin by 140 basis points compared to FY 2021, reflecting improved financial health and operational efficiency.

6.Financial Performance

FY 2023: The Inflexion Point of Electrification

- The central government increased the incentive for electric vehicles from ₹10,000 to ₹15,000 per kilowatt-hour.

- The subsidy cap was raised to 40% of the vehicle cost, incentivising more buyers.

1.Restructuring of FAME-II (June 2022)

- The enhanced subsidy led many hesitant consumers to become immediate buyers.

- TVS Motor was well-prepared with localised supply chains, allowing for the expedited production of the second-generation iQube.

2.Impact on Consumer Behaviour

- TVS increased its domestic localisation ratio from 60% to 84% within a year, minimising the financial impact of an appreciating dollar on production costs.

3.Localisation and Cost Management

- Electric vehicle dispatches skyrocketed from 0.13 lakh to 1.07 lakh, indicating a twelve-fold increase over the fiscal year.

- The customer demographic shifted from primarily early adopters in metropolitan areas to a more diverse group, including educators and small-business owners in various cities.

4.Surge in Electric Vehicle Dispatches

- The enhanced range (100 km in real-world conditions) and the development of third-party charging networks alleviated initial customer concerns about range anxiety.

- The running cost savings of approximately ₹1 per kilometre became a significant selling point.

5.Improved Value Proposition

- The Apache RTR series was updated with modern features such as ride-by-wire throttle, slipper clutch, and racing aesthetics influenced by TVS’s participation in the Asia Road Racing Championship.

- The 200-cc motorcycle segment gained a competitive edge with an aggressive offering priced under ₹1.60 lakh.

6.Innovation in Internal Combustion (IC) Products

s

- By March 2023, over 40% of bookings originated on digital platforms, even if finalised in physical stores, marking a doubling of year-on-year digital penetration.

- This digital shift provided valuable first-party data for future marketing, cross-selling of accessories, and insurance products.

7.Omnichannel Purchase Experience

- Total domestic wholesale shipments reached 25.77 lakh units, with a year-on-year growth of 3.77 lakh units.

- This growth rate of 17.14% surpassed the category average and exceeded internal growth targets set for investors.

8.Domestic Wholesale Shipments

FY 2024: Scaling New Heights in Premium and Electric Segments

- TVS Motor launched the Apache RTR 310, its most significant product in a decade.

- The motorcycle features a lightweight steel trellis frame and a 312-cc liquid-cooled engine developed with BMW Motorrad. Advanced technologies included:

– Cornering ABS for improved safety.

– Cornering ABS for improved safety.

1.TVS Motor’s New Product Launch

- The introduction of the Apache RTR 310 led to an 18% increase in inquiries for smaller Apache models at showrooms.

- Encouraged customer interest in the brand’s offerings.

2.Impact of Apache RTR 310 Launch

- Ergonomically designed handlebars for better comfort.

- Voice-enabled infotainment system for enhanced user experience.

- AI-powered mileage optimiser, delivering significant fuel efficiency while remaining competitively priced under ₹1 lakh.

3.Scooter Innovations

The Ntorq 125 XT was introduced with advanced features:

- Electric vehicles transitioned from being a novelty to a mainstream choice.

- The iQube received a new battery pack, increasing energy density to 172 Wh/kg, resulting in:

– An extended range of 150 km per charge.

– Reduced charging time to four hours when using a 650-W home charger.

4.Mainstream Adoption of Electric Vehicles

- TVS signed an agreement with Bharat Petroleum Corporation to establish 1,000 fast-charging stations.

- Planned operationalisation of 300 stations by March 2024, providing:

– Enhanced long-distance travel options.

– Solutions to battery-swap concerns for fleet operators.

5.Infrastructure Expansion for Electric Vehicles

- Domestic two-wheeler dispatches reached 29.46 lakh units, an increase of 3.69 lakh units annually.

- Significant growth in electric vehicle sales, reaching 2.19 lakh units.

- The EV share of TVS’s domestic portfolio surpassed 7%, achieving a milestone earlier than analysts had projected, who expected this to happen by FY 2026.

6.Operational Excellence of TVS

FY 2025: Sustaining Momentum Through Technological Leadership

- Introduced as India’s first fully-faired electric motorcycle.

- Features a powerful 12-kW mid-mounted motor and liquid-cooled battery sleeves.

- Capable of accelerating from 0 to 60 km/h in just 3.9 seconds.

- Designed to attract a youth market that is environmentally conscious yet desires excitement in their rides.

- Incorporates an over-the-air firmware update feature for enhanced user experience.

1.Introduction of the e-Apache

- Equipped with 16-litre waterproof under-seat storage, this feature enhances utility for users.

- Advanced dual-fork front suspension offers improved ride quality and handling.

- Strengthens TVS Motor’s position within the electric vehicle (EV) sector.

2.Introduction of the Creon Electric Scooter

- Aimed at expanding presence in rural areas through innovative dealership models.

- Transformations included smaller, cloud-connected kiosks requiring only 400 square feet.

- Implementation of Aadhaar-based e-KYC and UPI payment systems streamlined loan approvals.

- Quick motorcycle deliveries facilitated the conversion of latent demand into actual sales.

- Rural districts contributed to 55% of FY 2025 domestic sales, marking a 10-percentage point increase from the previous year.

Rural Accelerator Programme

- Helped balance production capacity for domestic markets during slow periods.

- Production was redirected to West Africa and Latin America to maintain steady line rates.

- Cost reduction efforts supported rural financing solutions.

4.Strategic Exporting of Motorcycles

- Total domestic sales reached 34.28 lakh units, a growth of 4.82 lakh units (16.36%) from FY 2024.

- Marked the highest sales gain in the company’s history.

- Electric two-wheeler sales rose significantly to 4.19 lakh units, nearly doubling compared to the previous year.

- Motorcycle sales totalled 13.20 lakh units, boosted by new trims of the Raider, Ronin, and Apache RTR.

- Enhanced features included self-diagnostics and configurable riding modes via the TVS Connect app.

5.Sales Performance Overview for FY 2025

What are the Strategic Factors Behind the Growth Trajectory of TVS in the past years in India?

- Integral to TVS’s identity, with a notable increase in R&D spending from 4.2% to 6.1% of turnover during the review period.

- Focused investments in lightweight materials, traction-control algorithms, and hybrid technologies led to significant product enhancements, moving beyond mere superficial updates.

1.Innovation

- Initially implemented as a cost-saving strategy, localisation has transformed into a strategic approach to minimise supply-chain risks.

- By FY 2025, the iQube showcased 92% localised content, which includes a homegrown battery-management system and locally sourced motors.

- Mitigated exposure to currency fluctuations and stabilised against commodity price increases through effective localisation.

2.Localisation

- Encompasses both consumer and enterprise dimensions, fostering a connection between technology and business operations.

- The TVS Connect platform experienced significant growth, reaching 3.5 million active users by March 2025, contributing to a growing subscription revenue stream for connected services.

- Implementation of cloud-based manufacturing systems led to a 14% reduction in cycle-time variability and enhanced quality ratios.

3.Digitisation

- Partnerships with non-banking financial companies (NBFCs) and fintech organisations have facilitated improved access to financing for localised development buyers.

- Data-driven risk assessment approaches effectively lowered interest rates by 40 basis points for these buyers, making financial products more accessible.

- Notably, first-time buyers constituted 37% of TVS’s domestic customer base in FY 2025, a stable figure since FY 2021.

4.Financial Inclusion

- Sustainability efforts have positively influenced the brand’s digital delivery and resulted in financial advantages.

- The Hosur manufacturing plant operates on 78% renewable energy, underscoring a commitment to environmental responsibility.

- A lithium-ion battery-recycling facility was inaugurated in late 2024, with a capacity of three gigawatt-hours, supporting a circular economy and yielding cost savings via lower energy tariffs.

5.Sustainability

What specific strategies did TVS Motor Company implement to diversify its product offerings and establish itself in the electric two-wheeler market in India?

Some of the specific strategies that TVS Motor Company implemented to diversify its product offerings are

Diversification of Product Offerings

- Premiumisation: Introduced premium models like the Apache and the Raider Super Squad Edition, featuring advanced technologies such as race-tuned stability control and smart connectivity.

- Broader Product Mix:Maintained strong sales in commuter motorcycles (Raider, Star City+), economic scooters (Jupiter, Zest, Scooty Pep+), and mopeds (XL 100) to cater to both urban and rural markets.

- Electric Two-Wheeler Innovation:Launched the TVS iQube and flagship TVS X, backed by dedicated R&D for EVs. Incorporated cutting-edge technologies like a 10-inch TFT touchscreen and achieved over 650 EV-related patents.

- In-House Capabilities: Developed battery manufacturing and energy management expertise, becoming India’s only OEM with comprehensive EV and connected vehicle solutions.

- Continuous Pipeline:Regularly planned and launched new ICE and EV products to adapt to changing consumer demands.

Market Entry and EV Establishment

- Complete EV Platform: Made early investments in electric powertrain development, positioning the iQube and TVS X as segment benchmarks.

- Expansion of Dealer Network:Increased EV reach to over 690 dealers in India to enhance service and customer confidence.

- Connected Mobility & Digitalisation: Implemented SmartXonnect telematics across many models, improving user experience with features like apps and live charge status. A team of over 2,000 engineers now focuses on advanced technology solutions at TVS

How did the changes in Indian government policies and market regulations directly affect TVS’s operational decisions during this period?

Here are some of the Direct influences of Indian government policies and market regulations on TVS’ Operational Decisions, and they are

- FAME-II and Policy Incentives: Increased government subsidies under the FAME-II scheme lowered electric vehicle costs, prompting TVS to expand its electric vehicle portfolio.

- BS-VI and Emission Norms: Stricter BS-VI standards prompted TVS to rapidly update its product line with efficient internal combustion engines and compliant models, thereby moving towards cleaner technologies.

- PLI Schemes: The ₹25,938 crore production-linked incentive for the automotive sector supported local manufacturing growth, leading TVS to source 93% of materials locally and boost domestic R&D for EVs.

- Tax and Regulatory Changes: A reduction in corporate tax from 30% to 25% and increased government capital expenditure improved profitability, enabling TVS to invest in product development, digitalisation, and expansion.

- Safety and Compliance: New regulations requiring features like ABS, OBD-II, and enhanced vehicle safety drove TVS to focus on advanced technology in its premium models.

What factors contributed to the steady growth in TVS electric two-wheeler sales compared to TVS traditional two-wheeler segments?

The main factors contributing to the steady growth in TVS electric two-wheeler sales compared to the traditional two-wheeler segments are as follows.

EV Growth Drivers

- Product Innovation: Focus on next-gen features like digital clusters, OTA updates, long-range batteries, and smart connectivity has made EVs appealing to young, urban consumers and fleet operators.

- Competitive Pricing: Policy incentives (FAME-II), local supply chain development, and R&D on affordable batteries have enabled TVS to price the iQube and TVS X competitively against ICE models.

- Dealer Coverage & Trust: A wide network of over 690 EV dealers, strong after-sales service, and established trust in the ICE segment have supported the growth of EV sales.

- Marketing and Customer Experience: TVS utilised digital outreach, consumer education, app-based ownership experiences, and robust warranty support to alleviate range anxiety and promote EV adoption.

- Government Support: City-level bans on older ICE vehicles, green zones, and government backing for EV charging infrastructure have increased interest in electric vehicles, benefiting TVS due to its readiness and market presence.

Comparison with the ICE Segment

The ICE segment experienced steady growth, driven by ongoing launches and rural demand. In contrast, the EV segment experienced exponential growth, with over 100% year-over-year sales increase, driven by technology, regulatory incentives, consumer support, and TVS’s proactive development efforts.

Other related links from Bikeleague India

- Two wheeler Sales in India FY 2023-24 | Analysis of Top Brands

- Best bike tyre brands for your motorcycle in India

- Electric two-wheeler sales figures in India FY23 & FY24

- Top 10 sold petrol two-wheelers in India in FY24

- Simple Energy

Conclusion

Over the past five years, TVS Motor Company has demonstrated strong strategic and operational capabilities. The company quickly adapted during the COVID-19 pandemic by using digital tools and taking advantage of government support for electric vehicles, leading to significant growth.

TVS’s domestic two-wheeler sales grew from 18.61 lakh in FY 2021 to 34.28 lakh in FY 2025, while keeping profits and brand value strong. This growth was driven by new technology, local supply chains, and better financing options, all of which helped reduce risk and support expansion.

Looking ahead, TVS will face more competition as global companies and startups enter India’s two-wheeler market. Still, TVS’s strengths in engineering, digital technology, and sustainability put it in a good position to meet these challenges. The company is not just keeping up with industry changes—it is helping to shape them. TVS Motor’s success shows both national resilience and the power of steady, innovation-driven growth.

We hope you now understand the reasons and data behind the Unprecedented TVS Motors Growth Story in FY21-25. If you have any questions or need more information about the top 10 sold petrol two-wheeler sales and insights, please email us at bikeleague2017@gmail.com or leave a comment below. We’re always here and happy to help! However, don’t forget to check out Bikeleague India on our social media platforms to stay connected!